by Calculated Risk on 11/29/2007 11:45:00 AM

Thursday, November 29, 2007

More on New Home Sales

First, three key points to consider on housing.

Note: For more graphs, please see my earlier post: October New Home Sales

Let's start with revisions. In August, I wrote:

The new homes sales number today [August] will probably be revised down too. Applying the median cumulative revision (4.8%) during this downtrend suggests a final revised Seasonally Adjusted Annual Rate (SAAR) sales number of 757 thousand for August (was reported as 795 thousand SAAR by the Census Bureau). Just something to remember when looking at the data.Sure enough, sales for August have been revised down to 717 thousand! The same is true for September (initially reported at 770 thousand, now revised down to 716 thousand).

The same will probably be true for the just reported October sales number of 728 thousand. It is likely the final number will be below 700K.

I believe the Census Bureau is doing a good job, but the users of the data need to understand what is happening (during down trends, the Census Bureau initially overestimates sales).

For an analysis on Census Bureau revisions, see the bottom of this post.

Next up, inventory. The Census Bureau reported that inventory was 516 thousand units. But this excludes the impact of cancellations. Currently the inventory of new homes is understated by about 100K (See this post for an analysis of the impact of cancellations on inventory).

This also means that the months of supply is understated. The Census Bureau reported the months of supply as 8.5 months. Assuming a typical downward revision, and adjusting for the impact of cancellations, the actual months of supply is probably closer to 10.5 months.

The impact of OFHEO reported falling prices on household assets. Also this morning, OFHEO reported that house prices fell in Q3. This will impact the Fed's calculation of household real estate assets. I expect household real estate assets to decline around $60 Billion in Q3. (0.3% price decline times $21 Trillion in assets).

Since Mortgage Equity Withdrawal appears to have still been strong in Q3, the percent equity will decline sharply! I believe this will start to impact the ability of homeowners to use the Home ATM in the near future.

Click on graph for larger image.

Click on graph for larger image.This graph shows New Home Sales vs. Recession for the last 35 years. New Home sales were falling prior to every recession, with the exception of the business investment led recession of 2001.

This is what we call Cliff Diving!

And this shows why so many economists are concerned about a possible consumer led recession - possibly starting right now!

The second graph compares annual New Home Sales vs. Not Seasonally Adjusted (NSA) New Home Sales through October.

Typically, for an average year, about 86% of all new home sales happen before the end of October. Therefore the scale on the right is set to 86% of the left scale.

It now looks like New Home sales will be around 800 thousand - the lowest level since 1996 (758K in '96). My forecast was for 830 to 850 thousand units in 2007 and that now appears a little too high.

Monday, November 26, 2007

Upside Down in America

by Calculated Risk on 11/26/2007 04:07:00 PM

The Irvine Housing blog brings us these details (hat tip Atrios):

| Asking Price: $1,249,000 Purchase Price: $1,157,000 Purchase Date: 1/6/2005 |

The property was purchased in January 2005 for $1,157,000. The combined first and second mortgages totalled $1,156,730 leaving a downpayment of $270. Let’s just call it 100% financing.This story has been repeated all across America (usually on a smaller scale). This was not a subprime loan when the home was first purchased, but the collateral is now less than the total loan amount. The house hasn't sold yet, so perhaps the $999,999 Option ARM first is also impaired.

By April, they owners were able to find refinancing through Countrywide with a $999,999 first mortgage. This mortgage was an Option ARM with a 1% teaser rate. The minimum payment would be $3,216 per month.

Also in April of 2005, they took out a simultaneous second mortgage for $215,000 pulling out their first $58,000.

So look at their situation: They are living in a million dollar plus home in Turtle Ridge making payments less than those renting, and they “made” $58,000 in their first 4 months of ownership.

Apparently, these owners liked how hard their house was working for them, so they opened a revolving line of credit (HELOC) in August 2005 for $293,000. Did they spend it all? I can’t be sure, but the following certainly suggests they did.

In December of 2005, they extended their HELOC to $397,990.

In June of 2006, they extended their HELOC to $485,000.

In April of 2007, the well ran dry as they did their final HELOC of $491,000. I bet they were pissed when they couldn’t get more money.

