by Calculated Risk on 8/28/2008 12:49:00 AM

Thursday, August 28, 2008

Plunge Protection Team, Pakistan Style

From Bloomberg: Pakistan Sets Floor on Stock Prices to Stop Plunge

Pakistan set a floor for stock prices on the benchmark exchange, moving to halt a plunge that has wiped out $36.9 billion of market value since April.Ahhh ... stock prices that can only go up. That is a real PPT (Plunge Protection Team).

Securities can trade within their daily limit of 5 percent ``but not below the floor-price level'' of yesterday's close ...

This is funny, but doomed.

Wednesday, August 27, 2008

We Get Mail

by Tanta on 8/27/2008 07:21:00 AM

It used to be, whenever I had no inspiration for a blog post at all, I could just go slumming over at one of the broker boards and find something for edification of my readers or just comic relief. These days, it seems, I just have to check my email.

Yesterday I was being asked to help write a hardship letter, which was certainly an understandable request since I have offered advice on that subject in the past and so, you might say, I asked for it. Today I am being asked to do somebody else's homework. I publish the following in its entirety with the exception of the name:

hiSince I have examined my conscience and discovered that I have no scruples about subjecting people who ask me to do their story problems for them to a high degree of risk, I hereby invite the Calculated Risk commenting community to assist. Please explain to "A" here how to derive a VaR of 419. You may of course assume as many can openers--or as much convexity--as you need to. Remember that your answer could be going into A's frat house files, so please approach this with the appropriate degree of seriousness.

i saw in your blog that you are a risk expert.

for university purpose i am supposed to calculate a value at risk of an option.

the optoin is a call option on 1000 shares for one year with strike price at 10$. the delta of this option is 1.5, meaning that if the share price goes up by 1bp the option by 1.5bp

daily volatilty is 12cents, the value at risk for 95% is supposed to be 419. how do i get this? oh it is delta normal

thank you

A____

Monday, August 25, 2008

Take A Load Off Fannie

by Calculated Risk on 8/25/2008 06:05:00 PM

"The story of Fannie Mae, as narrated by The Band"

Saturday, July 26, 2008

Why the FDIC Fears Bloggers

by Calculated Risk on 7/26/2008 11:50:00 AM

Saturday, July 19, 2008

Daily Show: It's the Stupid Economy

by Calculated Risk on 7/19/2008 06:54:00 PM

Jon Stewart's take on the economy.

Friday, July 18, 2008

"There is NO problem, and we are dealing with it"

by Calculated Risk on 7/18/2008 10:11:00 PM

Stu says thanks!

From Stu:

"I’d like to thank the 885 CR readers who have voted on my form so far. They were a tremendous resource whether complimenting me or challenging me to be better."Check out the 12 cartoons that made the cut: Stu's Real Estate Cartoons

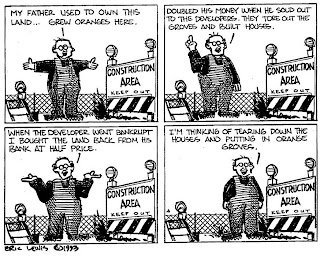

A Housing Cartoon from 1993

by Calculated Risk on 7/18/2008 11:24:00 AM

Haven't we been here before? Ah, yes ... Click on graph for larger image in new window.

Click on graph for larger image in new window.

This cartoon was drawn in 1993 by Eric G. Lewis, a freelance cartoonist living in Orange County, CA (used with permission).

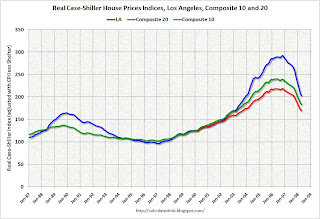

The following graph puts the cartoon into context. The graph compares real Case-Shiller house prices for Los Angeles and the Composite 10 and 20 Index (10 and 20 large cities). The indices are adjusted with CPI less Shelter.

Note that the cartoon was drawn in 1993 and real prices fell in the Los Angeles area for about four more years! The current Composite 20 bubble looks similar (although larger) to the previous Los Angeles bubble. (Note the Composite 20 index started in 2000). And prices will probably fall in real terms for several more years.

The current Composite 20 bubble looks similar (although larger) to the previous Los Angeles bubble. (Note the Composite 20 index started in 2000). And prices will probably fall in real terms for several more years.

Professor Krugman presents a similar graph today using the Case-Shiller Composite 10 index and also looking at how elevated unemployment will probably linger. His conclusion: Housing slumps last.

