by Calculated Risk on 2/23/2017 03:47:00 PM

Thursday, February 23, 2017

Update on lack of Chinese Residential Real Estate Buyers

A few weeks ago I wrote Some Random Concerns and Observations .... One of my concerns was that stricter capital controls in China would negatively impact certain U.S. real estate markets. After that post, I spoke to an excellent source in San Marino (high end area of Los Angeles), and he told me that some Chinese owners were looking to sell (impacting prices).

Here is an article today from David Pierson at the LA Times: Mega-mansions in this L.A. suburb used to sell to Chinese buyers in days. Now they're sitting empty for months

The turnaround in activity, industry officials say, is directly linked to policies in China. ... To defend against capital flight, Chinese regulators allow citizens to take out only $50,000 a year. But that’s been largely ignored and circumvented, often by asking dozens of friends and family to exercise their quota on someone else’s behalf.If this continues, then this will impact certain areas - and have spillover effects to other areas.

... on Dec. 31, China’s State Administration of Foreign Exchange, which swaps Chinese yuan for dollars, issued some of its strictest guidelines yet. Customers now have to pledge not to invest in foreign property and provide a detailed account of how foreign funds will be used. They also prohibited customers from taking foreign currency out for someone else.

The rules could have broad implications around the world for any city exposed to Chinese real estate investment such as Vancouver, Sydney and more recently, Seattle.

Kansas City Fed: Regional Manufacturing Activity "Expanded Further" in February

by Calculated Risk on 2/23/2017 11:00:00 AM

From the Kansas City Fed: Tenth District Manufacturing Activity Expanded Further

The Federal Reserve Bank of Kansas City released the February Manufacturing Survey today. According to Chad Wilkerson, vice president and economist at the Federal Reserve Bank of Kansas City, the survey revealed that Tenth District manufacturing activity expanded further with continued strong expectations.The Kansas City region was hit hard by the decline in oil prices, but activity is expanding solidly again. The regional Fed surveys suggest a strong reading for the ISM manufacturing index for February.

“This was the highest reading for our month-over-month composite index since June 2011,” said Wilkerson. “In addition, the future composite index was the highest since our survey switched to a monthly frequency in 2001.”

...

The month-over-month composite index was 14 in February, its highest reading since June 2011, up from 9 in both January and December. The composite index is an average of the production, new orders, employment, supplier delivery time, and raw materials inventory indexes. Activity in both durable and nondurable goods plants increased, particularly for metals, machinery, computer, and electronic products. Most month-over-month indexes improved moderately in February. The new orders, order backlog, and employment indexes all edged higher, and the new orders for exports index moved into positive territory for the first time in over a year. ... The future composite index moved higher from 27 to 29, its highest reading since the survey moved to a monthly frequency in 2001.

emphasis added

Weekly Initial Unemployment Claims increase to 244,000, 4-Week Average Lowest Since 1973

by Calculated Risk on 2/23/2017 08:38:00 AM

The DOL reported:

In the week ending February 18, the advance figure for seasonally adjusted initial claims was 244,000, an increase of 6,000 from the previous week's revised level. The previous week's level was revised down by 1,000 from 239,000 to 238,000. The 4-week moving average was 241,000, a decrease of 4,000 from the previous week's revised average. This is the lowest level for this average since July 21, 1973 when it was 239,500. The previous week's average was revised down by 250 from 245,250 to 245,000.The previous week was revised down.

emphasis added

The following graph shows the 4-week moving average of weekly claims since 1971.

Click on graph for larger image.

Click on graph for larger image.The dashed line on the graph is the current 4-week average. The four-week average of weekly unemployment claims decreased to 241,000.

This was close to the consensus forecast.

The low level of claims suggests relatively few layoffs.

Black Knight: Mortgage Delinquencies Declined in January

by Calculated Risk on 2/23/2017 07:00:00 AM

From Black Knight: Black Knight Financial Services’ First Look at January Mortgage Data: Impact of Rising Rates Felt as Prepayments Decline by 30 Percent in January

• Prepayment speeds (historically a good indicator of refinance activity) declined by 30 percent in January to the lowest level since February 2016According to Black Knight's First Look report for January, the percent of loans delinquent decreased 3.9% in January compared to December, and declined 16.6% year-over-year.

• Delinquencies improved by 3.9 percent from December and were down 17 percent from January 2016

• Foreclosure starts rose 18 percent for the month; January’s 70,400 starts were the most since March 2016

• 2.6 million borrowers are behind on mortgage payments, the lowest number since August 2006, immediately following the pre-crisis national peak in home prices

The percent of loans in the foreclosure process declined 0.5% in January and were down 27.6% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.25% in January, down from 4.42% in December.

The percent of loans in the foreclosure process declined in January to 0.94%.

