by Calculated Risk on 9/16/2005 09:53:00 PM

Friday, September 16, 2005

"Housing Bust Ahead"

This is a summary of three commentaries on housing and the economy. Writing in the Financial Times, Jim Pickard notes many of the incorrect predictions on housing over the last few years (an amusing read).

"For some critics, the doom-monger phenomenon calls to mind the crazy men with placards who like to forecast the end of the world."Hopefully I'm not crazy or a prophet of doom, but I do think the housing boom is nearing the end (or already peaked). At least in the UK, Pickard thinks so too:

"And yet the pessimists’ time seems to have arrived at last. Just because they got it wrong before there is no reason to believe they are more likely to be wrong now, as some would have you think. In fact, the reverse is surely true. In a few years’ time, it may be the mortgage companies and housebuilders, which have long lived on a diet of unbridled optimism, which look foolish in retrospect - whether house prices fall in nominal terms or only in real terms.Gary Shilling is even more direct: Housing Bust Ahead

But ironically, many commentators have become so weary of being caught out yet again that they have fallen silent on the subject. Andrew Oswald, the Warwick University professor, for example, now refuses to talk publicly about house prices.

There is a widely used expression in stockmarkets that the right time to buy shares is when the last seller has sold. Perhaps the right time to sell residential property is when the pessimists have given up and the last buyer has bought."

"The link between residential real estate and the state of the economy has to do with Americans' dismally low saving rate. Leaping house prices make consumers feel wealthy so they save less and borrow more. Extracting money from their homes when they either refinance or move and take out a bigger mortgage, all too many homeowners use borrowed funds to make up for their declining incomes and huge energy bills. Baby boomer[s] ... think ... that ever rising home values will bail them out."Shilling sees a National bust:

"The next housing bust might be national.Shilling concludes:

...

Today's boom is national in scope: low interest rates, loose mortgage-lending practices and investor caution over stocks following the 2000-02 bloodbath. Yes, today's boom is mainly on the coasts, but that's where the population and income are concentrated. When the U.S. bubble breaks, it will affect more families than the recent stock slump, since 69% of families own their abodes while 50% own stocks.

This is a dire forecast. Still, a severe nationwide break in house prices could destroy enough net worth and spawn a big enough financial crisis to shift the good deflation of excess supply I foresee to the bad deflation of deficient demand.And finally, on Stephen Roach:

"The world as we know it," Stephen Roach says, "must come to an end."The article summarizes many of the global imbalances and then offers Roach's take on Katrina and the US economy:

Mr Roach found many reasons to take exception with the conventional wisdom on Katrina. Rather, he poses another troubling question: Could Katrina be the tipping point for the US economy? As he puts it, "by living beyond its means, America's energy-shocked, post-Katrina economy may be lacking in the resilience financial markets seem to be banking on".In my view, whether the US economy has reached a "tipping point" depends on housing. Housing is the key. If the boom ends, mortgage extraction will end, and the US consumer will be forced to live within their means. That isn't necessarily "dire" and I'm not wearing a sign proclaiming the "End of the World as We Know It" - but I do think these are interesting economic times. Achieving a soft landing, expecially without fiscal and public policy leadership, seems impossible.

In Mr Roach's reckoning, the US is a "shoestring economy" – there has never been a leading economic power that has tried to do "so much with so little". The US has been expanding its spending at home and abroad at a time when the fiscal spigot has next to nothing left, meaning it is unable to respond to even the slightest shock, let alone a massive disruption like Katrina, Iraq or some other unforeseen catastrophe. "All three major pieces of domestic saving – personal, government and business – are likely to be reduced further by the combination of higher energy prices and post-Katrina aftershocks. For America's saving-short economy, that will fray the shoestring all the more."

Port of Long Beach: Record Imports for August

by Calculated Risk on 9/16/2005 03:10:00 PM

Import traffic at the Port of Long Beach increased 6% compared to July, breaking the record traffic of last fall's heavy shipping season. A total of 306 thousand loaded cargo containers came into the Port of Long Beach, compared to 289.5 thousand in July and breaking the previous record of 296 thousand last November.

