by Calculated Risk on 5/02/2005 02:45:00 AM

Monday, May 02, 2005

Looking Ahead: March Trade Deficit

I'm getting a little ahead of the news this week with my post recent on Angry Bear: March Trade Balance Preview. But this story in today's NY Times kept me focused on trade: China Trade Surplus With West Still Rising.

China's global exports soared in the first quarter of this year, allowing the country to rack up huge trade surpluses with the United States and western Europe, according to detailed trade data released late last week by Chinese customs officials.And more on China's trade with Germany:

Even Germany, which has long run trade surpluses with China because it sells heavy manufacturing equipment to Chinese factories, is now in the red: its $2 billion trade surplus in the first three months of last year evaporated, turning into a $159 million trade deficit in the first months of this year.

For those of us worried by the impact of global imbalances, this trend is disconcerting.

Sunday, May 01, 2005

Buffett on Real Estate Bubble and Trade

by Calculated Risk on 5/01/2005 05:52:00 PM

Here are a few quotes from Warren Buffett and Charles Munger from the Berkshire Hathaway annual meeting:

Buffett: "A lot of the psychological well-being of the American public comes from how well they've done with their houses over the years. If indeed there's been a bubble, and it's pricked at some point, the net effect on Berkshire might well be positive [because the company's financial strength would allow it to buy real-estate-related businesses at bargain prices]....And on the Trade Deficit:

"Certainly at the high end of the real estate market in some areas, you've seen extraordinary movement.... People go crazy in economics periodically, in all kinds of ways. Residential housing has different behavioral characteristics, simply because people live there. But when you get prices increasing faster than than the underlying costs, sometimes there can be pretty serious consequences."

Munger: "You have a real asset-price bubble in places like parts of California and the suburbs of Washington, DC. "

Buffet: "It seems to me that a $618 billion trade deficit, rich as we are, strong as this country is, well, something will have to happen that will change that. Most economists will still say some kind of soft landing is possible. I don't know what a soft landing is exactly, in how the numbers come down softly from levels like these...."Read the article for more quotes on other subjects.

Munger: "The present era has no comparable referent in the past history of capitalism. We have a higher percentage of the intelligentsia engaged in buying and selling pieces of paper and promoting trading activity than in any past era. A lot of what I see now reminds me of Sodom and Gomorrah. You get activity feeding on itself, envy and imitation. It has happened in the past that there came bad consequences."

Buffett: "I have no idea on timing. It's far easier to tell what will happen than when it will happen. I would say that what is going on in terms of trade policy is going to have very important consequences. "

Munger: "A great civilization will bear a lot of abuse, but there are dangers in the current situation that threaten anyone who swings for the fences."

Buffett to Munger: "What do you think the end will be?"

Munger: "Bad."

Friday, April 29, 2005

Q1 GDP and Trade

by Calculated Risk on 4/29/2005 06:35:00 PM

Reviewing the first quarter 2005 (advance) GDP report, the first unusual item was inventories. Kash covered inventories in "Changes in Inventories".

Trade

UPDATE: All numbers are seasonally adjusted from the advance GDP report and the Trade report. So these numbers are correct. However, my calculation of $4.5 Billion in additional oil imports is not seasonally adjusted (I noted this in my previous post) so this might be a little less after adjustment.

But another area for concern is the balance of trade. The following table includes the reported trade balance, export and imports, for January and February and the projected numbers for March according to the GDP report.

| Trade | Exports | Imports | ||

| Balance | ||||

| January | -$58.5 | $100.4 | $158.9 | |

| February | -$61.0 | $100.5 | $161.5 | |

| March (est. from GDP) | -$59.9 | $110.3 | $170.1 | |

| Q1 TOTAL | -$179.4 | $311.2 | $490.6 |

We already know the dollar value of oil imports surged in March, probably adding another $4.5 Billion to imports. Therefore imports of $170 Billion is very possible. But why does the BEA expect exports to surge? The global slowdown is impacting other countries more than the US, so we might expect exports to be flat.