The number of delinquent properties, but not in foreclosure, is down 413,000 properties year-over-year, and the number of properties in the foreclosure process is down 178,000 properties year-over-year.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Jan 2017 | Dec 2016 | Jan 2016 | Jan 2015 | |

| Delinquent | 4.25% | 4.42% | 5.09% | 5.48% |

| In Foreclosure | 0.94% | 0.95% | 1.30% | 1.76% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,162,000 | 2,248,000 | 2,575,000 | 2,764,000 |

| Number of properties in foreclosure pre-sale inventory: | 481,000 | 483,000 | 659,000 | 885,000 |

| Total Properties | 2,643,000 | 2,731,000 | 3,234,000 | 3,649,000 |

Wednesday, February 22, 2017

Thursday: Unemployment Claims

by Calculated Risk on 2/22/2017 07:23:00 PM

Thursday:

• At 8:30 AM ET, The initial weekly unemployment claims report will be released. The consensus is for 240 thousand initial claims, up from 239 thousand the previous week.

• Also at 8:30 AM, Chicago Fed National Activity Index for January. This is a composite index of other data.

• At 9:00 AM, FHFA House Price Index for December 2016. This was originally a GSE only repeat sales, however there is also an expanded index.

• At 11:00 AM, the Kansas City Fed manufacturing survey for February.

A Few Comments on January Existing Home Sales

by Calculated Risk on 2/22/2017 05:35:00 PM

Earlier: NAR: "Existing-Home Sales Jump in January"

A few key points:

1) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the consensus.

2) The contracts for most of the January existing home sales were entered after the recent increase in mortgage rates (rates started increasing after the election).

With the recent increase in rates, I'd expect some decline in sales volume as happened following the "taper tantrum" in 2013. So far that hasn't happened.

3) Inventory is still very low and falling year-over-year (down 7.1% year-over-year in January). More inventory would probably mean smaller price increases and slightly higher sales, and less inventory means lower sales and somewhat larger price increases.

Two of the key reasons inventory is low: 1) A large number of single family home and condos were converted to rental units. In 2015, housing economist Tom Lawler estimated there were 17.5 million renter occupied single family homes in the U.S., up from 10.7 million in 2000. Many of these houses were purchased by investors, and rents have increased substantially, and the investors are not selling (even though prices have increased too). Most of these rental conversions were at the lower end, and that is limiting the supply for first time buyers. 2) Baby boomers are aging in place (people tend to downsize when they are 75 or 80, in another 10 to 20 years for the boomers). Instead we are seeing a surge in home improvement spending, and this is also limiting supply.

Of course low inventory keeps potential move-up buyers from selling too. If someone looks around for another home, and inventory is lean, they may decide to just stay and upgrade.

I expect inventory will be increasing year-over-year by the end of 2017.

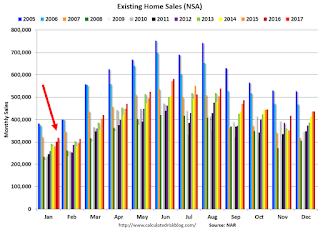

The following graph shows existing home sales Not Seasonally Adjusted (NSA).

Sales NSA in January (red column) were the highest for January since 2007 (NSA).

Note that sales NSA are in the slow seasonal period, and will increase sharply (NSA) in March.

FOMC Minutes: "Might be appropriate to raise the federal funds rate again fairly soon"

by Calculated Risk on 2/22/2017 02:05:00 PM

From the Fed: Minutes of the Federal Open Market Committee, January 31-February 1, 2017 . Excerpts:

In discussing the outlook for monetary policy over the period ahead, many participants expressed the view that it might be appropriate to raise the federal funds rate again fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations or if the risks of overshooting the Committee's maximum-employment and inflation objectives increased. A few participants noted that continuing to remove policy accommodation in a timely manner, potentially at an upcoming meeting, would allow the Committee greater flexibility in responding to subsequent changes in economic conditions. Several judged that the risk of a sizable undershooting of the longer-run normal unemployment rate was high, particularly if economic growth was faster than currently expected. If that situation developed, the Committee might need to raise the federal funds rate more quickly than most participants currently anticipated to limit the buildup of inflationary pressures. However, with inflation still short of the Committee's objective and inflation expectations remaining low, a few others continued to see downside risks to inflation or anticipated only a gradual return of inflation to the 2 percent objective as the labor market strengthened further. A couple of participants expressed concern that the Committee's communications about a gradual pace of policy firming might be misunderstood as a commitment to only one or two rate hikes per year and stressed the importance of communicating that policy will respond to the evolving economic outlook as appropriate to achieve the Committee's objectives. Participants also generally agreed that the Committee should begin discussions at upcoming meetings about the economic conditions that could warrant changes in the existing policy of reinvesting proceeds from maturing Treasury securities and principal payments from agency debt and mortgage-backed securities, as well as how those changes would be implemented and communicated.

emphasis added

AIA: Architecture Billings Index decreased in January

by Calculated Risk on 2/22/2017 11:01:00 AM

Note: This index is a leading indicator primarily for new Commercial Real Estate (CRE) investment.

