by Calculated Risk on 7/03/2009 09:40:00 AM

Friday, July 03, 2009

SEC may Reinstate Uptick Rule for Short Selling

From the NY Times: S.E.C. May Reinstate Rules for Short-Selling Stocks

The Securities and Exchange Commission appears poised to reverse itself and reinstate rules that would make shorting stocks ... somewhat more difficult.Some people will always blame the short sellers.

...the most likely outcome may be for the S.E.C. to reinstate ... the uptick rule ...

“I don’t mind what I see as minor inconveniences,” said Whitney Tilson, an author and managing partner of T2 Partners, “if it will get rid of the critics who like to blame short-sellers every time a stock goes down.”

Thursday, July 02, 2009

The Krugman Blues

by Calculated Risk on 7/02/2009 11:41:00 PM

A little night music: Loudon Wainwright III performs 'The Krugman Blues' at Madison Square Park in NYC (June 17, 2009)

Note: The last music video I posted featuring an economist was Merle Hazard's discussion with John Taylor (very funny).

UPDATE: And here is Krugman's column tonight: That ’30s Show

Since the recession began, the U.S. economy has lost 6 ½ million jobs — and as that grim employment report confirmed, it’s continuing to lose jobs at a rapid pace. Once you take into account the 100,000-plus new jobs that we need each month just to keep up with a growing population, we’re about 8 ½ million jobs in the hole.

And the deeper the hole gets, the harder it will be to dig ourselves out. The job figures weren’t the only bad news in Thursday’s report, which also showed wages stalling and possibly on the verge of outright decline. That’s a recipe for a descent into Japanese-style deflation, which is very difficult to reverse. Lost decade, anyone?

Wait — there’s more bad news ...

Another Involuntary Landlord and Summary

by Calculated Risk on 7/02/2009 08:48:00 PM

| A little sublease space in D.C. Click on photo for larger image in new window. Photo Credit: a reader in dc Taken today, July 2, 2009. |

Here is a repeat of one of the graphs this morning:

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).

This graph shows the job losses from the start of the employment recession, in percentage terms (as opposed to the number of jobs lost).The current recession is now the 2nd worst recession since WWII in percentage terms - and also in terms of the unemployment rate (only early '80s recession was worse).

And a few posts:

Employment Report: 467K Jobs Lost, 9.5% Unemployment Rate

Unemployment: Stress Test Scenarios, Diffusion Index, Weekly Claims

Employment-Population Ratio, Part Time Workers, Hours Worked

From Paul Krugman on wages: Smells like deflation

On the '00s (the "Naughts") ...

Employment Dec 1999: 130.53 million

Employment Jun 2009: 131.69 million

A gain of just 1.16 million. What are the odds that the economy loses another 1.16 million jobs over the next 6 months? Pretty high. That would mean no net jobs added to the economy for the naughts: Naught for the Naughts!

Bank Failure #52, 7th Today, Founders Bank, Worth, Illinois

by Calculated Risk on 7/02/2009 06:48:00 PM

Founders gambled deposits

Then rolled a seven.

by Soylent Green is People

From the FDIC: The PrivateBank and Trust Company, Chicago, Illinois, Assumes All of the Deposits of Founders Bank, Worth, Illinois

As of April 30, 2009, Founders Bank had total assets of $962.5 million and total deposits of approximately $848.9 million. ...That makes SEVEN today and SIX in Illinois!

The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $188.5 million. The PrivateBank and Trust Company's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Founders Bank is the 52nd FDIC-insured institution to fail in the nation this year, and the twelfth in Illinois. The last FDIC-insured institution to be closed in the state was The First National Bank of Danville, earlier today.