Yes we've been here before - although this housing bubble was larger and more geographically pervasive than the earlier Los Angeles bubble.

Thursday, July 17, 2008

Stu's Views Real Estate Cartoons

by Calculated Risk on 7/17/2008 07:00:00 PM

Cartoonist Stu Reese has drawn a series of a real estate related cartoons.

Here is his main site: Stu's Views.

Stu has generously offered to allow CR readers to preview, rate and offer suggestions on his new real estate cartoons.

Here is the preview page (removed) with 18 cartoons. This will only be posted for a short period.

You guys know real estate - and you know funny too - I'm sure he'd appreciate any suggestions.

Tuesday, May 06, 2008

Building Castles to the Sky

by Calculated Risk on 5/06/2008 06:45:00 PM

Here are a couple of interviews with analysts that were wrong about housing (emphasis added) ...

From a Newsweek interview with ex-NAR economist David Lereah: It’s Going to Get Worse

"[I] just didn't realize the scope, the extent, the magnitude of the loose underwriting—not looking at incomes and wages, just providing so many mortgage loans based on [expected] future price appreciation rather than the creditworthiness of the borrower," Lereah says. "That got so out of hand, and none of us realized the magnitude of it until it was too late."And from Jon Lansner at the O.C. Register: Insider Q&A learns how a housing expert goofed

Note: this is the "expert" that was mentioned on the front page of the O.C. Register in 2005 - see Lansner's Emblem of O.C.’s $600,000 home market, now a short sale)

Us: Where did you go wrong?Hoocoodanode?

Walter: Along with almost everyone else, I didn’t recognize that the 2003 thru mid-2006 housing market boom was caused almost exclusively by the introduction (and pushing) of low-teaser-rate loans.

...

Us: What was it you didn’t foresee? Where did the demand go?

Walter: Shame on me! After 40 years of analyzing my way through four economic and housing market booms and busts, I knew that the fuel for every boom also eventually burns it up and causes it to go bust. I had my head in the sand and wasn’t paying attention.If I had been paying attention I would have known that a high percentage of those low-teaser-rate loans would go into foreclosure and bring the whole house of greed tumbling down. But I wasn’t paying attention.

Saturday, April 26, 2008

Miss Busta and the Death of Satire

by Tanta on 4/26/2008 07:57:00 AM

Regulars may remember this little post about Accredited Home Lender's new Chief Advisor of Things Both Relevant and Interesting in the Non-Conforming Loan Market, Miss Busta.

Well, Miss Busta's website is up and running. I confess to complete and utter disappointment; after the build-up in the announcement email, I really expected this to be funnier:

Dear Miss Busta,$150MM since January might be a lot of clams, but it isn't very many mortgage loans. In Q1 2006 Accredited originated $3.6 billion.

Given the crazy events of the last year or so, it seems that the subprime loan market is dead. Please tell me the truth. I can take it.

—Grieving in Grand Rapids

Dear Grand,

Dry your tears and stop that annoying sniveling. The rumors that Subprime is dead are greatly exaggerated. Granted, it was tough going there for a while and some serious intervention was needed, but it’s been brought back from the brink. Seems Subprime was hanging around with a bad crowd and fell victim to some wicked peer pressure. After the deadbeats were run off and a few warts were removed, things have started to get a lot better, thank you very much. In fact, Accredited has closed more than $150 million in subprime loans since January. That’s a lot of clams. And we’re back doing business with some solid friends—nice brokers who predict steady growth over the next year. So enough with the hand-wringing. Let’s get to work. Something you might want to try.

Accredited may be targeting the "nice broker" demographic, but if this kind of thing either amuses or reassures their broker base, then they're also dealing with the dim broker demographic. There is a long and storied history in the mortgage business of both overpaying the sales force and simultaneously treating them like not very bright fifth graders. Fly them to Hawaii, put them up in an expensive hotel, and then send them to pep rallies with the intellectual content of an episode of The Brady Bunch. That sort of thing. My own view is that people tend to live up to the expectations you have of them, which is why there are so many overpaid fifth graders in the business.

You'd think Accredited might have reflected a bit on that strategy, but apparently not. I am not known as a humorless person, but I'm actually mildly surprised that any subprime lender thinks the time has already come to be merely cute about the whole thing. I would have thought they might still be trying to prove to the world that the grownups are, in fact, in charge now. Perhaps investing some time into actual training of brokers in credit analysis, acceptable loan documentation, and responsible disclosure practices. Putting some honest effort into understanding what went wrong and why. Guess not. It's all about attitude and platitude, any fleeting breakthrough of seriousness instantly stifled with chicken casserole recipes. The warts have been removed, the clams are back, and the same anti-intellectual drivel that papered over the problem in the first place returns to cheer everyone up.

