by Calculated Risk on 9/02/2005 03:06:00 PM

Friday, September 02, 2005

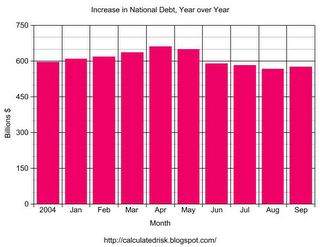

National Debt Increase: $575 Billion YoY

As of Sep 1, 2005 our National Debt is:

$7,929,658,283,890.28 (almost $8 Trillion)

As of Aug 1, 2004, our National Debt was:

$7,354,611,427,274.47

SOURCE: US Treasury.

Click on graph for larger image.

For comparison Year over Year Increase:

For Fiscal 2004 (End Sept 30, 2004): $596 Billion

For Jan 1, 2004 to Jan 1, 2005: $609.8 Billion

For Feb 1, 2004 to Feb 1, 2005: $618.6 Billion

For Mar 1, 2004 to Mar 1, 2005: $635.9 Billion

For Apr 1, 2004 to Apr 1, 2005: $660.9 Billion

For May 1, 2004 to May 1, 2005: $648.8 Billion

For Jun 1, 2004 to Jun 1, 2005: $588.0 Billion

For Jul 1, 2004 to Jul 1, 2005: $581.2 Billion

For Aug 1, 2004 to Aug 1, 2005: $566.2 Billion

For Sep 1, 2004 to Sep 1, 2005: $575.0 Billion

The debt situtation worsened slightly in August and fiscal 2005 has a chance to see the worst annual increase in National Debt ever. The current record annual increase in the National Debt is $596 Billion for fiscal '04.

So far, despite the much ballyhooed "budget improvement", the US keeps accumulating debt at about the same pace as last year.

August Jobs Report: 169 Thousand Added

by Calculated Risk on 9/02/2005 09:54:00 AM

From the AP:

In Friday's report, U.S. employers added 169,000 jobs in August, reflecting increased employment in industries, including construction, professional and business services, health care and education, and financial activities. But manufacturers shed jobs for the third straight month, reflecting the industry's sometimes bumpy road to recovery from the 2001 recession.Numbers are before the impact of Hurricane Katrina.

Also encouraging was that payroll gains were revised up for both June and July. Employers in July added 242,000 jobs, an improvement from the government's initial estimate of 207,000 net job gains. For June, 175,000 jobs were added, up from a previous estimate of a 166,000 jobs gain.

The payroll gain of 169,000 reported for August was less than the 190,000 new jobs some economists were forecasting before the release of the report. Economists were predicting the unemployment would hold steady at July's 5 percent rate.

Professional and business services added 29,000 jobs in August. Financial companies added 15,000. Education and health services expanded employment by 43,000. Leisure and hospitality added 34,000 jobs. Retailers added close to 12,000 during the month. Construction companies boosted payrolls by 25,000.

But factories cut another 14,000 jobs in August. Auto makers accounted for the biggest chunk of those job losses.

The labor market is the one part of the economy that has had difficulty getting back to full throttle after the 2001 recession.

Jobseekers still face challenges. The report showed that the average time that the 7.4 million unemployed spent searching for work in August was 18.9 weeks, up from 17.6 weeks in July.

Those who do have jobs are seeing wages rising. Average weekly earnings climbed to $544.59 in August, up from $543.92 in July. The figures aren't adjusted for inflation.

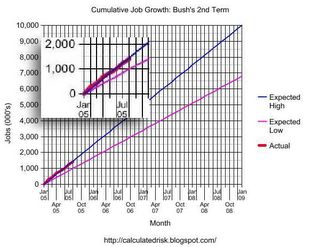

Bush's first term, with a net loss of 759K private sector jobs (a gain of 119K total jobs), has to be considered disappointing. For Bush's 2nd term, anything less than 6.8 Million net jobs will have to be considered poor. And anything above 10 million net jobs as excellent. Of course, in additional to the number of jobs, the quality of the jobs and real wage increases are also important measures.

For the quantity of jobs, the following graph provides a measurement tool for job growth during Bush's 2nd term.

Click on graph for larger image.

The blue line is for 10 million jobs created during Bush's 2nd term; the purple line for 6.8 million jobs. The insert shows net job creation for the first 7 months of the 2nd term - currently just below the blue line.

Thursday, September 01, 2005

DOE: Storm may shut refineries for months

by Calculated Risk on 9/01/2005 02:41:00 PM

From Reuters: Storm may shut refineries for months

The government warned on Thursday that some U.S. refineries shut by Hurricane Katrina may not resume processing oil for several months ...This is a temporary refined products supply shock. See Dr. Thoma's overview of AD vs. AS shocks.

...

"Some refineries likely (will be) able to restart their operations within the next 1 to 2 weeks, while others will likely be down for a more extended period, possibly several months," the Energy Information Administration said.

