by Calculated Risk on 7/23/2005 02:02:00 AM

Saturday, July 23, 2005

Housing, Jobs and Bernanke Revisited

The Press-Enterprise quotes UCLA economist Christopher Thornberg on California's Inland Empire:

Thornberg also agreed ... that construction is the Inland area's economic driver -- a situation he finds troubling for the area.In a previous post I suggested CEA Chairman Bernanke misspoke when he argued that jobs were a driving factor in higher home prices. Dr. Hamilton of Econobrowser came to Bernanke's defense showing that there was some correlation between jobs and higher home prices (on a per state basis over the last 5 years). However, I believe Dr. Hamilton confused correlation with causation.

"There's a housing bubble and it's going to burst," he said. "When it does, everything else is going to start falling like dominoes behind it."

NOTE ADDED: I really enjoy Dr. Hamilton's blog and recommend it highly. I just disagree with him on this point.

I've argued for some time that the housing bubble was leading to RE related job creation (not the inverse). Apparently Dr. Thornberg agrees with me. In fact, if you back out RE related jobs, the correlation between jobs and housing prices appears to disappear.

I only analyzed a few states since this is a big job and the state by state BLS data varies. I looked at the boom states of California and Nevada, and bust states Ohio and Tennessee. In California, 309K of the 361K jobs added since March 2000 were RE related. In Nevada, it is 83K out of 189K. The reverse is true for Ohio and Tennessee; both of these states have lost RE related jobs. Although this isn't definitive, I would argue that the causation is the housing bubble is creating jobs - not jobs leading to higher housing prices.

To echo Dr. Thornberg: There is a housing bubble, it is going to burst, and those areas dependent on housing related jobs will experience a snowball economic effect.

Friday, July 22, 2005

Housing: Storm Clouds?

by Calculated Risk on 7/22/2005 01:35:00 PM

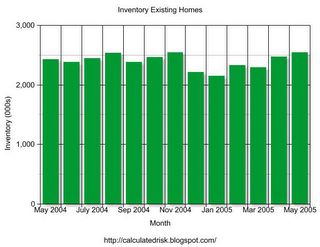

Next week, the National Association of Realtors will report June Existing Home Sales. Also, the Census Bureau will report New Home Sales. I expect the sales numbers to be strong, but I will be looking closely at inventories. There have been numerous local area reports of rising existing home inventories for June, and this report should tell us if rising inventories is a widespread phenomenon.

Click on graph for larger image.

Inventories have been relatively flat for the last year with normal seasonal fluctuations.

A jump in inventories to 2.7+ million would probably be a warning sign for the housing market.

On another note, General Glut predicts "The end of ultra-easy mortgage money". Gen'l Glut writes: "These interest rate hikes should hit ARM-dependent markets in particular -- and that means California." I concur.

The Mortgage Bankers Association reports:

The adjustable-rate mortgage (ARM) share of activity increased to 28.5 percent of total applications from 27.9 percent the previous week.Given the spread between the various mortgage products, I'm surprised anyone is using an ARM. The breakeven point for a 30 year fixed rate mortgage vs. a 1 year ARM is less than 3 years. For those using a 5/1 year ARM (fixed for 5 years), the rate is the same as a 15 year fixed!

Since 28% of all application are for ARMs, this probably means:

1) Buyers think interest rates will decline in the future, or

2) Buyers are planning on moving within 3 years, or

3) Buyers can only qualify with a reduced payment.

None of these reasons seem compelling. I think this is more evidence of speculation / excessive leverage.

UPDATE: Rising "Workouts" (Thanks to Ben Jones)

Typically, mortgage delinquencies and foreclosures result from an unexpected financial crisis - a job loss or medical illness that leaves homeowners unable to pay the bills. But now experts are warning that homeowners who - thanks to low rates - have taken on more debt than they should have, face a growing risk of mortgage delinquencies and foreclosures.

Indeed, the first signs of it are starting to emerge. The number of homeowners seeking loan workouts reached 89,741 in the first quarter of 2005, compared with 155,495 for all of 2004, according to the U.S. Department of Housing and Urban Development.

Last month, Standard & Poor's Ratings Services in New York said the risk of defaults is growing on certain adjustable-rate mortgages. These loans initially can lower monthly mortgage payments, allowing some buyers to purchase homes they otherwise couldn't afford. Some borrowers may face increases in their monthly payments of 50% to 90% when the low-rate period ends, S&P warned, and homeowners who haven't planned carefully, or whose income proves insufficient, may default.