So by April 2007, they have a first mortgage (Option ARM with a 1% teaser rate) for $999,999, and a HELOC for $491,000. These owners pulled $333,000 in HELOC money to fuel consumer spending.

Assuming they spent the entire HELOC (does anyone think they didn’t?), and assuming the negative amortization on the first mortgage has increased the loan balance, the total debt on the property exceeds $1,500,000. The asking price of $1,249,000 does not look like a rollback, but if the property actually sells at this price, the lender on the HELOC (Washington Mutual) will lose over $300,000.

These owners will probably just walk away. I doubt they have any assets. They never put any money into the deal, they pulled out $333,000 in cash, and they got to live in Turtle Ridge for 3 years. Not a bad deal — for them.

And look at the Mortgage Equity Withdrawal (MEW). One third of a million dollars, or over $100K per year. Perhaps the money was invested. Perhaps it was spent on new cars, flat screen TVs, vacations, or more - but this Home ATM appears out of money, and I suspect that will impact the homeowners' lifestyle.

This illustrates two important points: We are all subprime now, and, with falling house prices, the Home ATM is running dry.

Sunday, November 18, 2007

The Fed, Household Real Estate Assets and Equity

by Calculated Risk on 11/18/2007 12:37:00 PM

JW sent me this Washington Post commentary: Bits of Bad News Obscure A Big Truth About Wealth

Despite declining prices in many markets, homeowners still control near-record equity holdings, just under $11 trillion.This is similar to the argument that John Berry of Bloomberg suggested a few days ago: Bloomberg's Berry: No Recession. Although the WaPo's Kenneth Harney didn't focus on equity extraction - just wealth - it is declining wealth and less equity extraction that will impact the U.S. economy in the coming quarters. After reading the Bloomberg article, I tried to show, using the Fed's numbers that the Home ATM is running out of cash.

... there's no question that equity holdings have declined recently and may well be lower when the Fed issues its next quarterly report, in mid-December. But in an $11 trillion marketplace, a $6 billion giveback in a cyclical correction is not a cause for panic.

But Harney raises another interesting question: Why does the Fed Flow of Funds report show a decline in household real estate equity of only $6 Billion in Q2? Here is the relevant table (B.100 Balance Sheet of Households and Nonprofit Organizations).

The Fed shows household real estate assets (line 4) increased from $20.808 Trillion in Q1 to $20.997 Trillion in Q2. An increase of $189 Billion in assets. Wait - aren't prices falling? I'll get back to that ...

The Fed also shows household mortgages (line 32) increased from 9.951 Trillion in Q1 to $10.146 Trillion in Q2. An increase in mortgages of $195 Billion. The Home ATM was very active in Q2!

So that is the $6 Billion decline in equity mentioned by Harney: An increase in assets of $189 Billion eclipsed slightly by an increase in mortgage debt of $195 Billion.

Why did assets increase $189 Billion in Q2? All the data isn't publicly available, and the calculation is very complicated, but here is a simple formula:

Assets (Q2) = Assets (Q1) * PriceChange (Q2) + Assets Added (New Homes, Home improvement) - Assets Subtracted (demolished, damaged, etc.)I believe the key is the price change in Q2. Look at these price indices:

Click on graph for larger image.

Click on graph for larger image.These are all nominal prices, and the OFHEO index is Purchase Only, seasonally adjusted, and set to 100 in Q1 2000. Note: The Case-Shiller composite indices are monthly, and the graph is plotted quarterly.

All of the Case-Shiller indices show house prices have peaked, and have been declining for over a year. Meanwhile the OFHEO purchase only seasonally adjusted index shows prices increased in Q2 by 0.5% (a 2.1% annual rate).

There are significant differences between the OFHEO HPI and the Case-Shiller National index. This is an excellent summary by OFHEO economist Andrew Leventis: A Note on the Differences between the OFHEO and S&P/Case-Shiller House Price Indexes

OFHEO’s House Price Indexes (the “HPI”) and home price indexes produced by S&P/Case-Shiller are constructed using the same basic methodology. Both use the repeat-valuations framework initially proposed in the 1960s and later enhanced by Karl Case and Robert Shiller. Important differences between the indexes remain, however. The two models use different data sources and implement the mechanics of the basic algorithm in distinct ways.The OFHEO note suggests that the primary reason for the difference between Case-Shiller and OFHEO price indices is geographical coverage (not the loan limitations for OFHEO).