From the AIA: Entering 2017, architecture billings slip modestly

The Architecture Billings Index (ABI) dipped slightly into negative territory in January, after a very strong showing in December. As a leading economic indicator of construction activity, the ABI reflects the approximate nine to twelve month lead time between architecture billings and construction spending. The American Institute of Architects (AIA) reported the January ABI score was 49.5, down from a score of 55.6 in the previous month. This score reflects a minor decrease in design services (any score above 50 indicates an increase in billings). The new projects inquiry index was 60.0, up from a reading of 57.6 the previous month.

“This small decrease in activity, taking into consideration strong readings in project inquiries and new design contracts, isn’t exactly a cause for concern,” said AIA Chief Economist, Kermit Baker, Hon. AIA, PhD. “The fundamentals of a sound nonresidential design and construction market persist.”

...

• Regional averages: South (54.2), Northeast (53.0), Midwest (52.4), West (48.8)

• Sector index breakdown: institutional (54.6), commercial / industrial (53.4), mixed practice (48.1), multi-family residential (48.1)

emphasis added

Click on graph for larger image.

Click on graph for larger image.This graph shows the Architecture Billings Index since 1996. The index was at 49.5 in January, down from 55.6 in December. Anything above 50 indicates expansion in demand for architects' services.

Note: This includes commercial and industrial facilities like hotels and office buildings, multi-family residential, as well as schools, hospitals and other institutions.

According to the AIA, there is an "approximate nine to twelve month lag time between architecture billings and construction spending" on non-residential construction. This index was positive in 9 of the last 12 months, suggesting a further increase in CRE investment in 2017.

NAR: "Existing-Home Sales Jump in January"

by Calculated Risk on 2/22/2017 10:09:00 AM

From the NAR: Existing-Home Sales Jump in January

Existing-home sales stepped out to a fast start in 2017, surpassing a recent cyclical high and increasing in January to the fastest pace in almost a decade, according to the National Association of Realtors®. All major regions except for the Midwest saw sales gains last month.

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, expanded 3.3 percent to a seasonally adjusted annual rate of 5.69 million in January from an upwardly revised 5.51 million in December 2016. January's sales pace is 3.8 percent higher than a year ago (5.48 million) and surpasses November 2016 (5.60 million) as the strongest since February 2007 (5.79 million).

In December, existing sales decreased 2.8 percent to a seasonally adjusted annual rate of 5.49 million in December from an upwardly revised 5.65 million in November. With last month's slide, sales are only 0.7 percent higher than a year ago....

Total housing inventory at the end of January rose 2.4 percent to 1.69 million existing homes available for sale, but is still 7.1 percent lower than a year ago (1.82 million) and has fallen year-over-year for 20 straight months. Unsold inventory is at a 3.6-month supply at the current sales pace (unchanged from December 2016).

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales, on a Seasonally Adjusted Annual Rate (SAAR) basis since 1993.

Sales in January (5.69 million SAAR) were 3.3% higher than last month, and were 3.8% above the January 2016 rate.

The second graph shows nationwide inventory for existing homes.

According to the NAR, inventory increased to 1.69 million in January from 1.65 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.

According to the NAR, inventory increased to 1.69 million in January from 1.65 million in December. Headline inventory is not seasonally adjusted, and inventory usually decreases to the seasonal lows in December and January, and peaks in mid-to-late summer.The third graph shows the year-over-year (YoY) change in reported existing home inventory and months-of-supply. Since inventory is not seasonally adjusted, it really helps to look at the YoY change. Note: Months-of-supply is based on the seasonally adjusted sales and not seasonally adjusted inventory.

Inventory decreased 7.1% year-over-year in January compared to January 2016.

Inventory decreased 7.1% year-over-year in January compared to January 2016. Months of supply was at 3.6 months in January.

This was above consensus expectations. For existing home sales, a key number is inventory - and inventory is still low. I'll have more later ...

MBA: Mortgage Applications Decrease in Latest Weekly Survey

by Calculated Risk on 2/22/2017 07:00:00 AM

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 2.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending February 17, 2017.

... The Refinance Index decreased 1 percent from the previous week to the lowest level since January 2017. The seasonally adjusted Purchase Index decreased 3 percent from one week earlier to the lowest level since November 2016. The unadjusted Purchase Index increased 2 percent compared with the previous week and was 10 percent higher than the same week one year ago which included the President’s Day holiday.

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($424,100 or less) increased to 4.36 percent from 4.32 percent, with points increasing to 0.35 from 0.34 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

It would take a substantial decrease in mortgage rates to see a significant increase in refinance activity.

The second graph shows the MBA mortgage purchase index.

The second graph shows the MBA mortgage purchase index. Even with the recent increase in mortgage rates, purchase activity is still holding up.

However refinance activity has declined significantly since rates increased.