by Calculated Risk on 7/27/2005 11:00:00 AM

Wednesday, July 27, 2005

June: Record New Home Sales

According to a Census Bureau report, New Home Sales in June were at a seasonally adjusted annual rate of 1.374 million vs. market expectations of 1.3 million. May sales were revised up to 1.321 million from 1.271 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

Sales of new one-family houses in June 2005 were at a seasonally adjusted annual rate of 1,374,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development.

The Not Seasonally Adjusted monthly rate was 122,000 New Homes sold, down from a revised 123,000 in May.

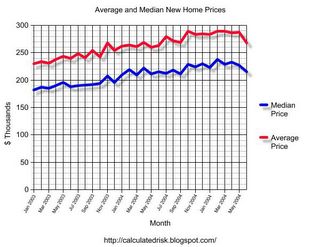

The median sales price of new houses sold in June 2005 was $214,800; the average sales price was $267,400.

The average sales price is down and the median price is the lowest since September of 2004.

The seasonally adjusted estimate of new houses for sale at the end of June was 454,000. This represents a supply of 4.0 months at the current sales rate.

The seasonally adjusted supply of New Homes was 4.0 months, about normal for the last few years.

Tuesday, July 26, 2005

Housing Inventories

by Calculated Risk on 7/26/2005 02:22:00 AM

Existing home inventories rose to 2.653 million in June. Because sales were so strong (7.33 million annual rate), this represented a supply of 4.3 months.

I expect a further increase in inventories based on recent articles like this one: D.C. Area Housing Market Cools Off.

Home sales tend to slow in the summer, but the number of houses for sale in the Washington area has climbed by 50 percent in recent months. The available inventory has risen to about 35,300 homes, up from an average of about 23,000 in the past three years....Therefore I expect a further increase in July inventories to 2.9+ million (from 2.653 million in June). I also expect to see a small drop in July sales to maybe around 6.8 million (still very strong) annual rate.

If both of these predictions hold, this computes to a 5.1 month supply - the highest level in a number of years.

Monday, July 25, 2005

DiMartino: Bubble's Fallout?

by Calculated Risk on 7/25/2005 10:52:00 PM

DiMartino disagrees with Greenspan on the housing bubble:

There's a good chance the housing bubble carries severe macroeconomic implications, a point Alan Greenspan disputed in his congressional testimony last week.I tried to quantify the impact of the housing bust on the economy on Angry Bear. DiMartino does a better job:

If prices fall, he said, "they likely would be accompanied by some economic stress, though the macroeconomic implications need not be substantial."

Let's start with some factoids from Merrill Lynch:

•Real estate accounts for 70 percent of the rise in household net worth since 2001.

•Forty percent of private-sector jobs created since then are housing-related.

•Consumer spending and residential construction have accounted for 90 percent of U.S. economic growth.

The inevitable pullback in construction speaks directly to housing's risks. A similar 40 percent decline in construction to that of the 1981-82 recession implies a decline of 2 percentage points in GDP.

And then there's the wealth effect. The housing bubble has added $5 trillion to household net worth, equating to about $70,000 for a family of four.

"The large wealth effect associated with the housing bubble, which has spurred a consumption boom in the last few years, will go into reverse as housing prices plummet," Mr. Baker predicted.

This dent in consumption would whack an additional 1.6 to 2.5 percentage points off GDP growth. Totaled out, that GDP retreat about equals current GDP growth.

Maybe I'm being obtuse, but a recession is about as macro as you can get, economically speaking.

Maybe the best thing to do is respectfully agree to disagree with Mr. Greenspan and let time render its own decision.

Contract Oil Prices

by Calculated Risk on 7/25/2005 05:49:00 PM

Back in April, on Angry Bear, I suggested that a sustained oil contract price above $50 per barrel might lead to a recession.

UPDATE: By "contract" I mean actual price paid for oil, not Futures contract. The DOE provides the average price paid per contract on a weekly basis. When measuring the impact on the economy, I want to look at the actual dollars paid. Sorry for any confusion.

Click on graph for larger image.

The average contract price for a barrel of oil has been above $50 for four consecutive weeks.

The DOE expects this trend to continue and they are projecting spot prices to "average $59 per barrel for the third quarter of 2005" and "above $55 per barrel for the rest of 2005 and 2006".