"With some of the very unique and potentially risky loan products out there now, and the very high rate at which they're being used, it could turn into the full employment act for loan workout specialists," says Laurie Maggiano, deputy director of the office of single family asset management at HUD.

Thursday, July 21, 2005

Federal Reserve on Housing (June Minutes)

by Calculated Risk on 7/21/2005 02:04:00 PM

Federal Reserve minutes for June. Here are some excerpts on housing:

At this meeting the Committee reviewed and discussed staff presentations on the topic of housing valuations and monetary policy. Prices of houses in the United States had risen sharply in recent years, especially in certain areas of the country, to very high levels relative to incomes or rents. In addition to local market factors, a wide range of influences appeared to be supporting home prices, including solid gains in disposable income, low mortgage rates, and financial innovation in the residential mortgage market. Prices might be somewhat above the levels consistent with these underlying factors, but measuring the extent of any overvaluation either nationally or in regional markets posed considerable conceptual and statistical difficulties. Meeting participants noted that the rise in house prices had been accompanied by a modest shift toward potentially riskier types of mortgages, including adjustable-rate and interest-only loans, which could pose challenges to both lenders and borrowers. Nonetheless, financial institutions generally remained in a comfortable capital position, such loans had performed well thus far, much of the associated risk had been transferred to other investors through securitization, and valuations had risen more rapidly than mortgage debt on average--so that loan-to-value ratios had fallen.

Activity in the housing sector remained robust. Single-family starts averaged more than 1.65 million units at an annual rate in April and May, not much below the very strong first-quarter pace. Sales of both new and existing homes remained at a high level in May. While prices of existing homes continued to increase rapidly, new home prices showed signs of decelerating. Available indicators suggested that, with the ongoing support of low mortgage rates, the housing sector remained strong in June.

With regard to any role for monetary policy in responding to possible imbalances in housing or bond markets, meeting participants stressed the importance of the pursuit of their core objectives of price stability and maximum sustainable economic growth. To the extent that an asset price movement threatened the achievement of those objectives, it would of course be taken into consideration in setting policy. However, given the unavoidable uncertainties associated with judgments regarding the appropriate level of and likely future movements in asset prices, a strategy of responding more directly to possible mispricing was seen as very unlikely to contribute, on balance, to the achievement of the Committee's objectives over time.My interpretation: "There is a problem. There is nothing we can do." This is eerily reminiscent of minutes from the FED in late '99 concerning the NASDAQ.

Wednesday, July 20, 2005

Greenspan on Housing

by Calculated Risk on 7/20/2005 12:23:00 PM

Testimony of Chairman Alan Greenspan July 20, 2005. A short housing excerpt:

... they suggest that risk takers have been encouraged by a perceived increase in economic stability to reach out to more distant time horizons. These actions have been accompanied by significant declines in measures of expected volatility in equity and credit markets inferred from prices of stock and bond options and narrow credit risk premiums. History cautions that long periods of relative stability often engender unrealistic expectations of its permanence and, at times, may lead to financial excess and economic stress.

Such perceptions, many observers believe, are contributing to the boom in home prices and creating some associated risks. And, certainly, the exceptionally low interest rates on ten-year Treasury notes, and hence on home mortgages, have been a major factor in the recent surge of homebuilding, home turnover, and particularly in the steep climb in home prices. Whether home prices on average for the nation as a whole are overvalued relative to underlying determinants is difficult to ascertain, but there do appear to be, at a minimum, signs of froth in some local markets where home prices seem to have risen to unsustainable levels. Among other indicators, the significant rise in purchases of homes for investment since 2001 seems to have charged some regional markets with speculative fervor.

The apparent froth in housing markets appears to have interacted with evolving practices in mortgage markets. The increase in the prevalence of interest-only loans and the introduction of more-exotic forms of adjustable-rate mortgages are developments of particular concern. To be sure, these financing vehicles have their appropriate uses. But some households may be employing these instruments to purchase homes that would otherwise be unaffordable, and consequently their use could be adding to pressures in the housing market. Moreover, these contracts may leave some mortgagors vulnerable to adverse events. It is important that lenders fully appreciate the risk that some households may have trouble meeting monthly payments as interest rates and the macroeconomic climate change.

