by Calculated Risk on 11/29/2016 02:13:00 PM

Tuesday, November 29, 2016

FDIC: Fewer Problem banks, Residential REO Declined in Q3

The FDIC released the Quarterly Banking Profile for Q3 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $45.6 billion in the third quarter of 2016, up $5.2 billion (12.9 percent) from a year earlier. The increase in earnings was mainly attributable to a $10 billion (9.2 percent) increase in net interest income and a $1.2 billion (1.9 percent) rise in noninterest income. One-time accounting and expense items at three institutions had an impact on the growth in income. Banks increased their loan-loss provisions by $2.9 billion (34 percent) from a year earlier. Financial results for the third quarter of 2016 are included in the FDIC’s latest Quarterly Banking Profile released today.

...

“Revenue and net income rose from a year ago, loan balances increased, asset quality improved, and the number of unprofitable banks and ‘problem banks’ continued to fall,” Gruenberg said. “Community banks also reported solid results for the quarter with strong income, revenue, and loan growth.

“Nevertheless, the banking industry continues to operate in a challenging environment,” he said. “Low interest rates for an extended period have led some institutions to reach for yield, which has increased their exposure to interest-rate risk, liquidity risk, and credit risk. Current oil and gas prices continue to affect borrowers that depend on the energy sector and have had an adverse effect on asset quality. These challenges will only intensify as interest rates normalize.”

...

Deposit Insurance Fund’s Reserve Ratio Rises to 1.18 Percent: The DIF increased $2.8 billion during the third quarter, from $77.9 billion at the end of June to $80.7 billion at the end of September, largely driven by $2.6 billion in assessment income. The DIF reserve ratio rose from 1.17 percent to 1.18 percent during the quarter. Because the reserve ratio surpassed 1.15 percent on June 30, lower regular FDIC assessment rates on all insured institutions went into effect in the third quarter. On average, regular quarterly assessments were about one-third lower than in the previous quarter, although temporary assessment surcharges on banks with assets greater than $10 billion led to an increase in total assessments at most large banks.

emphasis added

Click on graph for larger image.

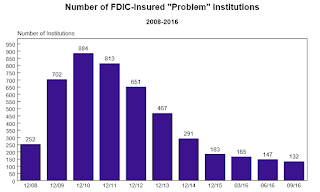

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks for Q1, Q2 and Q3 2016, and year end prior to 2016):

“Problem List” Shows Further Improvement: The number of banks on the FDIC’s Problem List fell from 147 to 132 during the third quarter. This is the smallest number of problem banks in more than seven years and is down significantly from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $29.0 billion to $24.9 billion during the third quarter.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $4.12 billion in Q2 2016 to $3.98 billion in Q3. This is the lowest level of REOs since Q1 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $4.12 billion in Q2 2016 to $3.98 billion in Q3. This is the lowest level of REOs since Q1 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.

Since REOs are reported in dollars, and house prices have increased, it is unlikely FDIC institution REOs will get back to the $2.0 to $2.5 billion range back that happened in 2003 to 2005. FDIC REOs will probably bottom closer to $3 billion.

Real Prices and Price-to-Rent Ratio in September

by Calculated Risk on 11/29/2016 11:59:00 AM

Here is the earlier post on Case-Shiller: Case-Shiller: National House Price Index increased 5.5% year-over-year in September

It has been ten years since the bubble peak. In the Case-Shiller release this morning, the National Index, not seasonally adjusted (NSA) was reported as being at a new nominal high. The seasonally adjusted (SA) index was reported as being only 0.8% below the bubble peak. However, in real terms, the National index (SA) is still about 15.7% below the bubble peak.

The year-over-year increase in prices is mostly moving sideways now around 5%. In September, the index was up 5.5% YoY.

In the earlier post, I graphed nominal house prices, but it is also important to look at prices in real terms (inflation adjusted). Case-Shiller, CoreLogic and others report nominal house prices. As an example, if a house price was $200,000 in January 2000, the price would be close to $276,000 today adjusted for inflation (38%). That is why the second graph below is important - this shows "real" prices (adjusted for inflation).

Nominal House Prices

In nominal terms, the Case-Shiller National index (SA) is back to February 2006 levels, and the Case-Shiller Composite 20 Index (SA) is back to June 2005 levels, and the CoreLogic index (NSA) is back to August 2005.