NOTE: Actual contract prices are usually $5 to $10 per barrel below spot prices.

Based on my earlier calculations, I believe the price of oil is now in the danger zone for the economy. The good news is the price is being driven by growing demand as opposed to a supply shock like in '73 and '79. We will probably see some slackening of demand in the near future and that should lead to somewhat lower prices.

EDIT: Greenspan believes the current price of oil will not hurt the economy:

Should the prices of crude oil and natural gas flatten out after their recent run-up--the forecast currently embedded in futures markets--the prospects for aggregate demand appear favorable.However he cautioned:

Energy prices represent a second major uncertainty in the economic outlook. A further rise could cut materially into private spending and thus damp the rate of economic expansion.

Sunday, July 24, 2005

Premature Celebration

by Calculated Risk on 7/24/2005 10:13:00 PM

On Angry Bear I discuss a tale of two governors and the danger of premature fiscal celebrating. We should also consider the recent premature celebration by the Bush Administration.

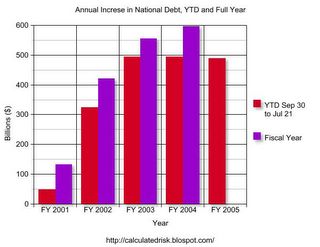

Click on graph for larger image.

This graph shows the Year to Date (July 21st) and full fiscal year increase in the National Debt for 2001 through 2005.

The graph shows that for YTD fiscal 2005 (Oct 1, 2004 - July 21, 2005), the National Debt has increased $489.6 Billion. This is almost the same as for the equivalent period for the previous two years. Last year for the same period was $494.5 Billion.

Not exactly cause for celebration.

I will stick to my earlier prediction that the National Debt will increase more in Fiscal 2005 than in Fiscal 2004. It will probably be close, but this is far from the claims of the Bush Administration. Of course the Bush Administration isn't talking about reductions in the increase in the debt, they are discussing improvements in "forecasts" for the Enron style "Unified Budget".

Housing: "Rapid shifts putting chill on hot June data"

by Calculated Risk on 7/24/2005 04:06:00 PM

Rising inventories is the story in many housing bubble areas. The Sacramento Bee reports:

While the latest sales statistics for June show more of the same - a strong market with rising prices - many agents and brokers say the lagging data don't reflect recent market trends. The number of homes for sale has risen to levels not seen since the late 1990s, they say, and buyer psychology is changing fast.I think the surge in inventories will show up in June's Existing Home Sales numbers (released this coming week), but we may have to wait until the July numbers are released.

"We are in a shifting situation right now," said broker Pam Petterle, the manager for Prudential California Realty's Sacramento-Tahoe region. "The biggest change is that we have a much greater inventory ... and that's a major change because it shifts the balance from sellers driving this market to a more balanced market. There are not as many multiple offers, and listings are staying on the market longer."

At the end of June, the inventory of resale homes on the market in Sacramento, Placer, El Dorado and Yolo counties rose to 6,246. It was the highest for any June since 1999 and the most for any month since September 2001, according to TrendGraphix, a local data firm affiliated with Lyon Real Estate.

Saturday, July 23, 2005

Housing, Jobs and Bernanke Revisited

by Calculated Risk on 7/23/2005 02:02:00 AM

The Press-Enterprise quotes UCLA economist Christopher Thornberg on California's Inland Empire:

Thornberg also agreed ... that construction is the Inland area's economic driver -- a situation he finds troubling for the area.In a previous post I suggested CEA Chairman Bernanke misspoke when he argued that jobs were a driving factor in higher home prices. Dr. Hamilton of Econobrowser came to Bernanke's defense showing that there was some correlation between jobs and higher home prices (on a per state basis over the last 5 years). However, I believe Dr. Hamilton confused correlation with causation.

"There's a housing bubble and it's going to burst," he said. "When it does, everything else is going to start falling like dominoes behind it."

NOTE ADDED: I really enjoy Dr. Hamilton's blog and recommend it highly. I just disagree with him on this point.

I've argued for some time that the housing bubble was leading to RE related job creation (not the inverse). Apparently Dr. Thornberg agrees with me. In fact, if you back out RE related jobs, the correlation between jobs and housing prices appears to disappear.