The U.S. economy has weathered such episodes before without experiencing significant declines in the national average level of home prices. Nevertheless, we certainly cannot rule out declines in home prices, especially in some local markets. If declines were to occur, they likely would be accompanied by some economic stress, though the macroeconomic implications need not be substantial. Nationwide banking and widespread securitization of mortgages make financial intermediation less likely to be impaired than it was in some previous episodes of regional house-price correction. Moreover, a decline in the national housing price level would need to be substantial to trigger a significant rise in foreclosures, because the vast majority of homeowners have built up substantial equity in their homes despite large mortgage-market-financed withdrawals of home equity in recent years.

Historically, it has been rising real long-term interest rates that have restrained the pace of residential building and have suppressed existing home sales, high levels of which have been the major contributor to the home equity extraction that arguably has financed a noticeable share of personal consumption expenditures and home modernization outlays.

Tuesday, July 19, 2005

Port of Los Angeles: Imports Up, Exports Down for June

by Calculated Risk on 7/19/2005 08:35:00 PM

The Port of Los Angeles released their June statistics today. Inbound (loaded containers) was 335 thousand compared to 313 thousand in May - an increase of 7%.

Outbound volume was 97 thousand loaded containers vs. 105 thousand for May. This is an 8% decline from May.

Port of Long Beach statistics correlate better with imports from China, but I can't overlook the strong import performance / weak export performance for the Port of Los Angeles.

This may indicate a stronger than expected June trade deficit and possibly a larger deficit with Japan.

Financial Times: Housing Bubble to Spread

by Calculated Risk on 7/19/2005 07:10:00 PM

An American Express economist is predicting that the US housing bubble [is] expected to spread according to the Financial Times.

"...the current bubble, which was already larger than the last one, is likely to grow - and spread even further - said John Calverley, chief economist at American Express, the financial services group.See Dr. Setser's comments on the Netherlands.

The boom in US house prices has started later than in other countries such as the UK, Australia, the Netherlands and Spain. However, figures suggest that it is catching up fast."

"...Mr Calverley warned that the boom had definitely become a bubble. The giveaway signs included excitement in the media and new lending policies from banks.

People were borrowing as much as they could because they expected prices would only go up. Meanwhile, new entrepreneurs were springing up offering property advice or “condo flipping”, when flats are bought off-plan and sold as quickly as possible.

A swift end to the phenomenon was unlikely unless interest rates rose significantly. Instead, the US could expect an expansion of the bubble and an even harder landing, predicted Mr Calverley ..."

Monday, July 18, 2005

DataQuick: SoCal RE Still Hot

by Calculated Risk on 7/18/2005 07:51:00 PM

UPDATE: Bay Area: Near Record Sales, New Price Peak

DataQuick reports: Southland Real Estate Market Hits New Highs

Both sales counts and prices reached new highs in Southern California last month. While appreciation continued to ease back, a new price peak was reached in each of the Southland counties.

| All Homes Sold | June-04 | June-05 | Pct.Chg |

| Los Angeles | 11,673 | 12,001 | 2.8% |

| Orange County | 4,749 | 4,898 | 3.1% |

| San Diego | 6,208 | 5,663 | -8.8% |

| Riverside | 6,343 | 6,485 | 2.2% |

| San Bernardino | 4,292 | 4,700 | 9.5% |

| Ventura | 1,466 | 1,707 | 16.4% |

| TOTAL SoCal | 34,731 | 35,454 | 2.1% |

| Median Home Price | June-04 | June-05 | Pct.Chg |

| Los Angeles | $414K | $475K | 14.7% |

| Orange County | $540K | $603K | 11.7% |

| San Diego | $464K | $493K | 6.3% |

| Riverside | $319K | $393K | 23.2% |

| San Bernardino | $246K | $322K | 30.9% |

| Ventura | $500K | $584K | 16.8% |

| TOTAL SoCal | $406K | $465K | 14.5% |

Friday, July 15, 2005

June Trade Deficit Forecast: OIL

by Calculated Risk on 7/15/2005 07:19:00 PM

The May numbers are barely dry, and here we go for June, starting with oil. Using the same model (described here) the ERPP (Energy Related Petroleum Products) trade numbers for June are forecast to be:

Forecast: Total NSA ERRP Imports: $19.6 Billion

Total SA ERPP FORECAST:

Imports SA: $19.4 Billion (seasonal factor estimated at 0.9925 for June)

Exports SA: $2.3 Billion

Balance ERPP: $17.1 Billion

DETAIL ALERT: The following are the internal numbers (mostly for my notes) that will cause your eyes to glaze over!