...

Based on a review of the methodology documentation that is available, it appears that OFHEO’s national index has broader geographic coverage than the S&P/Case-Shiller National Home Price Index. According to the methodology materials, the S&P/Case-Shiller index does not include house price data from thirteen states.

...

The S&P/Case-Shiller index also apparently has incomplete coverage in another 29 states. ... To the extent that the missing areas tend to be more rural counties, given that rural areas appear to be exhibiting stronger market conditions in recent periods, the missing data might partially explain why the OFHEO and S&P/Case-Shiller national indexes diverge.

...

OFHEO’s sales price data include only homes that have conforming mortgages, while the S&P/Case-Shiller sales prices are not restricted to houses with certain types of financing. Because many of the homes not covered in the OFHEO index may be relatively expensive (i.e., may have required non-conforming, “jumbo” mortgages), the OFHEO restriction to conforming mortgages may produce appreciation rate estimates that are less reflective of price trends for the most expensive homes.

This is important because it appears the Fed uses the OFHEO index (or something similar) to calculate changes in household real estate asset value. If the Case-Shiller index is more representative of recent price changes, then the Fed actually underestimated the recent increase in household real estate assets!

But looking forward, prices will probably be falling for the OFHEO index in Q3 (to be released Thursday, November 29) and the Fed would then also show declining prices in the Q3 Flow of Funds report. Based on some rough estimates, it appears that over $100 Billion of the $189 Billion in household real estate asset increases in Q2 was from the estimated price increase. With declining prices in Q3, household equity will probably fall significantly - putting a big dent in Harney's argument.

Friday, November 16, 2007

NAR: Repeat Buyers With No Down

by Tanta on 11/16/2007 10:05:00 AM

From National Mortgage News, via Clyde:

Nearly one in three buyers between June 2006 and June 2007 had no skin in their deals, according to new research that represents further evidence of the poor quality of loans that helped fuel the rising tide of delinquencies and foreclosures. Though the study of nearly 10,000 transactions by the National Association of Realtors did not note whether the loans were prime or subprime, it found that 29% of all buyers -- and 45% of all first-timers -- financed the entire purchase price. Somewhat surprisingly, considering that they usually have money from the sale of their previous residence to put into the transaction, 18% of repeat buyers also put up none of their own money.The NAR press release is here.

I note that in the Greenspan-Kennedy method of calculating MEW, those transactions where a repeat buyer receives sales proceeds for an existing home in excess of the existing mortgage amount, but does not use those proceeds to reduce the mortgage amount on the next home purchase, will end up counting as MEW. It is, after all, equity extraction: the equity from the previous home is "extracted" in the sale, but does not become equity in the new home. This means that the loss of 100% financing for purchases will lower net MEW, just as the loss of some cash-out refinancing options will.

Thursday, November 15, 2007

How Much Cash is Left in the Home ATM?

by Calculated Risk on 11/15/2007 01:11:00 PM

This post is a followup to: Bloomberg's Berry: No Recession (Hat tip NJ_Bob for graph ideas)

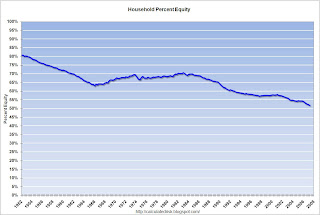

One of the questions raised by the Bloomberg article is how much more equity can be borrowed on U.S. household real estate. Based on the Fed's flow of funds report, the percent of homeowner equity was at a record low of 51.7% at the end of Q2 2007.

However, according to the Census Bureau, 31.8% of all U.S. owner occupied homes have no mortgage. You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 68%. But we can construct a model based on data from the 2006 American Community Survey (see table here). Click on graph for larger image.

Click on graph for larger image.

This graph shows the distribution of U.S. households by the value of their home, with and without a mortgage. This data is for 2006.

By using the mid-points of each range, and solving for the price of the highest range (to match the Fed's estimate of household real estate assets at the end of 2006: $20.6 Trillion), we can estimate the total dollar value of houses with and without mortgages.