The Energy Department's analytical arm said nine major oil refineries in Louisiana and Mississippi remained shut from the hurricane. Those refineries account for about 11 percent of total U.S. refining capacity.

"Unlike 2004's Hurricane Ivan, which affected oil production facilities and had a lasting impact on crude oil production in the Gulf of Mexico, it appears that Hurricane Katrina may have a more lasting impact on refinery production and the distribution system," the EIA said in its most recent update on the effects of the hurricane on the energy sector.

Some key points: Oil is a global market. The loss of production in the GOM will be felt worldwide. Gasoline is much more of a domestic market (and regional), though some refined gasoline is imported - so there is a global aspect.

A Supply Shock will force the reduction in consumption of refined products through higher prices (Rationing hasn't been mentioned yet). It is possible that this reduction in demand will lead to lower crude oil prices even though gasoline and other refined products will remain elevated.

Just musing about possibilities ...

OFHEO: Huge House Price Increase

by Calculated Risk on 9/01/2005 10:53:00 AM

UPDATE: Kash looks at the numbers: House Prices

The Office of Federal Housing Oversight (OFHEO) reports:

LARGEST U.S. HOUSE PRICE INCREASES IN MORE THAN 25 YEARSMore to come.

OFHEO House Price Index Shows Annual Rise of 13.4 Percent

WASHINGTON, D.C. – Average U.S. home prices increased 13.43 percent from the second quarter of 2004 through the second quarter of 2005. Appreciation for the most recent quarter was 3.20 percent, or an annualized rate of 12.8 percent. The new data represent the largest four-quarter increase since the second quarter of 1979. The figures were released today by OFHEO Acting Director Stephen A. Blumenthal, as part of the House Price Index (HPI), a quarterly report analyzing housing price appreciation trends.

"There is no evidence here of prices topping out," said OFHEO Chief Economist Patrick Lawler. "On the contrary, house price inflation continues to accelerate, as some areas that have experienced relatively slow appreciation are picking up steam."

House prices grew considerably faster over the past year than did prices of non-housing goods and services reflected in the Consumer Price Index. House prices rose 13.4 percent, while prices of other goods and services rose only 3.1 percent.

Wednesday, August 31, 2005

Recession Coming?

by Calculated Risk on 8/31/2005 06:12:00 PM

Even before the devastation of hurricane Katrina, the US economy was apparently headed for a significant slowdown and possible recession. According to a survey of CFOs completed on August 28th (before Katrina): Housing, Fuel Are Top CFO Concerns

In the four years of the survey, this is the first time that CFOs with growing pessimism outnumbered CFOs with growing optimism. Indeed, the level of optimism is down sharply from last quarter's 40 percent and is strikingly lower than last year's 72 percent.Emphasis added. And the most recent numbers have not looked good:

"This is the greatest increase in pessimism that we have seen," says Don Durfee, research editor of CFO magazine. "We’ve found that this optimism index predicts future economic growth quite well. In a situation like this, where the growth in pessimism outweighs the growth in optimism, we expect to see a slowdown in economic growth."

Macroblog: Not The Most Bullish Day For Economic News

The Big Picture: PMI, GDP stink up the joint

And here is how Briefing.com described the Chicago PMI report (with chart):

- An unbelievable plunge to 49.2 in August Chicago PMI index (-14.3 pts).

Key Factors - Record sized plunge leaves index in a contractionary sub 50 level -- the first since April '03 after reaching a 17 yr high in March.

- New orders (30% weight) plunged an astounding 23 points to 46.5 -- presumably off the highs in oil prices.

- Production fell to 56.2 from a nose bleed 70.5 in July as it followed orders.

- Employment fell in line to 51.7, March stood at a high 66.

- Prices paid rose to just 62.9 and doesn't reflect the pricing fear we are assuming caused the orders plunge.

So Katrina impacted an already fragile US economy. Dr. Hamilton notes this while discussing the energy related economic impact of Katrina: Day 2:

... this event did not arrive out of the blue. Instead, it came in an environment in which there was already considerable anxiety about gas prices and sound basis for worrying about a possible recession even if Katrina had done no harm.And Kash makes a similar observation - "I’ve been a bit worried about which way animal spirits were heading in the US" before Katrina struck - he writes on Katrina and Psychology over on Angry Bear:

Could this be enough to tip the whole economic cart over? I'm not certain that it will. But it would seem foolish to deny the very real possibility that it could.