The Port of Los Angeles import traffic showed a 3% decline in August. However imports of 343 thousand containers were still near the all time high.

For Long Beach, outbound traffic was up 3.5% at 110.7 thousand containers - also a record. At Los Angeles, outbound traffic was down 3% to 95 thousand containers.

The quantity of containers says nothing about the content value, but provides a rough guide on imports from China and the rest of Asia. With these numbers, I expect record imports from China for August.

Thursday, September 15, 2005

IMF Warns on Household Finances and Imbalances

by Calculated Risk on 9/15/2005 08:53:00 PM

The Independent reports:

Record levels of mortgage and credit card debt have left families "potentially vulnerable" to a sudden economic shock, the International Monetary Fund warned yesterday.The Sydney Morning Herald reports on the IMF warnings on global imbalances:

The world's chief financial watchdog said households in countries such as the UK and US were exposed to asset prices such as housing that were being used as collateral for their debts.

"These developments increasingly expose the household sector to the performance of asset markets," it said in its biannual review of financial stability. "Most likely, substantial asset price declines would undermine consumer confidence and reduce personal consumption."

Imbalances between the US and the rest of the world were "clearly unsustainable" and the "issue is not whether but how they adjust", the fund said in its September 2005 World Economic Outlook.The warnings just keep coming and no action is taken. Are people growing numb to all the debt warnings? This reminds me of a new movie coming out (I haven't seen it, just the Ads) "Cry Wolf".

It expects the US current account deficit to remain stuck at an unprecedented 6 per cent of GDP, matched by large surpluses in Japan, emerging-Asian and oil-exporting countries.

"Hence the United States' net external position would continue to deteriorate, reaching a record 50 per cent of GDP by 2010, matched by rising net creditor positions in the rest of the world," it said.

The IMF report canvasses a scenario where investors lose confidence as a result of these imbalances and dump US assets, causing a rapid fall in the value of the US dollar and a surge in protectionist economic policies across the world.

The IMF report said the combinations of protectionist pressures and falling demand for US assets could trigger volatile exchange rate adjustments and heighten the risk of a global economic slump.

Prediction August Trade Deficit: Petroleum

by Calculated Risk on 9/15/2005 07:24:00 PM

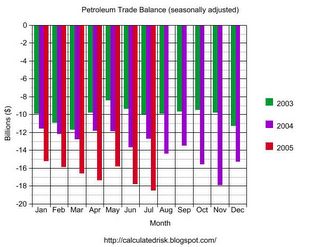

Here are the forecasted August oil numbers using the same model (described here). The ERPP (Energy Related Petroleum Products) trade numbers for August are forecast to be:

Forecast: Total NSA ERRP Imports: $24.2 Billion

Total SA ERPP FORECAST:

Imports SA: $23.5 Billion (seasonal factor estimated at 0.972 for Aug)

Exports SA: $2.4 Billion

Balance ERPP: $21.1 Billion

I am forecasting a record average price per barrel of $52.94 compared to July's record of $49.03.

Imports SA and NSA will set records in August (again). The $21.1 Billion Petroleum deficit compares to the SA July deficit of $18.48 Billion. It appears oil imports will add approximately $2.6 Billion to the SA August trade deficit.

It is highly probable that the SA August Trade deficit will break the record deficit set in February of $60.4 Billion.

UK: Construction Industry Suffers Job Losses

by Calculated Risk on 9/15/2005 01:02:00 AM

The Independent reports: Construction industry suffers biggest fall in jobs since 1993

The number of construction workers has suffered its steepest fall for more than 11 years, according to figures yesterday that were the latest to highlight a slowdown in the property market.Back in May I asked on Angry Bear: When will Housing Slowdown?

About 38,000 jobs were lost in the sector over the three months to July, the biggest fall since a cull of 56,000 in December 1993 when the housing market was suffering the hangover of the crash, the Office for National Statistics said.