Using this method, the total value of U.S. houses, at the end of 2006, with mortgages was $15.27 Trillion or 74.2% of the total. The value of houses without mortgages was $5.32 Trillion or 25.8% of the total U.S. household real estate.

Since all of the mortgage debt is from the houses with mortgages, these homes have an average of 36% equity. It's important to remember this includes some homes with 90% equity, and some homes with negative equity.

The following graph shows the impact of falling house prices on the percent aggregate equity. At the end of 2006, aggregate equity for mortgage holders was 36%.

At the end of 2006, aggregate equity for mortgage holders was 36%.

If household assets fall 10%, and liabilities stay the same, the percent equity will fall to 28.9%. If household assets fall 20%, the percent equity will fall to 20%.

If assets fall 35%, there will be no equity in the aggregate - households with positive equity will be offset by households with negative equity. Although I don't expect prices to fall anywhere near 35%, even a decline of 10% will probably severely limit the ability of marginal homeowners to borrow from their home equity.

This is based on 2006 data. Mortgage equity borrowing was still strong through the first three quarters of 2007 (Q3 estimated), and the situation is even worse now.

Tuesday, November 13, 2007

Bloomberg's Berry: No Recession

by Calculated Risk on 11/13/2007 06:43:00 PM

From Bloomberg: Consumer Spending Won't Fall and Cause Recession: John M. Berry. An excerpt on the impact of declining homeowners' equity:

Some analysts argue that falling home prices are wiping out a chunk of owners' equity and limiting their ability to borrow against it. In addition, having less equity will depress owners' willingness to spend on consumption, they say.First, a typo correction in Berry's piece. According to the Fed's Flow of Funds report, the value of household real estate was

Again, there is some truth to both those points, though it's not clear how much.

While homeowners' equity has begun to fall and is likely to continue doing so for some time, there are still huge paper gains in place from previous years.

For example, the Federal Reserve's most recent Flow of Funds report said that at the end of the second quarter owners' equity was $18.85 trillion. That was still almost $40 billion more than at the end of last year and $1.56 trillion more than at the end of 2004.

...

So homeowners can still borrow to supplement their current income even though it may be more difficult and somewhat more expensive.

Berry notes correctly that homeowner equity has started to decline, and will decline further in the future. But then he argues that "there are still huge paper gains in place" that homeowners can continue to borrow against.

Really? Are there huge gains that homeowners can borrow against to supplement their incomes?

Click on graph for larger image.

Click on graph for larger image.This graph shows the percent of homeowner equity for the last 50 years. Although the percent of homeowner equity was at a record low of 51.7% at the end of Q2 2007, that still sounds pretty good ... at least until you realize that about 1/3 of all owner occupied households have no mortgage debt (their homes are paid off).

You can't do a direct subtraction because the value of these paid-off homes is, on average, lower than the mortgaged 2/3. But it is unreasonable to expect these more risk-averse homeowners will suddenly change their habits and start borrowing against their homes.

So, although there have been gains, there is a real question of much more the already leveraged homeowners can borrow against their equity.

The second graph shows the Federal Reserve's estimate of household assets and mortgage debt as a percent of GDP.

The second graph shows the Federal Reserve's estimate of household assets and mortgage debt as a percent of GDP.With falling house prices, the value of household assets will probably fall significantly as a percent of GDP. Yet Berry appears to be arguing that mortgage debt, as a percent of GDP, will continue to increase. And remember that 1/3 of owner occupied households have no mortgage debt.

Although there are several unknowns, if assets fell to 120% of GDP, it is hard to conceive of mortgage debt growing faster than GDP - even staying even with GDP would imply that the mortgaged 2/3 would owe something like 80% of the value of their homes - unlikely.

On this point, I think Berry is wrong. Sure, some homeowners will be able to supplement their incomes by borrowing against their homes, but I think in the aggregate this borrowing will slow significantly over the next few quarters.

Monday, November 12, 2007

Roubini on Home Equity Extraction

by Calculated Risk on 11/12/2007 04:53:00 PM

In his most recent post, Professor Roubini commented on the impact of less homeowner equity extraction on consumption.

