by Calculated Risk on 9/15/2005 01:02:00 AM

Thursday, September 15, 2005

UK: Construction Industry Suffers Job Losses

The Independent reports: Construction industry suffers biggest fall in jobs since 1993

The number of construction workers has suffered its steepest fall for more than 11 years, according to figures yesterday that were the latest to highlight a slowdown in the property market.Back in May I asked on Angry Bear: When will Housing Slowdown?

About 38,000 jobs were lost in the sector over the three months to July, the biggest fall since a cull of 56,000 in December 1993 when the housing market was suffering the hangover of the crash, the Office for National Statistics said.

Construction firms slashed their demand for new workers, with a 4,700 cut in vacancies, the largest for any sector measured by the ONS. The figures follow a series of downbeat statements from housebuilders such as Bovis, Taylor Woodrow and Berkeley.

The Construction Confederation said the slowdown in growth was driven entirely by a fall-off in private-sector demand.

Perhaps we can look at the UK for guidance on timing. ... The housing boom has apparently ended, and the retailers are already feeling the impact.And now the next step: job losses in the UK construction industry.

Back in May I guessed that the US was "about 6 to 8 months behind the UK". That would put our housing slowdown (and retail slowdown) in the 2nd half of this year. Unfortunately the US economy is probably more dependent on housing and the construction industry than the UK. When housing slows in the US, I expect employment growth to take a significant hit - probably following the UK pattern - with layoffs starting about 6 months after housing clearly slows down.

Wednesday, September 14, 2005

Gasoline Demand Continues to Fall

by Calculated Risk on 9/14/2005 01:16:00 PM

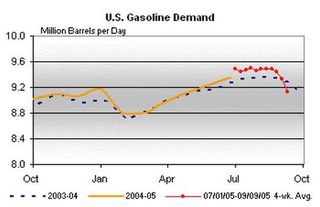

The DOE reports that gasoline demand fell to 8.636 million barrels per day for the week ending September 9, 2005, down from 9.027 m bbls/day for the pervious week.

UPDATE: Dr. Hamilton provides an excellent discussion and a weekly graph (as opposed to 4 wk average from DOE).

Click on graph for larger image.

Demand for gasoline usually falls after labor day, but this still represents a 6% drop in demand for the comparable week from 2004. Prices for "Retail Average Regular Gasoline" dropped about 3% to $2.96 from the record $3.06 the previous week. Based on futures prices for unleaded gasoline, it appears prices will drop further this week.

Tuesday, September 13, 2005

US Bank Economist: Recession Imminent

by Calculated Risk on 9/13/2005 08:07:00 PM

The Rocky Mountain News reports:

Economist Tucker Hart Adams said today it's not a question of if the U.S. economy slips into recession — it's just a matter of when.Here is the economic forecast. The conclusion:

Adams, giving her annual forecast at a breakfast for U.S. Bank customers, predicted 3.0 percent growth in the economy for 2006, down from an estimated 3.5 percent in 2005 and 4.2 percent in 2004.

But that's what she calls the "glass half full" scenario. The "glass half empty, and leaking" possibility is a recession in 2006 or 2007.

Adams continues to be concerned about consumer debt, unsustainable housing price increases, and high oil prices.

"Will (the recession) begin in 2006, or will we keep fooling ourselves, thinking we can spend more than we make and go further and further into debt? I don't know."

This is the glass half full forecast. The economy stands at a fork in the road as we move through 2006, and we can make an equally compelling case for a year that ends in recession for the nation and most of the industrialized world. If the Chinese economy crashes, if Asian central governments stop buying U.S. government securities and interest rates move up 150-200 basis points, if there is an outbreak of trade protectionism in the U.S. that spreads around the globe, if the housing bubble bursts, if U.S. debt and deficits – consumer, government and/or current account – become unmanageable, if oil prices continue to rise – any combination of these and perhaps no more than a single one makes a recession inevitable. In terms of a mild recession, it is only a question of when it occurs, in 2006 or a year or so later. At some point U.S. consumers must bring their debt under control and housing prices must reflect demand for living space rather than Ponzischeme speculation. At worst, the eerie parallels with 1929 turn out to be predictive and we face a long period of difficult economic times.