Three More Bank Failures: #49, #50, #51

by Calculated Risk on 7/02/2009 06:13:00 PM

Like Whack-A-Mole, banks pop up

Hammered by the man.

by Soylent Green is People

From the FDIC: Millennium State Bank of Texas, Dallas, Texas

From the FDIC: As of June 30, 2009, Millennium State Bank of Texas had total assets of approximately $118 million and total deposits of $115 million. State Bank of Texas agreed to purchase essentially all of the failed banks assets. ... The FDIC estimates that the cost to the Deposit Insurance Fund will be $47 million. State Bank of Texas' acquisition of all the deposits was the "least costly" resolution for the DIF compared to alternatives. Millennium State Bank of Texas is the 51st FDIC-insured institution to fail in the nation this year and the first in Texas. The last bank to fail in the state was Sanderson State Bank, Sanderson, on December 12, 2008.From the FDIC: Elizabeth State Bank, Elizabeth, Illinois

As of April 30, 3009, The Elizabeth State Bank had total assets of $55.5 million and total deposits of approximately $50.4 million. ...The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $11.2 million. Galena State Bank and Trust's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. The Elizabeth State Bank is the 49th FDIC-insured institution to fail in the nation this year, and the tenth in Illinois. The last FDIC-insured institution to be closed in the state was Rock River Bank, Oregon, earlier today.From the FDIC: First National Bank of Danville, Danville, Illinois

As of April 30, 2009, The First National Bank of Danville had total assets of $166 million and total deposits of approximately $147 million. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $24 million. First Financial Bank's, N.A. acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. The First National Bank of Danville is the 50th FDIC-insured institution to fail in the nation this year, and the eleventh in Illinois. The last FDIC-insured institution to be closed in the state was The Elizabeth State Bank, Elizabeth, earlier today.Six down today.

Three More Bank Failures: #46, #47, #48

by Calculated Risk on 7/02/2009 05:45:00 PM

This Lincoln State bank fell hard

Now worth a penny.

First State... Second Fail

Winchester, shot by bank Regs

Any more Partner?

A vein has opened

Red ink drains from Rock River

No stop to the flow

by Soylent Green is People

From FDIC: John Warner Bank, Clinton, Illinois

As of April 30, 2009, The John Warner Bank had total assets of $70 million and total deposits of approximately $64 million ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $10 million. State Bank of Lincoln's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. The John Warner Bank is the 46th FDIC-insured institution to fail in the nation this year, and the seventh in Illinois.From the FDIC: First State Bank of Winchester, Winchester, Illinois

As of April 30, 2009, The First State Bank of Winchester had total assets of $36 million and total deposits of approximately $34 million. ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $6 million. The First National Bank of Beardstown's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. The First State Bank of Winchester is the 47th FDIC-insured institution to fail in the nation this year, and the eighth in IllinoisFrom FDIC: Rock River Bank, Oregon, Illinois

As of April 30, 2009, Rock River Bank had total assets of $77 million and total deposits of approximately $75.8 million ... The FDIC estimates that the cost to the Deposit Insurance Fund (DIF) will be $27.6 million. The Harvard State Bank's acquisition of all the deposits was the "least costly" resolution for the FDIC's DIF compared to alternatives. Rock River Bank is the 48th FDIC-insured institution to fail in the nation this year, and the ninth in Illinois.

Naught for the Naughts?

by Calculated Risk on 7/02/2009 04:00:00 PM

On the '00s (the "Naughts") ...

Employment Dec 1999: 130.53 million

Employment Jun 2009: 131.69 million

A gain of just 1.16 million. What are the odds that the economy loses another 1.16 million jobs over the next 6 months? Pretty high. That would mean no net jobs added to the economy for the naughts: Naught for the Naughts!

And for the stock market?

S&P 500, Dec 31, 1999: 1469.25

S&P 500, July 2, 2009: 897.29

Equity investors wish they went Naught for the Naughts. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the S&P 500 since 1990.

The dashed line is the closing price today.

The S&P 500 is up almost 33% from the bottom (221 points), and still off almost 43% from the peak (668 points below the max).

This graph is from Doug Short of dshort.com (financial planner): "Four Bad Bears".

Note that the Great Depression crash is based on the DOW; the three others are for the S&P 500.

Personal Bankruptcy Filings increase 40% in June (YoY)

by Calculated Risk on 7/02/2009 02:57:00 PM

From Bloomberg: Consumer Bankruptcy Filings Rose 36.5% in First Half, ABI Says (ht Ron)

U.S. consumers made 675,351 bankruptcy filings in the first half, a 36.5 percent increase from a year ago, according to the American Bankruptcy Institute.The monthly rate slowed in June (from May), but monthly ups and downs are not unusual for this data.

June filings by consumers totaled 116,365, up 40.6 percent from the same period in 2008 ...