Note that Roubini calls equity extraction HEW (Home Equity Withdrawal) and I usually refer to it as MEW (Mortgage Equity Withdrawal). MEW has been used for years, but HEW is a more accurate description.

Roubini writes:

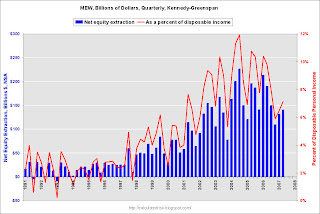

... there is the effect of home equity withdrawal (HEW) on consumption. There is some debate in the literature on whether the effect of HEW is a proxy for the wealth effect or an additional and separate effect. Again the literature has a variety of estimates ranging from 50% of HEW being consumed according to Greenspan-Kennedy to 25% of it being consumed according to other studies. The appropriate measure of HEW is also important: gross or net, overall or active. HEW peaked at $700 billion annualized in 2005 and has dropped to about $150 billion by Q2 of 2007. So, the fall in consumption – assuming unrealistically no further fall in HEW from now on – would be $275 billion based on the Greenspan-Kennedy estimates or about $140 billion according to the more conservative estimates. Evidence suggests that this effect of HEW on consumption occurs with lags; that is why we have not yet seen its full effects on consumption as late as Q3. Rather, we will see its effects in the next few quarters. Another interpretation – according to Zandi – is that HEW (measured in a different way) has started to fall only in the recent quarters; so again the effect of falling HEW on consumption will be observed mostly in 2008.First, for those that want to follow along, here is a copy of the Kennedy-Greenspan data for Q2 in Excel. NOTE this request from the Fed:

These data are the product of a research project undertaken by James Kennedy and Alan Greenspan. The data are not an official publication or product of the Federal Reserve Board. If you cite these data, please reference one of the two papers that Jim wrote with Alan Greenspan. For example, a reference might read something like this:Here are the Seasonally Adjusted Annual Rate (SAAR) Kennedy-Greenspan estimates of home equity extraction through Q2 2007, provided by James Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41.

"Updated estimates provided by Jim Kennedy of the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41."

For Q2 2007, Dr. Kennedy calculated Net Equity Extraction as $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).

For Q2 2007, Dr. Kennedy calculated Net Equity Extraction as $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).This graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Roubini is suggesting the MEW has declined significantly in Q2. I think this is incorrect. Roubini wrote:

HEW peaked at $700 billion annualized in 2005 and has dropped to about $150 billion by Q2 of 2007.According to Dr. Kennedy, MEW was about $140 Billion in Q2 2007 (or a seasonally adjusted annual rate of almost $500 Billion). So MEW hasn't fallen very far yet! This actually makes Roubini's argument even stronger. So I'd argue the following sentence is also incorrect:

So, the fall in consumption – assuming unrealistically no further fall in HEW from now on – would be $275 billion based on the Greenspan-Kennedy estimates or about $140 billion according to the more conservative estimates.In fact I expect MEW to fall signficantly starting in Q4 2007. As of Q2, 2007 the consumption impact of falling MEW (using 50%) would be closer to $25 Billion per quarter ($100 Billion annualized), and even though there appears to be a lag from equity extraction to consumption, most of the decline in equity extraction is still ahead of us.

In fact it appears MEW was strong in Q3 based on my advance estimate. Using the Q3 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is approximately $520 Billion (SAAR) or 5.1% of Disposable Personal Income (DPI). This would be slightly higher than the Q2 estimates, from the Fed's Dr. Kennedy, of $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).

The actual Q3 data for MEW is released after the Flow of Funds report is available from the Fed (scheduled for December 6th for Q3).

Click on graph for larger image.

Click on graph for larger image.This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high (0.90, R2 = 0.81) but there are differences quarter to quarter. This does suggest that MEW was at about the same level in Q3 as Q2. We will have to wait until September to know for sure.

MEW will probably decline precipitously in the Q4 2007, with a combination of tighter lending standards and falling house prices. The impact of less equity extraction on consumer spending is still being debated, but I agree with Roubini that a slowdown in consumption expenditures is likely.

Friday, November 09, 2007

September Trade Deficit

by Calculated Risk on 11/09/2007 12:51:00 PM

The Census Bureau reported today for September 2007:

"a goods and services deficit of $56.5 billion, compared

with $56.8 billion in August"

Click on graph for larger image.