Real House Prices

CPI less Shelter is unchanged over the last two, so real prices increased the same as nominal prices.

In real terms, the National index is back to March 2004 levels, the Composite 20 index is back to November 2003, and the CoreLogic index back to February 2004.

In real terms, house prices are back to late 2003 / early 2004 levels.

Price-to-Rent

In October 2004, Fed economist John Krainer and researcher Chishen Wei wrote a Fed letter on price to rent ratios: House Prices and Fundamental Value. Kainer and Wei presented a price-to-rent ratio using the OFHEO house price index and the Owners' Equivalent Rent (OER) from the BLS.

This graph shows the price to rent ratio (January 1998 = 1.0).

On a price-to-rent basis, the Case-Shiller National index is back to August 2003 levels, the Composite 20 index is back to April 2003 levels, and the CoreLogic index is back to July 2003.

In real terms, and as a price-to-rent ratio, prices are back to late 2003 - and the price-to-rent ratio maybe moving a little more sideways now.

Case-Shiller: National House Price Index increased 5.5% year-over-year in September

by Calculated Risk on 11/29/2016 09:16:00 AM

S&P/Case-Shiller released the monthly Home Price Indices for September ("September" is a 3 month average of July, August and September prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

Note: Case-Shiller reports Not Seasonally Adjusted (NSA), I use the SA data for the graphs.

From S&P: The S&P CoreLogic Case-Shiller National Index Reaches New High as Home Price Gains Continue

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, surpassed the peak set in July 2006 as the housing boom topped out. The National index reported a 5.5% annual gain in September, up from 5.1% last month. The 10-City Composite posted a 4.3% annual increase, up from 4.2% the previous month. The 20-City Composite reported a yearover-year gain of 5.1%, unchanged from August.

Seattle, Portland, and Denver reported the highest year-over-year gains among the 20 cities over each of the last eight months. In September, Seattle led the way with an 11.0% year-over-year price increase, followed by Portland with 10.9%, and Denver with an 8.7% increase. 12 cities reported greater price increases in the year ending September 2016 versus the year ending August 2016.

...

Before seasonal adjustment, the National Index posted a month-over-month gain of 0.4% in September. Both the 10-City Composite and the 20-City Composite posted a 0.1% increase in September. After seasonal adjustment, the National Index recorded a 0.8% month-over-month increase, the 10-City Composite posted a 0.2% month-over-month increase, and the 20-City Composite reported a 0.4% month-over-month increase. 15 of 20 cities reported increases in September before seasonal adjustment; after seasonal adjustment, all 20 cities saw prices rise.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is off 10.7% from the peak, and up 0.2% in September (SA).

The Composite 20 index is off 8.5% from the peak, and up 0.4% (SA) in September.

The National index is off 0.8% from the peak (SA), and up 0.8% (SA) in September. The National index is up 34.0% from the post-bubble low set in December 2011 (SA).

The second graph shows the Year over year change in all three indices.

The second graph shows the Year over year change in all three indices.The Composite 10 SA is up 4.3% compared to September 2015.

The Composite 20 SA is up 5.1% year-over-year.

The National index SA is up 5.5% year-over-year.

Note: According to the data, prices increased in all 20 cities month-over-month seasonally adjusted.

I'll have more later.

Q3 GDP Revised Up to 3.2% Annual Rate

by Calculated Risk on 11/29/2016 08:46:00 AM

From the BEA: Gross Domestic Product: Third Quarter 2016 (Second Estimate)

Real gross domestic product increased at an annual rate of 3.2 percent in the third quarter of 2016, according to the "second" estimate released by the Bureau of Economic Analysis. In the second quarter, real GDP increased 1.4 percent.Here is a Comparison of Second and Advance Estimates. PCE growth was revised up from 2.1% to 2.8%. (decent PCE). Non-Residential investment in structures was revised up from 5.4% to +10.1%. This was above the consensus forecast.

The GDP estimate released today is based on more complete source data than were available for the "advance" estimate issued last month. In the advance estimate, the increase in real GDP was 2.9 percent. With the second estimate for the third quarter, the general picture of economic growth remains the same; the increase in personal consumption expenditures was larger than previously estimated ...

emphasis added

Black Knight: Mortgage "Foreclosure Starts Hit Lowest Level Since January 2005" in October

by Calculated Risk on 11/29/2016 07:01:00 AM

Note: There was a report of a "foreclosure spike" in October. This data shows the opposite happened.