I expect the March trade deficit (due May 11) to be worse than the BEA estimate and to negatively impact GDP (preliminary) due on May 26th. Other factors may lead to a positive GDP revision.

Thursday, April 28, 2005

Macroblog to Roach: J'Défends!

by Calculated Risk on 4/28/2005 01:29:00 AM

In a four post series (1, 2, 3, 4) , Dr. Altig defends the Federal Reserve against Stephen Roach's most recent Fed bashing piece: "Original Sin".

Stripping aside Roach's hyperbole, I believe Roach makes three arguments:

1) that recent growth in the US economy has resulted from borrowing against inflated assets leading to "imbalances and distortions";

2) the FED should consider asset prices when setting interest rates and

3) that FED officials have made some irresponsible comments in recent years.

On the first point, I mostly agree with Roach. In my mind there is no question that the US has been buying growth with debt, both public (general fund deficit) and private (mortgage equity withdrawal).

On the second point, I believe the FED should not consider asset prices when setting interest rates, so I disagree with Roach. Much of Roach's scathing commentary is based on his belief that the FED should target asset prices.

And on the third point, I generally agree with macroblog that FED officials have, with the exception of Mr. Greenspan, been responsible in their comments, especially in recent months. I believe Chairman Greenspan has made several irresponsible and inaccurate comments when speaking for himself.

Perhaps the FED could have spoken out sooner on certain issues, like the general fund deficit and the housing bubble. As Dr. Thoma wrote in the macroblog comments concerning the 'behavior of congress over the deficit/trust fund':

"... watching out for the public interest is an important role of the Fed, but that's not something the Fed had direct control over and other than publicly denouncing such policy, they have little choice but to do their best in spite of poor policy elsewhere in government."In my view Roach's anger is misdirected. Although I agree with Roach's general economic assessment, I believe the problems are primarily due to poor fiscal and public policy.

Wednesday, April 27, 2005

More Signs of a Global Slowdown

by Calculated Risk on 4/27/2005 12:45:00 AM

UPDATE: The Economist (on Germany): If not now, when?

Germany:

NYTimes: Fears Mount That Germany Faces Recession

Financial Times: German business data add to eurozone gloom

Japan:

Bloomberg: Japan's Household Spending Falls; Economy Sheds Jobs

Financial Times: Japanese economy stuck in deflation

And the really dark side ...

$100 (US) oil, major recession seen as likely

Conference told of imminent price shocks as world demand rises while reserves fall

Tuesday, April 26, 2005

New Home Sales, Monthly Unadjusted

by Calculated Risk on 4/26/2005 08:21:00 PM

Here is a graph of actual monthly New Home Sales for the last 3 years.

Click on graph for larger image.

March is usually one of the strongest months of the year, and for March 2005, sales were a monthly record of 144 thousand units.

Interestingly the median sales price dropped significantly in March. The reason probably is due to the surge in sales in the South. Over half the sales in March (73 thousand) occured in the South (the Census bureau segments the data into four regions). The previous record for the South was 59 thousand last March.

So sales in the South increased 23% from last March, but only 10% over the other three regions.

Record New Home Sales

by Calculated Risk on 4/26/2005 12:54:00 AM

According to a Census Bureau report, New Home Sales set a record in March to a seasonally adjusted annual rate of 1.431 million vs. market expectations of 1.19 million.

Click on Graph for larger image.

NOTE: The graph starts at 700 thousand units per month to better show monthly variation.

Sales of new one-family houses in March 2005 were at a seasonally adjusted annual rate of 1,431,000, according to estimates released jointly today by the U.S. Census Bureau and the Department of Housing and Urban Development. This is 12.2 percent above the revised February rate of 1,275,000 and is 12.7 percent above the March 2004 estimate of 1,270,000.

The median sales price of new houses sold in March 2005 was $212,300; the average sales price was $281,300. The seasonally adjusted estimate of new houses for sale at the end of March was 433,000. This represents a supply of 3.6 months at the current sales rate.