Click on graph for larger image.The red line is the trade deficit excluding petroleum products. (Blue is the total deficit, and black is the petroleum deficit).

The ex-petroleum deficit is falling fairly rapidly, almost entirely because of weak imports (export growth is still strong). But unlike the previous decline in the trade deficit (during the '01 recession), petroleum imports are still strong.

UPDATE: Petroleum imports are strong in dollar terms, but they appear to be declining in BBLs, see exhibit 17. Imports are noisy month to month, but BBLs imported has declined year over year for the last several months. Also note the price per barrel. This will increase sharply over the next few months (but not to the spot level). Hat tip dryfly.

Normally oil prices would now be falling as the U.S. economy weakens - instead we are seeing margins shrinks for U.S. refiners and record high oil prices. This would imply that global demand for oil is strong, while domestic consumption is weak. This evidence supports the "decoupling" argument: that the U.S. economy could slow, but economic growth in the rest of the World would stay strong. I'm not convinced by the decoupling argument, and my view is that there is simply a lag between a slowing U.S. economy and a slowdown for the rest of the world.

Looking at the trade balance, excluding petroleum products, it appears the deficit peaked at about the same time as the housing market / mortgage equity withdrawal in the U.S. This is an interesting correlation (but not does imply causation).

"Interestingly, the change in U.S. home mortgage debt over the past half-century correlates significantly with our current account deficit. To be sure, correlation is not causation, and there have been many influences on both mortgage debt and the current account."

Alan Greenspan, Feb, 2005

The second graph shows the trade deficit and mortgage equity withdrawal as a percent of GDP.

The second graph shows the trade deficit and mortgage equity withdrawal as a percent of GDP.Declining MEW is one of the reasons I forecast the trade deficit to decline in '07. And a declining trade deficit also has possible implications for U.S. interest rates; as the trade deficit declines, rates may rise in the U.S. because foreign CBs will have less to invest in the U.S..

Note also that import prices are surging. From Greg Ip at the WSJ:

Import prices jumped 1.8% in October from September and are up 9.6% from the previous year. To be sure, most of that was due to rising oil and natural-gas prices. But even excluding fuels, prices were 0.3% higher from September and up 2.4% from a year earlier.The import prices problem will only get worse in October and November with surging oil prices and the falling dollar.

Thursday, November 08, 2007

"Grim" Shopping Season

by Calculated Risk on 11/08/2007 11:52:00 PM

From the NY Times: Stores See Shoppers in Retreat

Consumers have rendered a verdict on the coming holiday season: grim.From the WSJ: 'Affordable Luxury' Stores Feel Economy's Pinch

From discounters like Wal-Mart to luxury emporiums like Nordstrom, the nation’s biggest chains reported the weakest October in 12 years yesterday.

...

Sales at stores open at least a year, a crucial yardstick in retailing, rose just 1.6 percent last month, the slowest growth since October 1995, according to the International Council of Shopping Centers. The poor results — on the heels of a dismal September — have made this one of the worst fall shopping seasons in decades.

Yesterday Nordstrom Inc. reported a rare 2.4% drop in October same-store sales, steeper than the 1% decline many analysts had expected. Morgan Stanley analyst Michelle Clark this week downgraded Nordstrom's shares to "underweight," the equivalent of a sell rating, citing weaker spending by the affluent middle class, rising credit-card delinquencies and the luxury retailer's exposure to risky housing markets in California and elsewhere.How long will the slowdown last? From the NY Times article:

“We expect the challenging retail environment to continue for the foreseeable future,” [Myron E. Ullman III, chief executive of J. C. Penney] said.The housing slump is definitely hurting consumer spending in Florida, Nevada, Arizona, and California - all states that are in or near recession - and probably impacting spending in many other places too.

We need to keep watching Mortgage Equity Withdrawal (MEW). MEW is probably declining sharply in Q4 with tighter lending standards and falling house prices, and that will likely directly impact consumer spending. In simpler terms, the Home ATM is running out of cash.

note: the advance MEW estimate suggests that MEW was still been pretty strong in Q3.