From Black Knight: Black Knight’s First Look at October 2016 Mortgage Data: Foreclosure Starts Hit Lowest Level Since January 2005; Foreclosure Rate Falls Below One Percent for First Time Since July 2007

• October’s 56,500 foreclosure starts is the lowest one-month total in nearly 12 yearsAccording to Black Knight's First Look report for October, the percent of loans delinquent increased 2% in October compared to September, and declined 8.9% year-over-year.

• Delinquencies see modest seasonal increase in October; still down nine percent from last year

• Active foreclosure inventory continues to improve, just over 500,000 active foreclosure cases remain

• Prepayment activity down slightly from September but remains 37 percent above last year’s level

The percent of loans in the foreclosure process declined 1% in October and were down 30% over the last year.

Black Knight reported the U.S. mortgage delinquency rate (loans 30 or more days past due, but not in foreclosure) was 4.35% in October, up from 4.27% in September.

The percent of loans in the foreclosure process declined in October to 0.99%. This is the lowest level since July 2007.

The number of delinquent properties, but not in foreclosure, is down 214,000 properties year-over-year, and the number of properties in the foreclosure process is down 217,000 properties year-over-year.

Black Knight will release the complete mortgage monitor for October on December 5th.

| Black Knight: Percent Loans Delinquent and in Foreclosure Process | ||||

|---|---|---|---|---|

| Oct 2016 | Sept 2016 | Oct 2015 | Oct 2014 | |

| Delinquent | 4.35% | 4.27% | 4.77% | 5.42% |

| In Foreclosure | 0.99% | 1.00% | 1.43% | 1.81% |

| Number of properties: | ||||

| Number of properties that are delinquent, but not in foreclosure: | 2,202,000 | 2,165,000 | 2,415,000 | 2,731,000 |

| Number of properties in foreclosure pre-sale inventory: | 504,000 | 509,000 | 721,000 | 912,000 |

| Total Properties | 2,706,000 | 2,674,000 | 3,136,000 | 3,643,000 |

Monday, November 28, 2016

Tuesday: GDP, Case-Shiller House Prices

by Calculated Risk on 11/28/2016 07:32:00 PM

From Matthew Graham at Mortgage News Daily: Mortgage Rates Fall at Fastest Pace Since Brexit

WARNING: this article's headline makes the overall mortgage rate situation sound much better than it actually is. While it is indeed a fact that today's rates are lower than the previous business day's rates by the widest margin since Brexit, caveats abound. First off, the Brexit move was more than twice as big. Today's move is only slightly better than a handful of other decent days over the past 5 months.Tuesday:

The post-Brexit move also occurred when rates were already fairly low. In fact, rates were near all-time lows already, and had been moving almost exclusively lower all year. In stark contrast, today's improvement comes on the heels of one of the sharpest moves higher in history. It's fairly normal to see a decent-sized correction after a huge spike higher.

...

Bottom line: it was a great individual day for rates, but we're still very much in the "new normal" range of conventional 30yr fixed rates between 4% and 4.25%.

emphasis added

• At 8:30 AM ET, Gross Domestic Product, 3rd quarter 2016 (Second estimate). The consensus is that real GDP increased 3.1% annualized in Q3, revised from 2.9% in the advance report.

• At 9:00 AM, S&P/Case-Shiller House Price Index for September. Although this is the September report, it is really a 3 month average of July, August and September prices. The consensus is for a 5.2% year-over-year increase in the Comp 20 index for September. The Zillow forecast is for the National Index to increase 5.4% year-over-year in September.

Possible Policy Impacts on Housing

by Calculated Risk on 11/28/2016 03:44:00 PM

On Friday I posted a few 2017 housing forecasts. I'll add more forecasts soon. Some of these forecasts may be revised due to the Presidential results and also due to the possibility of higher mortgage rates.

Here are some preliminary thoughts on several potential issues for housing over the next couple of years:

1) Higher interest rates due to policy changes (tax cuts and more spending). Higher mortgage rates could slow housing activity. However, if the tax cuts and more spending lead to more jobs, then that might offset any increase in mortgage rates.