On the other hand, at $150MM a quarter, that "overpaid" thing will no longer be a problem.

Thursday, April 24, 2008

Early Nominees for Word(s) of the Year

by Calculated Risk on 4/24/2008 06:09:00 PM

Last year we had "subprime" and "contained", two words frequently used together as by Bernanke in March 2007:

"the problems in the subprime market seems likely to be contained".Contained became a joke at the end of many posts, and Tanta's brilliant - "We're all subprime now!" - must have been the phrase of the year (at least for UberNerds).

Of course Merriam-Webster chose w00t. Yes, the housing bears owned the housing bulls - again.

Reader Matt suggests "perfect storm" for 2008. He has seen the words perfect storm used to describe the results of 'airlines, food, oil, foreclosures, condo sales, and credit problems'.

I'm leaning towards "negative equity" or perhaps "Hoocoodanode?" (makes a great post tag line). Of course it's still early ...

Saturday, April 19, 2008

We're All Busta Now

by Tanta on 4/19/2008 07:57:00 AM

Our Brian forwarded this email to me yesterday, and I haven't stopped chuckling yet. It's very well done and certainly appears to be a legitimate "memorandum" from Accredited. Apparently no one has yet managed to get it posted on Accredited's website, which would formalize the joke nicely, but that's no reason not to share it:

April 18, 2008 - San Diego , CAWelcome to the world wide wacky web, Miss Busta. We do look forward to your Relevant and Interesting posts.

Accredited Home Lenders is pleased to announce the promotion of Miss Helen Busta to the newly created position of Chief Advisor of Things Both Relevant and Interesting in the Non-Conforming Loan Market.

The position was created to help set the record straight in a market that's been turned upside down. Miss Busta will apply her vast knowledge and years of industry experience to bust the subprime myths that are so prevalent today.

As a young woman, Miss Busta arrived in San Diego from the Midwest and took a job in the mortgage industry as a temp. She was soon hired by Accredited to help out in the company's first office above an auto repair shop. Miss Busta earned her B.A. in History from San Diego State University while working full-time at Accredited.

Her duties will include advising Accredited staff and helping brokers build their non-conforming business. Miss Busta will soon launch her own Web site, where she will answer any and all questions regarding the mortgage industry. Her long-standing service to Accredited and wealth of knowledge from 20 years in home lending have made Miss Busta a solid performer in any type of economic climate.

Please extend your congratulations to Miss Helen Busta on her significant achievement.

Sunday, April 06, 2008

Mortgage Woes for the Mortgage Bankers Association

by Calculated Risk on 4/06/2008 12:04:00 AM

Jeffrey H. Birnbaum at the WaPo reports that the Mortgage Bankers Association (MBA) is "about to find it harder than it imagined to pay its own mortgage": Housing Crisis Hits Its Own

A year ago, the Mortgage Bankers Association was thrilled to sign a contract to buy a fancy new headquarters building in downtown Washington. Interest rates were low, the group's revenues were steady and the prospects for quickly renting out part of the structure were strong.This shows several aspects of the credit crisis. MBA members are struggling (or gone), so revenue is down. Financing costs have risen. And the market for office space has slowed sharply.

But since then, the association has fallen on tough times ...

The lobbying group is about to sign the final papers to buy the 12-story building on L Street NW for about $100 million. Like many of the companies it represents, the organization is facing a triple whammy of woes: Its financing costs are up, its income is down, and the leasing market is slow, leaving it, so far, without a single tenant.

emphasis added

I guess they could always just walk away.

Wednesday, April 02, 2008

The "R" Word

by Calculated Risk on 4/02/2008 07:34:00 PM

Since Chairman Bernanke allowed for the possibility of a recession in his testimony today - see NYTimes: Bernanke Nods at Possibility of a Recession - it might be fun to look back at a few Fed quotes from prior periods:

For the recession that started in April 1960:

“By and large, however, the economy seems quite solid.”For the recession that began in July 1990:

Federal Open Market Committee, May 1960

“[Chairman Martin] was by no means convinced that the situation was serious.”

Federal Open Market Committee, July 1960

“The Chairman reiterated his views ... There was a declining picture, ... but the economy was not going over a precipice by any means.”

Federal Open Market Committee, October 1960

“In the very near term there’s little evidence that I can see to suggest the economy is tilting over [into recession].”Source: "Booms, Busts, and the Role of the Federal Reserve" by David Altig

Chairman Greenspan, July 1990

“...those who argue that we are already in a recession I think are reasonably certain to be wrong.”