Click on graph for larger image in new window.

Click on graph for larger image in new window.This graph shows the non-business bankruptcy filings by quarter.

Note: Quarterly data from Administrative Office of the U.S. Courts, Q1 and Q2 2009 based on monthly data from American Bankruptcy Institute.

The quarterly rate is close to the levels prior to when the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 (BAPCPA) took effect. There were over 2 million bankruptcies filed in Calendar 2005 ahead of the law change.

The American Bankruptcy Institute is predicting over 1.4 million new bankruptcies by year end - I'll definitely take the over!

FDIC on Private Equity Acquisitions of Failed Banks

by Calculated Risk on 7/02/2009 02:02:00 PM

This is BFT (Bank Failure Thursday), and there are a couple of large banks that might fail (Corus Bank and Guaranty Bank), so this is timely ...

First, from MarketWatch: FDIC chills private-equity bank bidders

The Federal Deposit Insurance Corporation on Thursday urged tough capital requirements on private equity firms buying battered banks, and said any firms they buy must be held for at least three years.From the FDIC: FDIC Board Approves Proposed Policy Statement on Qualifications for Failed Bank Acquisitions

...

"Private-equity investors are probably going to lose their zeal for investing in this undervalued market because the upfront costs will be too much," said Lawrence Kaplan, of counsel in the banking and financial institutions group at law firm Paul Hastings and a former special counsel at the Office of Thrift Supervision.

"The FDIC is saying to private-equity firms that 'while we like your money, we're going to make it too expensive,'" he added.

FDIC Chairman Sheila Bair's Statement

I am particularly concerned with new owners’ ability to support depository institutions with adequate capital, management expertise, and a long term commitment to provide banking services in a safe and sound manner. Obviously, we want to maximize investor interest in failed bank resolutions. On the other hand, we don’t want to see these institutions coming back. I remain open minded on many aspects of this proposal, including the categories of investors to whom it should apply, the appropriate level of upfront capital commitments, and the operation of cross guarantee provisions and limits on affiliate transactions. I look forward to receiving comments in these areas.Federal Register Notice

I support the transactions we have completed to date which have involved sales to private equity owners. We have imposed some special restrictions on these, including higher capital requirements. However, some have suggested that capital requirements should be even higher, given the difficulties in enforcing source of strength obligations outside the initial capital investment made by the acquirers in so-called “shell” structures. I know that this will be a contentious area, and we are opening high, with a proposed 15% requirement.

I am also troubled by the opacity of some of the ownership structures that we have seen in our bidding process, though these have not been winning bids. We have seen bids where it has been difficult to determine actual ownership. We have seen bidders who have wanted permission to immediately flip ownership interests. We have seen structures organized in the secrecy law jurisdictions. So based on the experiences we have gathered, I think it is prudent to put some generic policies in place which tell non-traditional investors that we welcome their participation, but only if we have essential safeguards to assure that they will approach banking in a way that is transparent, long term, and prudently managed.

Hotel RevPAR off 17.4%

by Calculated Risk on 7/02/2009 12:20:00 PM

From HotelNewsNow.com: STR reports U.S. hotel performance for week ending 27 June 2009

In year-over-year measurements, the industry’s occupancy fell 8.7 percent to end the week at 65.4 percent. Average daily rate dropped 9.5 percent to finish the week at US$97.49. Revenue per available room for the week decreased 17.4 percent to finish at US$63.74.No wonder some expect as many as 20% of U.S. hotels to default on their loans ...

Click on graph for larger image in new window.

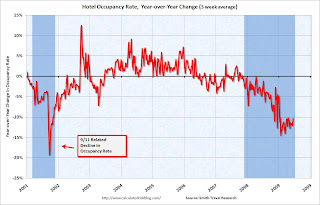

Click on graph for larger image in new window.This graph shows the YoY change in the occupancy rate (3 week trailing average).

The three week average is off 10.3% from the same period in 2008.

The average daily rate is down 9.5%, so RevPAR is off 17.4% from the same week last year.

Note: the occupancy rate has risen to 65% - this is just seasonal. The hotel occupancy rate is usually the highest during the peak vacation months of June, July and August (with declines on weeks with holiday weekends).