by Calculated Risk on 7/22/2005 01:35:00 PM

Friday, July 22, 2005

Housing: Storm Clouds?

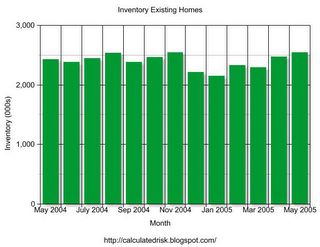

Next week, the National Association of Realtors will report June Existing Home Sales. Also, the Census Bureau will report New Home Sales. I expect the sales numbers to be strong, but I will be looking closely at inventories. There have been numerous local area reports of rising existing home inventories for June, and this report should tell us if rising inventories is a widespread phenomenon.

Click on graph for larger image.

Inventories have been relatively flat for the last year with normal seasonal fluctuations.

A jump in inventories to 2.7+ million would probably be a warning sign for the housing market.

On another note, General Glut predicts "The end of ultra-easy mortgage money". Gen'l Glut writes: "These interest rate hikes should hit ARM-dependent markets in particular -- and that means California." I concur.

The Mortgage Bankers Association reports:

The adjustable-rate mortgage (ARM) share of activity increased to 28.5 percent of total applications from 27.9 percent the previous week.Given the spread between the various mortgage products, I'm surprised anyone is using an ARM. The breakeven point for a 30 year fixed rate mortgage vs. a 1 year ARM is less than 3 years. For those using a 5/1 year ARM (fixed for 5 years), the rate is the same as a 15 year fixed!

Since 28% of all application are for ARMs, this probably means:

1) Buyers think interest rates will decline in the future, or

2) Buyers are planning on moving within 3 years, or

3) Buyers can only qualify with a reduced payment.

None of these reasons seem compelling. I think this is more evidence of speculation / excessive leverage.

UPDATE: Rising "Workouts" (Thanks to Ben Jones)

Typically, mortgage delinquencies and foreclosures result from an unexpected financial crisis - a job loss or medical illness that leaves homeowners unable to pay the bills. But now experts are warning that homeowners who - thanks to low rates - have taken on more debt than they should have, face a growing risk of mortgage delinquencies and foreclosures.

Indeed, the first signs of it are starting to emerge. The number of homeowners seeking loan workouts reached 89,741 in the first quarter of 2005, compared with 155,495 for all of 2004, according to the U.S. Department of Housing and Urban Development.

Last month, Standard & Poor's Ratings Services in New York said the risk of defaults is growing on certain adjustable-rate mortgages. These loans initially can lower monthly mortgage payments, allowing some buyers to purchase homes they otherwise couldn't afford. Some borrowers may face increases in their monthly payments of 50% to 90% when the low-rate period ends, S&P warned, and homeowners who haven't planned carefully, or whose income proves insufficient, may default.

"With some of the very unique and potentially risky loan products out there now, and the very high rate at which they're being used, it could turn into the full employment act for loan workout specialists," says Laurie Maggiano, deputy director of the office of single family asset management at HUD.