Greenspan, August 1990

“... the economy has not yet slipped into recession.”

Greenspan, October 1990

The Day The Subprime Died

by Tanta on 4/02/2008 03:23:00 PM

I was slumming again this afternoon . . . here's your daily dose of amusement.

And yes, the comment thread to that post makes me realize how lucky I am. Most of the time.

Tuesday, April 01, 2008

New UBS Logo

by Calculated Risk on 4/01/2008 02:04:00 PM

Source: Jan-Martin Feddersen, Immobilienblasen who writes:

I think it is a good start to kick off the "Fools Day" with news from the the greatest fool UBS.(hat tip Dwight) Here is the actually UBS logo.

Sunday, March 30, 2008

If You Don't Get It, It Might Be A Joke

by Tanta on 3/30/2008 09:29:00 AM

Taking notice of the endless silliness in the political blogosphere is no part of the mandate of this blog, and we normally try to carry on with our main mission while pretending that we can't hear most of the background noise and cannot feel that terrier gnawing on our ankles. It has never, really, been that we're stupid; it was mostly that we didn't want them to come over here and ruin a perfectly good nerd blog. Political discourse in this country has been so poisoned for so long that we were quite attracted to the possibility of pretending that it wasn't there in case it decided to go away while we weren't looking.

However, I for one did argue, quite early in this mess, that 1) housing policy is political in this country and 2) financial crises are even more so and that therefore 3) whether or not it "should" be that way is immaterial; it is so. The housing bust and the debt bubble pop have been and are going to remain political footballs for the foreseeable future. The least we can do about that is insist that everyone get the elementary concepts right.

Let me therefore do my obligatory least by pointing out that this kind of thing just has to stop:

Apparently, a lot of foreclosed tenants like to trash the house before they leave. I don't get it. It's hardly the bank's fault that you can't make your mortgage payment. I mean, I understand the rage at fate that has pushed you out of your home and left your credit record in shreds--yea, even if you had a hand in that fate yourself. But I don't get pointless destruction.I can't do anything about anyone who can't quite "get" vandalism, as if it had never existed in the world before middle-class homeowners got in over their heads with mortgage loans. (Really. I was "not getting" the point of cutting off the handset on pay phones and stealing the directory back in the days when we had pay phones and they cost a dime. I was therefore prepared to "not get"--or to "get," as it were--foreclosure "trash-outs," at the point they began to arise (again, in this cycle), since, well, it's a reusable conceptual paradigm thingy.)

But it isn't the not-getting of the "pointless" destruction that makes it less than completely pointless for us to examine this silly little blog post. It's that first sentence with the term "foreclosed tenants" in it.

I "get" vandalism a whole lot more than I "get" a self-described "economics blogger" weilding the English language like that. Which is to say, I suspect I do "get" it. And I don't approve of the latter any more than the former.

There has, for a long time now, been a certain persistent critique of a variety of boom-lending that went something like this: when you take an interest-only no-down-payment loan to buy a house at market price--that is, at anything other than a significant discount to market price--you are in effect, if not in fact, merely "leasing" the house from the bank.

This is a "critique" because, see, "secured lending" only really works when the collateral that secures the loan belongs to the borrower, not the lender. I suppose I could write you a loan that involved my promising to hand over an asset that I already owned to myself--that'll teach me!--in the event that you fail to pay me back as agreed. I'm not sure I could pass a licensing exam with an understanding of the process like that, but you never know.

So the critique came in on the grounds that 1) this is self-defeating for lenders and that 2) it is self-defeating for borrowers. I occasionally run into newbies to the financial world who demand to know why anyone would buy one of these "PO strips" or bonds that do not pay interest. They "get it" once you explain that such bonds are purchased at a "deep discount" to their par or face value. Of course their next question was always why people were using wacky subprime and Alt-A loans to buy houses at "par," and out of the mouths of babes came wisdom.

The point being that "foreclosed tenant" is not simply a curious misunderstanding of law and fact. It is, you know, a way to "get" the "pointless" behavior, if you apply any degree of attention to a contradiction in terms. Possibly some borrowers are coming to the belated recognition that they were, de facto, not much more than tenants who were paying well above "market rent," but the market no longer allows them to "sell" the "lease" to the next sucker, and the law does not allow them to simply forfeit the security deposit and move away. To be a "foreclosed tenant" is to live in the worst of both worlds.