2) Immigration. If the next administration focuses on deportation, this could lead to less demand in certain areas. This could lead to lower rents, fewer sales, more inventory, fewer housing starts, and possibly lower prices in those areas.

3) Financing. Although most policy discussions have focused on deregulation, it is also possible that Fannie and Freddie will be privatized, and that some mortgage lending will dry up. FHA loans might also become more expensive.

Hotels: Finishing Year Strong, Could be Best Year on Record

by Calculated Risk on 11/28/2016 01:34:00 PM

From HotelNewsNow.com: STR: US hotel results for week ending 19 November

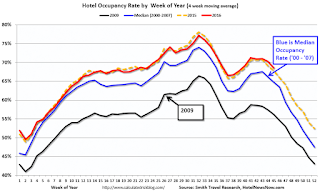

The U.S. hotel industry reported positive results in the three key performance metrics during the week of 13-19 November 2016, according to data from STR.The following graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

In year-over-year comparisons, the industry’s occupancy rose 4.5% to 65.8%. Average daily rate (ADR) increased 4.6% to US$122.02. Revenue per available room (RevPAR) grew 9.2% to US$80.25.

emphasis added

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.

The red line is for 2016, dashed orange is 2015, blue is the median, and black is for 2009 - the worst year since the Great Depression for hotels.2015 was the best year on record for hotels.

So far 2016 is tracking just behind 2015, and well ahead of the median rate. With a solid finish, 2016 could be the best year on record.

Year-to-date, the three best years are:

1) 2015: 67.4% average occupancy.

2) 2016: 67.4% average.

3) 2000: 66.5% average.

For hotels, the Fall business travel season is slowing down, and the occupancy rate will decline into the holiday season.

Data Source: STR, Courtesy of HotelNewsNow.com

Dallas Fed: Regional Manufacturing Activity "Continues to Expand" in November

by Calculated Risk on 11/28/2016 10:36:00 AM

Note: All regional Fed surveys indicated expansion in November. This is the first time all regional surveys were positive in two years (the decline in oil prices hit some regions hard - like Dallas).

From the Dallas Fed: Texas Manufacturing Activity Continues to Expand

Texas factory activity increased again in November, according to business executives responding to the Texas Manufacturing Outlook Survey. The production index, a key measure of state manufacturing conditions, posted a fifth consecutive positive reading and edged up to 8.8. ...This was the last of the regional Fed surveys for November.

...

The general business activity index shot up to 10.2 after nearly two years of negative readings.

...

Labor market measures indicated increased employment levels and longer workweeks. The employment index came in at 4.5 after a near-zero reading last month. Seventeen percent of firms noted net hiring, compared with 13 percent noting net layoffs. The hours worked index returned to positive territory in November, coming in at 2.5. ...

emphasis added

Here is a graph comparing the regional Fed surveys and the ISM manufacturing index:

Click on graph for larger image.

Click on graph for larger image.The New York and Philly Fed surveys are averaged together (yellow, through November), and five Fed surveys are averaged (blue, through November) including New York, Philly, Richmond, Dallas and Kansas City. The Institute for Supply Management (ISM) PMI (red) is through October (right axis).

It seems likely the ISM manufacturing index will show expansion again in November, and the consensus is for a reading of 52.3.

Black Knight: House Price Index up 0.1% in September, Up 5.4% year-over-year

by Calculated Risk on 11/28/2016 08:53:00 AM

Note: I follow several house price indexes (Case-Shiller, CoreLogic, Black Knight, Zillow, FHFA, FNC and more). Note: Black Knight uses the current month closings only (not a three month average like Case-Shiller or a weighted average like CoreLogic), excludes short sales and REOs, and is not seasonally adjusted.

From Black Knight: Black Knight Home Price Index Report: September 2016 Transactions, U.S. Home Prices Up 0.1 Percent for the Month; Up 5.4 Percent Year-Over-Year

• September’s home price movement was relatively flat at the national level, with home prices ticking up just 0.1 percent from AugustThe year-over-year increase in this index has been about the same for the last year.

• U.S. home prices are up 5.4 percent from last year and are now within just 0.6 percent of hitting a new national peak

• Home prices in seven of the nation’s 20 largest states and seven of the 40 largest metros hit new peaks

Note that house prices are close to the bubble peak in nominal terms, but not in real terms (adjusted for inflation). Case-Shiller for September will be released tomorrow.