I only analyzed a few states since this is a big job and the state by state BLS data varies. I looked at the boom states of California and Nevada, and bust states Ohio and Tennessee. In California, 309K of the 361K jobs added since March 2000 were RE related. In Nevada, it is 83K out of 189K. The reverse is true for Ohio and Tennessee; both of these states have lost RE related jobs. Although this isn't definitive, I would argue that the causation is the housing bubble is creating jobs - not jobs leading to higher housing prices.

To echo Dr. Thornberg: There is a housing bubble, it is going to burst, and those areas dependent on housing related jobs will experience a snowball economic effect.

Friday, July 22, 2005

Housing: Storm Clouds?

by Calculated Risk on 7/22/2005 01:35:00 PM

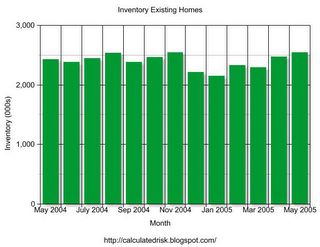

Next week, the National Association of Realtors will report June Existing Home Sales. Also, the Census Bureau will report New Home Sales. I expect the sales numbers to be strong, but I will be looking closely at inventories. There have been numerous local area reports of rising existing home inventories for June, and this report should tell us if rising inventories is a widespread phenomenon.

Click on graph for larger image.

Inventories have been relatively flat for the last year with normal seasonal fluctuations.

A jump in inventories to 2.7+ million would probably be a warning sign for the housing market.

On another note, General Glut predicts "The end of ultra-easy mortgage money". Gen'l Glut writes: "These interest rate hikes should hit ARM-dependent markets in particular -- and that means California." I concur.

The Mortgage Bankers Association reports:

The adjustable-rate mortgage (ARM) share of activity increased to 28.5 percent of total applications from 27.9 percent the previous week.Given the spread between the various mortgage products, I'm surprised anyone is using an ARM. The breakeven point for a 30 year fixed rate mortgage vs. a 1 year ARM is less than 3 years. For those using a 5/1 year ARM (fixed for 5 years), the rate is the same as a 15 year fixed!

Since 28% of all application are for ARMs, this probably means:

1) Buyers think interest rates will decline in the future, or

2) Buyers are planning on moving within 3 years, or

3) Buyers can only qualify with a reduced payment.

None of these reasons seem compelling. I think this is more evidence of speculation / excessive leverage.

UPDATE: Rising "Workouts" (Thanks to Ben Jones)

Typically, mortgage delinquencies and foreclosures result from an unexpected financial crisis - a job loss or medical illness that leaves homeowners unable to pay the bills. But now experts are warning that homeowners who - thanks to low rates - have taken on more debt than they should have, face a growing risk of mortgage delinquencies and foreclosures.

Indeed, the first signs of it are starting to emerge. The number of homeowners seeking loan workouts reached 89,741 in the first quarter of 2005, compared with 155,495 for all of 2004, according to the U.S. Department of Housing and Urban Development.

Last month, Standard & Poor's Ratings Services in New York said the risk of defaults is growing on certain adjustable-rate mortgages. These loans initially can lower monthly mortgage payments, allowing some buyers to purchase homes they otherwise couldn't afford. Some borrowers may face increases in their monthly payments of 50% to 90% when the low-rate period ends, S&P warned, and homeowners who haven't planned carefully, or whose income proves insufficient, may default.

"With some of the very unique and potentially risky loan products out there now, and the very high rate at which they're being used, it could turn into the full employment act for loan workout specialists," says Laurie Maggiano, deputy director of the office of single family asset management at HUD.

Thursday, July 21, 2005

Federal Reserve on Housing (June Minutes)

by Calculated Risk on 7/21/2005 02:04:00 PM

Federal Reserve minutes for June. Here are some excerpts on housing:

At this meeting the Committee reviewed and discussed staff presentations on the topic of housing valuations and monetary policy. Prices of houses in the United States had risen sharply in recent years, especially in certain areas of the country, to very high levels relative to incomes or rents. In addition to local market factors, a wide range of influences appeared to be supporting home prices, including solid gains in disposable income, low mortgage rates, and financial innovation in the residential mortgage market. Prices might be somewhat above the levels consistent with these underlying factors, but measuring the extent of any overvaluation either nationally or in regional markets posed considerable conceptual and statistical difficulties. Meeting participants noted that the rise in house prices had been accompanied by a modest shift toward potentially riskier types of mortgages, including adjustable-rate and interest-only loans, which could pose challenges to both lenders and borrowers. Nonetheless, financial institutions generally remained in a comfortable capital position, such loans had performed well thus far, much of the associated risk had been transferred to other investors through securitization, and valuations had risen more rapidly than mortgage debt on average--so that loan-to-value ratios had fallen.