Trade Deficit: Another Look

by Calculated Risk on 9/13/2005 06:45:00 PM

General Glut and Dr. Setser have some excellent analysis on the trade deficit today. In the comments of General Glut's blog, Vorpal points out that the trade deficit is a record NSA (Not Seasonally Adjusted). Vorpal wrote:

"I wouldn't trust the [seasonal] adjustments because the nature of the deficit is changing so rapidly that historical precedent may be inaccurate."Comment on Seasonal Adjustment: I believe the Census Bureau and the Bureau of Economic Analysis does the best possible job of seasonally adjusting these numbers. Vorpal makes a keen observation; the nature of portions of the deficit are changing rapidly and we need to look at several months worth of data and consider the NSA data too. For a brief description of adjustments, see this post (2nd graph and discussion). Although I didn't discover any apparent problems with the seasonal adjustment, Vorpal's comments did lead me to the following:

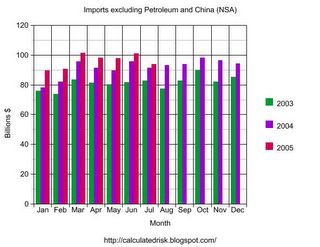

Click on graphs for larger images.

If we break down the NSA imports into three components (petroleum, China, and other) we see something possibly interesting. Petroleum imports are growing significantly and set another record in July.

Imports from China also set another record in July. Imports from China follow a clear seasonal pattern and we can expect imports to continue to rise for the next several months.

NOTE: The Long Beach and Los Angeles ports implemented the OffPeak initiative (adds late night hours to port operations) starting on July 23rd to handle the expected heavier late summer / fall imports. I expect August to be a strong month for imports from China.

While Petroleum imports and imports from China are setting records, other imports have shown relatively sluggish growth.

Perhaps the relatively weak dollar has slowed imports from other countries.

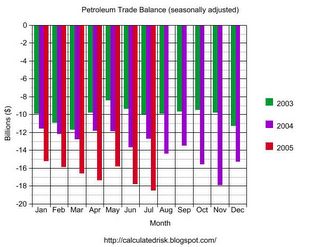

The final graph shows the trade deficit for goods excluding imports and exports of petroleum and China.

This graph shows that the "other" goods trade deficit (excluding services, and goods with China and Petroleum) peaked last summer. Perhaps that is why the dollar stopped falling earlier this year. Unfortunately it appears the "other" deficit is starting to climb again, and combined with more NSA records for China and petroleum products, I expect record SA trade deficit numbers over the next few months.

O.C. housing price hits $617,000

by Calculated Risk on 9/13/2005 11:35:00 AM

The OC Register reports:

The median housing selling price hit another record in August – the sixth peak in seven months – at $617,000, DataQuick reported this morning.Back in March I wrote that they were giving away "Free Money" in Orange County. The median price was $555K in March, so the price has increased $62K in 5 months (11%). OC Realtor Gary Watt's prediction of $70K in gains this year for a median priced home is looking good.

That's up from $601,000 in July and a 13 percent jump from the same month last year when fears were mounting that the local housing market was in trouble.

Sales were brisk in August as 4,708 units were sold. That's a 25 percent jump in pace from August 2004 amid that year's summertime doldrums.

US Trade Deficit: $57.9 Billion for July

by Calculated Risk on 9/13/2005 08:30:00 AM

The U.S. Census Bureau and the U.S. Bureau of Economic Analysis released the monthly trade balance report today for July:

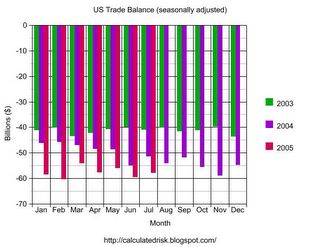

"... total July exports of $106.2 billion and imports of $164.2 billion resulted in a goods and services deficit of $57.9 billion, $1.6 billionNote: all numbers are seasonally adjusted.

less than the $59.5 billion in June, revised.

July exports were $0.4 billion more than June exports of $105.8 billion. July imports were $1.1 billion less than June imports of $165.3 billion."

Click on graph for larger image.

July 2005 was 13% worse than July 2004. For the first seven months of 2005, the trade deficits is up 18% over the same period in 2004.

Imports from China set another record of $21,283 Billion. Imports from Japan were off slightly to $11,363 Billion.

The average contract price for oil set a new record of $49.03 per barrel breaking the old record of $44.76 in April.

The SA petroleum trade deficit set another record of $18.5 Billion.

With record imports from China and a record petroleum deficit, I'm surprised that the overall trade deficit wasn't a record; but it was close. I expect the deficit to widen over the rest of the year.