There is a seasonal pattern to supply and 3.6 months is below the normal level of supply as compared to 2003 and 2004. Months of supply is based on sales, and the record sales in March makes the months of supply number smaller.

Monday, April 25, 2005

Lau and Stiglitz: China's Alternative to Revaluation

by Calculated Risk on 4/25/2005 07:40:00 PM

In a Financial Times commentary, Lawrence Lau and Joseph Stiglitz argue that an export tax would be a better choice for China.

"If China were to contemplate a revaluation, it should consider as an alternative the imposition of a tax on its exports. Export taxes are generally permitted under WTO rules. Indeed, China has already moved in a limited way in this direction on textiles. There are several reasons voluntary imposition of a tax on its exports may be preferable to a renminbi revaluation. Both would have similar effects on Chinese exports - they would make them appear more expensive to the rest of the world. Because of this similarity, an export tax would provide an empirical answer to the question of whether a revaluation would work. But it would do this without some of the significant costs attendant on revaluation.It seems a 5% export tax would just increase the US trade deficit with China and might lead to more inflation in the US. I'll be interested in Setser and Roubini's views on this proposal!

One of the advantages of an export tax is that, unlike a revaluation, it would not lead to financial losses for Chinese holders of dollar-denominated assets, such as the People's Bank of China or commercial banks and enterprises. China's central bank currently holds about $640bn (£334bn) in foreign exchange reserves. Assume that only 75 per cent is held in dollar-denominated assets. A renminbi revaluation of 10 per cent would result in a loss of $48bn or about 400bn yuan for the central bank.

Another cost of revaluation would be possible further deterioration in the distribution of income, including increasing the already large rural-urban wage gap. Revaluation would put downward pressure on domestic Chinese agricultural prices; an export tax would not. An export tax, by contrast, would have a beneficial side effect: it could generate substantial government revenue for China. Given the high import content of Chinese exports to the US, a 5 per cent export duty would be equivalent to a currency revaluation of some 15-25 per cent, generating about $30bn-$42bn a year.

Finally, an export tax would not reward currency speculators. It may even discourage the speculation that has complicated macro-economic management of China's economy. If potential speculators can be convinced that China would rather impose an export tax than revalue, less "hot money" will flow into China. By contrast, nothing encourages speculators more than a "victory", especially where, as here, it is likely to do little to correct the underlying problems."

Q1 2005: Housing Vacancies and Homeownership

by Calculated Risk on 4/25/2005 11:29:00 AM

The Census Bureau released their Housing Vacancies and Homeownership report for Q1 2005 this morning.

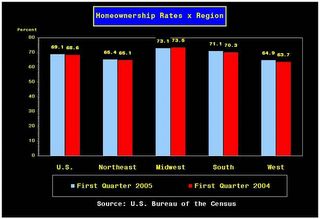

National vacancy rates in the first quarter 2005 were 10.1 percent in rental housing and 1.8 percent in homeowner housing, the Department of Commerce and Census Bureau announced today. The Census Bureau said the rental vacancy rate was not different from the first quarter rate last year (10.4 percent) or the rate last quarter (10.0 percent). For homeowner vacancies, the current rate (1.8 percent) was also not different from the rate a year ago (1.7 percent), or the rate last quarter (1.8 percent). The homeownership rate (69.1 percent) for the current quarter was higher than the first quarter 2004 rate (68.6 percent) but not different from the rate last quarter (69.2 percent).

Click on graph for larger image.

Rental vacancies are still over 10% and homeownership rates are still climbing when compared to Q1 2004.

More on Housing

by Calculated Risk on 4/25/2005 01:55:00 AM

My most recent post, "After the Housing Boom: Impact on the Economy", is up on Angry Bear.

On Tuesday, New Home Sales will be released. I believe New Home Sales is a better leading indicator than Existing Home Sales (to be released on Monday). It appears that Sales for March were still strong, so I'm not expecting a significant drop-off in sales volumes reported this month.

Also the Census Bureau will release their quarterly Housing Vacancies and Homeownership report tomorrow.

A busy week for housing stats.

Best to all!