Construction firms slashed their demand for new workers, with a 4,700 cut in vacancies, the largest for any sector measured by the ONS. The figures follow a series of downbeat statements from housebuilders such as Bovis, Taylor Woodrow and Berkeley.

The Construction Confederation said the slowdown in growth was driven entirely by a fall-off in private-sector demand.

Perhaps we can look at the UK for guidance on timing. ... The housing boom has apparently ended, and the retailers are already feeling the impact.And now the next step: job losses in the UK construction industry.

Back in May I guessed that the US was "about 6 to 8 months behind the UK". That would put our housing slowdown (and retail slowdown) in the 2nd half of this year. Unfortunately the US economy is probably more dependent on housing and the construction industry than the UK. When housing slows in the US, I expect employment growth to take a significant hit - probably following the UK pattern - with layoffs starting about 6 months after housing clearly slows down.

Wednesday, September 14, 2005

Gasoline Demand Continues to Fall

by Calculated Risk on 9/14/2005 01:16:00 PM

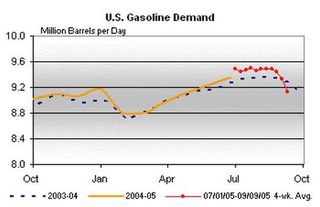

The DOE reports that gasoline demand fell to 8.636 million barrels per day for the week ending September 9, 2005, down from 9.027 m bbls/day for the pervious week.

UPDATE: Dr. Hamilton provides an excellent discussion and a weekly graph (as opposed to 4 wk average from DOE).

Click on graph for larger image.

Demand for gasoline usually falls after labor day, but this still represents a 6% drop in demand for the comparable week from 2004. Prices for "Retail Average Regular Gasoline" dropped about 3% to $2.96 from the record $3.06 the previous week. Based on futures prices for unleaded gasoline, it appears prices will drop further this week.

Tuesday, September 13, 2005

US Bank Economist: Recession Imminent

by Calculated Risk on 9/13/2005 08:07:00 PM

The Rocky Mountain News reports:

Economist Tucker Hart Adams said today it's not a question of if the U.S. economy slips into recession — it's just a matter of when.Here is the economic forecast. The conclusion:

Adams, giving her annual forecast at a breakfast for U.S. Bank customers, predicted 3.0 percent growth in the economy for 2006, down from an estimated 3.5 percent in 2005 and 4.2 percent in 2004.

But that's what she calls the "glass half full" scenario. The "glass half empty, and leaking" possibility is a recession in 2006 or 2007.

Adams continues to be concerned about consumer debt, unsustainable housing price increases, and high oil prices.

"Will (the recession) begin in 2006, or will we keep fooling ourselves, thinking we can spend more than we make and go further and further into debt? I don't know."

This is the glass half full forecast. The economy stands at a fork in the road as we move through 2006, and we can make an equally compelling case for a year that ends in recession for the nation and most of the industrialized world. If the Chinese economy crashes, if Asian central governments stop buying U.S. government securities and interest rates move up 150-200 basis points, if there is an outbreak of trade protectionism in the U.S. that spreads around the globe, if the housing bubble bursts, if U.S. debt and deficits – consumer, government and/or current account – become unmanageable, if oil prices continue to rise – any combination of these and perhaps no more than a single one makes a recession inevitable. In terms of a mild recession, it is only a question of when it occurs, in 2006 or a year or so later. At some point U.S. consumers must bring their debt under control and housing prices must reflect demand for living space rather than Ponzischeme speculation. At worst, the eerie parallels with 1929 turn out to be predictive and we face a long period of difficult economic times.