Activity in the housing sector remained robust. Single-family starts averaged more than 1.65 million units at an annual rate in April and May, not much below the very strong first-quarter pace. Sales of both new and existing homes remained at a high level in May. While prices of existing homes continued to increase rapidly, new home prices showed signs of decelerating. Available indicators suggested that, with the ongoing support of low mortgage rates, the housing sector remained strong in June.

With regard to any role for monetary policy in responding to possible imbalances in housing or bond markets, meeting participants stressed the importance of the pursuit of their core objectives of price stability and maximum sustainable economic growth. To the extent that an asset price movement threatened the achievement of those objectives, it would of course be taken into consideration in setting policy. However, given the unavoidable uncertainties associated with judgments regarding the appropriate level of and likely future movements in asset prices, a strategy of responding more directly to possible mispricing was seen as very unlikely to contribute, on balance, to the achievement of the Committee's objectives over time.My interpretation: "There is a problem. There is nothing we can do." This is eerily reminiscent of minutes from the FED in late '99 concerning the NASDAQ.

Wednesday, July 20, 2005

Greenspan on Housing

by Calculated Risk on 7/20/2005 12:23:00 PM

Testimony of Chairman Alan Greenspan July 20, 2005. A short housing excerpt:

... they suggest that risk takers have been encouraged by a perceived increase in economic stability to reach out to more distant time horizons. These actions have been accompanied by significant declines in measures of expected volatility in equity and credit markets inferred from prices of stock and bond options and narrow credit risk premiums. History cautions that long periods of relative stability often engender unrealistic expectations of its permanence and, at times, may lead to financial excess and economic stress.

Such perceptions, many observers believe, are contributing to the boom in home prices and creating some associated risks. And, certainly, the exceptionally low interest rates on ten-year Treasury notes, and hence on home mortgages, have been a major factor in the recent surge of homebuilding, home turnover, and particularly in the steep climb in home prices. Whether home prices on average for the nation as a whole are overvalued relative to underlying determinants is difficult to ascertain, but there do appear to be, at a minimum, signs of froth in some local markets where home prices seem to have risen to unsustainable levels. Among other indicators, the significant rise in purchases of homes for investment since 2001 seems to have charged some regional markets with speculative fervor.

The apparent froth in housing markets appears to have interacted with evolving practices in mortgage markets. The increase in the prevalence of interest-only loans and the introduction of more-exotic forms of adjustable-rate mortgages are developments of particular concern. To be sure, these financing vehicles have their appropriate uses. But some households may be employing these instruments to purchase homes that would otherwise be unaffordable, and consequently their use could be adding to pressures in the housing market. Moreover, these contracts may leave some mortgagors vulnerable to adverse events. It is important that lenders fully appreciate the risk that some households may have trouble meeting monthly payments as interest rates and the macroeconomic climate change.

The U.S. economy has weathered such episodes before without experiencing significant declines in the national average level of home prices. Nevertheless, we certainly cannot rule out declines in home prices, especially in some local markets. If declines were to occur, they likely would be accompanied by some economic stress, though the macroeconomic implications need not be substantial. Nationwide banking and widespread securitization of mortgages make financial intermediation less likely to be impaired than it was in some previous episodes of regional house-price correction. Moreover, a decline in the national housing price level would need to be substantial to trigger a significant rise in foreclosures, because the vast majority of homeowners have built up substantial equity in their homes despite large mortgage-market-financed withdrawals of home equity in recent years.

Historically, it has been rising real long-term interest rates that have restrained the pace of residential building and have suppressed existing home sales, high levels of which have been the major contributor to the home equity extraction that arguably has financed a noticeable share of personal consumption expenditures and home modernization outlays.