IMPORTS: Energy Related Petroleum Products.

Barrels Crude: 328.0 million barrels.

Barrels Other ERPP: 90.0 million barrels.

DOE Price per barrel (Crude): $45.11

DOE Price per barrel (Other): $51.88

Preliminary - Total NSA ERRP Imports: $19.5 Billion

NOTE: The BLS reports petroleum import prices rose 7.6% in June from May. The above model used DOE prices. After reviewing the prior prices and comparing the DOE and BLS approaches, the DOE has been slightly more accurate. Last month I split the difference between the estimates (the DOE was slightly closer).

This month I think the BLS numbers are too high (the real time data is revised significantly every month). The BLS approach would predict P(crude) = $46.35 compared to the DOE P(crude) = $45.11. I'm not going to split the difference, since I think the BLS is too high. Instead I will modify the DOE price forecast slightly upwards to reflect the BLS data as follows:

BLS/DOE Price per barrel (Crude): $45.40

BLS/DOE Price per barrel (Other): $52.21

Forecast: Total NSA ERRP Imports: $19.6 Billion

Total SA ERPP FORECAST:

Imports SA: $19.4 Billion (seasonal factor estimated at 0.9925 for June)

Exports SA: $2.3 Billion

Balance ERPP: $17.1 Billion

NOTE: This compares to the actual ERPP balance of -$15.8 Billion in May, so Oil is estimated to add $1.3 Billion to the deficit in June. Gen'l Glut has pointed out that the big jump in oil imports will come in July.

Bernanke, Job Growth and Home Prices

by Calculated Risk on 7/15/2005 05:20:00 PM

Earlier I quoted Ben Bernanke, the new chairman of the White House's Council of Economic Advisers suggesting that the boom in house prices was related to job growth:

"... states exhibiting higher rates of job growth also tend to have experienced greater appreciation in house prices."Now MSNBC's Martin Wolk provides data to show that Bernanke misspoke: Job growth fails to explain soaring home prices (Hat Tip to pgl at Angry Bear)

See the chart "Jobs & Home Prices". The conclusion ... Bernanke is wrong: "Job growth fails to explain soaring home prices".

Housing: New Loan Guidance Ignored

by Calculated Risk on 7/15/2005 11:19:00 AM

The NY Times is reporting: A Hands-Off Policy on Mortgage Loans

For two months now, federal banking regulators have signaled their discomfort about the explosive rise in risky mortgage loans.The regulators think Banks are not in danger because they have shifted the risk to investors and borrowers:

First they issued new "guidance" to banks about home-equity loans, warning against letting homeowners borrow too much against their houses. Then they expressed worry about the surge in no-money-down mortgages, interest-only loans and "liar's loans" that require no proof of a borrower's income.

The impact so far? Almost nil.

"It's as easy to get these loans now as it was two months ago," said Michael Menatian, president of Sanborn Mortgage, a mortgage broker in West Hartford, Conn. "If anything, people are offering them even more than before."

The reason is that federal banking regulators, from the Federal Reserve to the Office of the Comptroller of the Currency, have been reluctant to back up their words with specific actions. For even as they urge caution, officials here are loath to stand in the way of new methods of extending credit.

The main issue for regulators is whether banks and other lenders are properly managing their own risk, and the lenders are looking good.A couple of comforting thoughts:

They have hedged their risks by bundling mortgages into securities that are then sold to investors around the world. And if interest rates go higher, they have shifted much of the risk onto consumers because a growing share of home buyers have taken on adjustable-rate mortgages. At the same time, they have built sturdier financial institutions through mergers and the breakdown of barriers to interstate banking.

Bert Ely, an independent banking analyst who was among the first to recognize the crisis at savings and loan institutions in the 1980's, said the banks are far sounder today. "It's a night-and-day difference," Mr. Ely said. "No comparison."

But consumers - and perhaps the broader economy - are taking on more risk.

"There is a lot of pressure on banks to build market share, and consumers are looking for a quick response," said Barbara J. Grunkemeyer, deputy comptroller for credit risk at the Office of the Comptroller of the Currency. "With respect to these new mortgage products, they are new and have taken off rapidly. We are still in the process of understanding the risk-management systems that surround them."

"If you are the comptroller of the currency or the Federal Reserve, you're looking out for the system of the world," Mr. Frank added. "You're making macroeconomic policy. It's much more fun than looking out for consumers."