Monday, September 12, 2005

Oil and Gasoline Confusion

by Calculated Risk on 9/12/2005 06:48:00 PM

A Reuters article, "Oil sinks back near $63", quotes Gary Ross, chief executive of U.S. energy consultancy PIRA Energy, saying:

"U.S. gasoline data over the next few weeks will show the effect of high oil prices on demand."His statement is inaccurate. Gasoline data will show the effect of high gasoline prices on demand. Even with spot oil prices over $60, gasoline demand was still robust until Hurricane Katrina shut down several major refineries causing a supply shock for refined products.

The Financial Times makes a similar mistake:

"One factor driving up [crude oil] prices has been the inability of consuming countries to increase refinement capacity."It is very possible that limitations on refining heavy and/or sour crude have increased the spread between different grades of crude (see Sweet and Sour Crude). However, a general constraint on refining capacity would lead to lower crude prices, not "drive" up the price of crude oil.

This confusion seems to be widespread in the financial media.

Gasoline Update

by Calculated Risk on 9/12/2005 01:11:00 AM

My latest post on Angry Bear is up: Gasoline: A Time for Caution.

And here is an interesting follow on article: Could Katrina kill the SUV?

Even before Hurricane Katrina tore through the southern United States, hampering a big chunk of the US oil industry, consumers were having second thoughts about gas-guzzling sport utility vehicles.The headline is an exaggeration, but the automobile industry was in trouble before the hurricane and it is very possible that consumer preferences will change in response to higher gas prices (just like in the early '80s). The consequences for the automobile manufacturers and the US economy might be significant.

Katrina could now hasten the demise of the SUV, at least in its current guise, after years in which it has ruled the roost over the world's biggest auto market, analysts believe.

...

"Potentially, Katrina could signal the death knell of the SUV in as much as consumers are going to find themselves once burned, twice shy to buy such vehicles," Wachovia economist Jason Schenker said.

"High gas prices and the perceived fragility of the US energy sector are all likely to weigh on consumers' choices for years," he said.

Sales of big SUVs dropped dramatically in August, hurting both American and Japanese manufacturers, which have been trying to edge into the segment over the past five years

Best to all.

Saturday, September 10, 2005

Return from Paradise

by Calculated Risk on 9/10/2005 12:25:00 PM

After a week without news, hopefully I return with a clear head and a fresh look at the world. But first a few photos of Yellowstone ...

Click on photos for larger image.

The Yellowstone river winds its way through the Hayden valley in early September.

The wildlife viewing was excellent. Herds of bison were ubiquitous. We encountered several bull elk herding their harems through the forest. We saw wolves in the Lamar Valley, Pronghorn antelope, moose, coyote, trumpeter swan, mule deer and more. Did I mention the Bison were everywhere? Examining a large petrified Redwood tree stump on Specimen Ridge.

Examining a large petrified Redwood tree stump on Specimen Ridge.

This tree was buried some 50 million years ago by volcanic deposits and mudflows during a volcanic eruption. There are two smaller petrified Redwood trees just below the large Redwood (one in the bright sun, one in the shade). The view and the numerous specimens on the ridge (hence the name) made the steep climb worth the effort.

This Great Gray Owl greeted us on a short walk to the Natural Bridge (a small natural arch near Lake Yellowstone).

The park is incredible. The burn areas from the '88 fire are filling in with new growth and many of the young Lodgepole Pines, in the better growing areas, are 10 to 15 feet tall. I heartily recommend a September visit to Yellowstone.

Best to all and its great to be home!

Friday, September 02, 2005

Some Good News on Oil and Gas

by Calculated Risk on 9/02/2005 04:28:00 PM

NOTE: I will be out of town over the next week (leaving tonight). I hope everyone has a good week ... and my thoughts are with the victims of Hurricane Katrina.

The AP reports: Nations to Release 60M Barrels of Oil, Gas

Twenty-six countries in an international energy consortium will release more than 60 million barrels of crude oil and gasoline to relieve the energy crunch caused by Hurricane Katrina in the United States.This is a short term (30 day) fix since these countries are drawing down reserves to help the US. OCT Crude Oil was down to $67.57 per barrel and unleaded gasoline (OCT) down to $2.18 per gallon on the news.

...

[Energy Secretary Samuel Bodman] said he had received indications from other IEA members that a significant part of their portion would be refined products, mostly gasoline, which will be released onto global markets.

"We have made it known that we are facing shortfalls in available supplies of refined products in our country as a consequence of this storm," Bodman said, expressing confidence the gasoline will find its way to the United States where prices are expected to remain high.

Already there are 20 ships carrying gasoline from commercial foreign stocks to the United States, he said. The supplies from government stocks would be in addition.