Wednesday, November 07, 2007

Freddie Mac Cash-Out Report

by Tanta on 11/07/2007 07:37:00 AM

Percent of refis involving cash-out rises, but amount of cash taken out falls:

McLean, VA – In the third quarter of 2007, 87 percent of Freddie Mac-owned loans that were refinanced resulted in new mortgages with loan amounts that were at least five percent higher than the original mortgage balances, according to Freddie Mac's quarterly refinance review. The revised share for the second quarter of 2007 was 84 percent. . . .

In the third quarter of 2007, the median ratio of new-to-old interest rate was 1.11. In other words, one-half of those borrowers who paid off their original loan and took out a new one increased their mortgage coupon rate by 11 percent, or roughly five-eighths of a percentage point at today's level of 30-year fixed mortgage rates.

"This quarter we saw $60.1 billion cashed out, down from a revised $81.4 billion cashed out in the second quarter of 2007," said Amy Crews Cutts, Freddie Mac deputy chief economist. "Based on what we've been seeing in the share of mortgage applications for refinance, we are expecting the share of mortgage refinance originations to remain about the same in the fourth quarter as we saw in the third, at about 45 percent. . . .

The Cash-Out Refinance Report also revealed that properties refinanced during the third quarter of 2007 experienced a median house-price appreciation of 26 percent during the time since the original loan was made, up from a revised 24 percent in the second quarter 2007. For loans refinanced in the third quarter of 2007, the median age of the original loan was 3.9 years, 5 months older than the median age of loans refinanced during the second quarter of 2007.

Thursday, November 01, 2007

Advance Q3 MEW Estimate

by Calculated Risk on 11/01/2007 10:00:00 PM

Based on the Q3 GDP data from the BEA, my advance estimate for Mortgage Equity Withdrawal (MEW) is approximately $520 Billion (SAAR) or 5.1% of Disposable Personal Income (DPI). This would be slightly higher than the Q2 estimates, from the Fed's Dr. Kennedy, of $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).

The actual Q3 data for MEW is released after the Flow of Funds report is available from the Fed (scheduled for December 6th for Q3).  Click on graph for larger image.

Click on graph for larger image.

This graph compares my advance MEW estimate (as a percent of DPI) with the MEW estimate from Dr. James Kennedy at the Federal Reserve. The correlation is pretty high (0.90, R2 = 0.81) but there are differences quarter to quarter. This does suggest that MEW was at about the same level in Q3 as Q2. We will have to wait until September to know for sure.

MEW will probably decline precipitously in the Q4 2007, with a combination of tighter lending standards and falling house prices. The impact of less equity extraction on consumer spending is still being debated, but I believe a slowdown in consumption expenditures is likely.

Here are the Seasonally Adjusted Annual Rate (SAAR) Kennedy-Greenspan estimates of home equity extraction through Q2 2007, provided by James Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. For Q2 2007, Dr. Kennedy calculated Net Equity Extraction as $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).

For Q2 2007, Dr. Kennedy calculated Net Equity Extraction as $494.4 Billion (SAAR), or 4.9% of Disposable Personal Income (DPI).

This graph shows the MEW results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

Friday, September 21, 2007

Q2 Mortgage Equity Withdrawal: $140.3 Billion

by Calculated Risk on 9/21/2007 03:41:00 PM

Here are the Kennedy-Greenspan estimates of home equity extraction for Q2 2007, provided by Jim Kennedy based on the mortgage system presented in "Estimates of Home Mortgage Originations, Repayments, and Debt On One-to-Four-Family Residences," Alan Greenspan and James Kennedy, Federal Reserve Board FEDS working paper no. 2005-41. Click on graph for larger image.

Click on graph for larger image.

For Q2 2007, Dr. Kennedy has calculated Net Equity Extraction as $140.3 Billion, or 7.1% of Disposable Personal Income (DPI). Note that equity extraction for Q1 2007 has been revised upwards to $131.3 Billion.

This graph shows the net equity extraction, or mortgage equity withdrawal (MEW), results, both in billions of dollars quarterly (not annual rate), and as a percent of personal disposable income.

It is very likely that MEW will collapse in Q3 2007, based on the tighter lending standards and falling home prices, leading, most likely, to less consumer spending.