It is possible, you know, that about-to-be-former homeowners understand these things better than self-anointed "economic thinkers" do. They begin to grasp that they had only ever been given a short-term lease on the "American Dream," not a piece of the "ownership society" pie. More than a few of them are very, very, crabby. This, I can "get."

What I also "get" is that here you have a classic example of where the rush to start making a list of people you don't have any "sympathy" for gets you: nowhere, fast. It always disappoints me whenever a thread on one of our foreclosure or predatory lending posts immediately degenerates into a lot of people writing the same comment repeatedly: "I have no sympathy for these people."

It has, actually, been hard for me to "get" why some people think that the first question to be established in any discussion of the real world is whether their own personal sympathies are engaged or not. You'd think I'd be more familiar with the profoundly self-involved than I apparently am, coming out of the banking industry, but there you are. Some entertainment can be wrested out of the situation by responding that I don't have any sympathy for people who don't have any sympathy for other people, but it's limited entertainment because we are often dealing with heads over which such a response tends to fly at a fairly high altitude.

The trouble is I do "get" it. I get why some people need to turn it all into a matter of which contestant is more conventionally attractive, sympathies-wise. The original point of the "joke" about borrowers with these dumb loans just "renting" from the bank was about puncturing the claims of a certain class of economists, who seemed ready to believe that a finance-based "ponzi" economy could go on forever, and that it ought to. If you require to have the joke "foreclosed" in order to defend against its implications for the kool-aid you've been drinking for years about the larger economy, not just real estate, then you might want to willfully misunderstand the point of making jokes. Namely, to see it as making fun of "contemptible" people rather than unmasking the contradictions in economic silliness.

Joking around actually has a long and storied history in the old, old project of arriving at conceptual clarity about important problems, you know. Jokes are not merely "transgressive" of a kind of stuffy demeanor of academics and legislators and courts of law and so on, although they do have an invaluable function in ratcheting down the pompousness to tolerable levels. Jokes are, in fact, often funny because they fail to "resolve" or paper over real contradictions and conflicts: the joke drags it out into the light of day, and leaves it to squirm while we all laugh. We are all subprime now. Is a joke. With, as they say, more than a bit of "truth" in it.

It is of course not always easy to distinguish between a joke and a bog-standard stupidity. We touched on that the other day with the Zippy Tricks. Sometimes the joke actually arises when we find the naive or uninformed or logic-impaired coming up with an inspired phrase like "foreclosed tenants."

Sometimes people feel like they're being "laughed at." That, say, the joke's on them. It has been known for them to get very, very angry. Enough, say, to knock holes in the drywall and rip out the plumbing before following one's belongings to the curb.

Those whose only understanding of humor is to ridicule the victim--not to deflate the hot air filling the designers of this doomed system--will never quite "get" why the butts of the joke become so "pointlessly" destructive. Those humorless souls who do not see an appropriate role for humor in intellectual critique--who really just have to say that this is too serious for such lightmindedness, tut tut--will fail to grasp the overall dynamics of the situation from the other end of it. Between those who have no sympathy for others and those who have only sympathy--syrupy, patronizing, Sunday School-tract simple-minded sympathy--it's a wonder you can get a good joke going some days. Not that I've ever quit trying.

It is within the realm of possibility that some folks engaging in "trash-out refinances" are, well, making the point that the joke's on you, Mr. Bank. You might consider it a kind of performance art of the gallows-humor subgenre. I do think it's a usual expectation that people who write for outfits with the pretensions of The Atlantic are, frequently, expected to try to "get" that. We call these attempts to try to "get" such things intellectual effort. Expenditure of this kind of effort is way harder than, well, just asking yourself if you feel sorry for someone today. Or yukking it up at someone else's "expense."

Monday, March 17, 2008

Bear Stearns Building Today

by Calculated Risk on 3/17/2008 01:50:00 PM

I don't know the source to give credit.

A second photo (hat tip BR)

Friday, March 14, 2008

A Bear Market?

by Calculated Risk on 3/14/2008 05:51:00 PM

The general definition of a bear market is a 20% decline in the major indexes over a several month period.

The S&P 500 peaked at 1565.15 (closing) on October 9, 2007.

As of today, the S&P 500 is off 17.7%; not quite a Bear market.

And no bank failures today ... so here is a song for Friday afternoon.

"The U.S. dollar is worthless,

I've got the Ben Bernanke Blues."

Friday, March 07, 2008

Hedge Fund Humor

by Calculated Risk on 3/07/2008 12:52:00 PM

Who is this guy Margin that keeps calling me???(hat tip BR)