Trade Deficit: Another Look

by Calculated Risk on 9/13/2005 06:45:00 PM

General Glut and Dr. Setser have some excellent analysis on the trade deficit today. In the comments of General Glut's blog, Vorpal points out that the trade deficit is a record NSA (Not Seasonally Adjusted). Vorpal wrote:

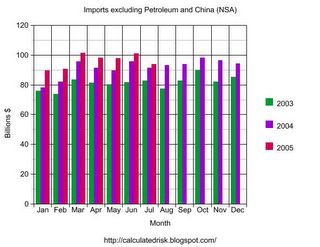

"I wouldn't trust the [seasonal] adjustments because the nature of the deficit is changing so rapidly that historical precedent may be inaccurate."Comment on Seasonal Adjustment: I believe the Census Bureau and the Bureau of Economic Analysis does the best possible job of seasonally adjusting these numbers. Vorpal makes a keen observation; the nature of portions of the deficit are changing rapidly and we need to look at several months worth of data and consider the NSA data too. For a brief description of adjustments, see this post (2nd graph and discussion). Although I didn't discover any apparent problems with the seasonal adjustment, Vorpal's comments did lead me to the following:

Click on graphs for larger images.

If we break down the NSA imports into three components (petroleum, China, and other) we see something possibly interesting. Petroleum imports are growing significantly and set another record in July.

Imports from China also set another record in July. Imports from China follow a clear seasonal pattern and we can expect imports to continue to rise for the next several months.

NOTE: The Long Beach and Los Angeles ports implemented the OffPeak initiative (adds late night hours to port operations) starting on July 23rd to handle the expected heavier late summer / fall imports. I expect August to be a strong month for imports from China.

While Petroleum imports and imports from China are setting records, other imports have shown relatively sluggish growth.

Perhaps the relatively weak dollar has slowed imports from other countries.

The final graph shows the trade deficit for goods excluding imports and exports of petroleum and China.

This graph shows that the "other" goods trade deficit (excluding services, and goods with China and Petroleum) peaked last summer. Perhaps that is why the dollar stopped falling earlier this year. Unfortunately it appears the "other" deficit is starting to climb again, and combined with more NSA records for China and petroleum products, I expect record SA trade deficit numbers over the next few months.

O.C. housing price hits $617,000

by Calculated Risk on 9/13/2005 11:35:00 AM

The OC Register reports:

The median housing selling price hit another record in August – the sixth peak in seven months – at $617,000, DataQuick reported this morning.Back in March I wrote that they were giving away "Free Money" in Orange County. The median price was $555K in March, so the price has increased $62K in 5 months (11%). OC Realtor Gary Watt's prediction of $70K in gains this year for a median priced home is looking good.

That's up from $601,000 in July and a 13 percent jump from the same month last year when fears were mounting that the local housing market was in trouble.

Sales were brisk in August as 4,708 units were sold. That's a 25 percent jump in pace from August 2004 amid that year's summertime doldrums.

US Trade Deficit: $57.9 Billion for July

by Calculated Risk on 9/13/2005 08:30:00 AM

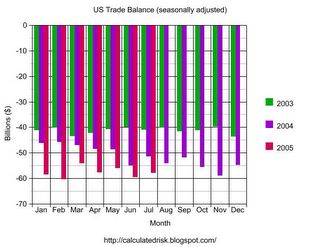

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for July:

"... total July exports of $106.2 billion and imports of $164.2 billion resulted in a goods and services deficit of $57.9 billion, $1.6 billionNote: all numbers are seasonally adjusted.

less than the $59.5 billion in June, revised.

July exports were $0.4 billion more than June exports of $105.8 billion. July imports were $1.1 billion less than June imports of $165.3 billion."

Click on graph for larger image.

July 2005 was 13% worse than July 2004. For the first seven months of 2005, the trade deficits is up 18% over the same period in 2004.

Imports from China set another record of $21,283 Billion. Imports from Japan were off slightly to $11,363 Billion.

The average contract price for oil set a new record of $49.03 per barrel breaking the old record of $44.76 in April.

The SA petroleum trade deficit set another record of $18.5 Billion.

With record imports from China and a record petroleum deficit, I'm surprised that the overall trade deficit wasn't a record; but it was close. I expect the deficit to widen over the rest of the year.