Now add Katrina. ... I think that the current situation contains the seeds for such a shift in sentiment. My personal odds for a recession in 2006 have just gone up, thanks to Katrina.UPDATE: Dr. Polley adds: Katrina and the probability of recession

"I am reluctant to speculate too much too soon about a recession. It's just too early. But all in all, the economics corner of the blogosphere has been (as evidenced by the links here) very reasoned in its assessment of the situation. My take is closest to Hamilton's. It would indeed be foolish to underestimate the possibility that this could be the straw that breaks the camel's back.OTOH, the Ten Year bond has rallied and the yield has dropped from 4.4% to just under 4.1% over the last few weeks. This will probably lead to lower mortgage rates and could possibly boost equity extraction and support the housing market. Tomorrow the OFHEO House Price Index will be released and I believe it will show stunning widespread gains in house prices and that might help with confidence. But I think the housing boom is almost over, even with slightly lower mortgage rates.

...

Of course, that doesn't mean a recession is inevitable. ... I think it is safe to say, however, that this is a very critical moment for the economy. It could swing either way. If we pass this hurdle, I think it bodes well for the future of the recovery."

Flooding as seen from Space

by Calculated Risk on 8/31/2005 03:37:00 PM

After and before photos of the New Orleans area:

Click on photo from larger image.

August 30, 2005.

Photo from NASA Earth Observatory.

August 27, 2005.

Relief and General Information

by Calculated Risk on 8/31/2005 10:44:00 AM

From The Big Picture: Katrina/New Orleans Disaster Relief Aid

From Movie Guy in comments: Many information links (scroll down - 3 different posts)

Bartlett: Housing Balloon or Bubble?

by Calculated Risk on 8/31/2005 01:11:00 AM

Bruce Barlett writes in the Washington Times:

Over the weekend, Federal Reserve Chairman Alan Greenspan warned housing boom speculators should be very careful. What goes up fast can come down just as fast.Bartlett then reviews many of the riskier loans available these days. He concludes:

A key underpinning of the housing price surge is the lenders' belief risks have fallen. They therefore became more willing to lend on terms they would not have extended in the past. This made available mortgages to previously unqualified borrowers and bigger mortgages to those with good credit.

Though he is no alarmist, Mr. Greenspan warned Friday that if lenders should perceive greater risk, rates could rise and borrowing qualifications tighten quickly. "Newly abundant liquidity can readily disappear," he noted.I suggest reading the entire commentary.

Access to mortgages will become much more limited, people will have less money to pay for housing, and this must bring prices down. A mild downturn could thereby become a collapse, with consequences throughout the economy.

Tuesday, August 30, 2005

Damage: "Swimming in Crude, No Gasoline"

by Calculated Risk on 8/30/2005 07:49:00 PM

CBS MarketWatch exaggerates - a little:

"Americans could be swimming in crude, but wouldn't have a drop of gasoline to run their cars."UPDATE: Series of Port Fourchon photos

Wholesale prices of gasoline are already over $3.00 per gallon on the Gulf Coast:

Wholesale gasoline prices on the Gulf Coast broke $3 a gallon on Tuesday -- far higher than prices at most U.S. pumps -- as major refineries remained shut after Hurricane Katrina, trading sources said.There have been some relatively positive damage reports (also CBSMarketWatch):

This could spell a huge spike in retail prices for drivers throughout the United States in the coming days and in particular those in the Southeast, where prices are typically the lowest in the country.

...

"Retail prices are going to vary among regions but for all practical purposes $3 is a floor," said private oil analyst Jim Ritterbusch.

The spike could spread across other regions of the United States due to the shutdown of two fuel pipelines from the Gulf Coast to the Northeast, including the massive Colonial Pipeline.

"This tightness of supply in the Gulf Coast is going to spread," said Ritterbusch, of Galena, Illinois. He said the shutdown of a major fuel pipeline from the Gulf Coast to the Northeast could push prices up in other regions.

"This thing has tentacles that are going to stretch all over the place," Ritterbusch said.

The vital Louisiana Offshore Oil Port, the only U.S. port that can handle supertankers, apparently escaped major damage, the manager of the port told Dow Jones NewsWires.Also: BP says US Gulf oil rigs intact after Hurricane Katrina. But its the refineries that are critical in the short term. Of the 9 major refineries in the area, only Exxon Mobil's Baton Rouge facility is operational. And, as reported earlier, Valero expect to be out of operation for 1 to 2 weeks. Damage reports are expected tomorrow for some of the other refineries.

The major onshore port at Port Fourchon, also escaped major damage, according to Dow Jones NewsWires. The port is the base for oil service operations for oil rigs in the Gulf.

However, the channel leading to the port may have suffered severe silting from the storm surge. Dredging the channel could take weeks or longer. There could be a "very large impact to the energy supply," if the port can't reopen, port manager Ted Falgout told CNBC.

The Henry Hub, the junction of several pipelines in central Louisiana that serves as the pricing point for natural gas, reopened Monday afternoon. The condition of pipelines leading to the Henry Hub from the coast is not known.

The FED Minutes: Two Reviews

by Calculated Risk on 8/30/2005 05:06:00 PM