by Calculated Risk on 11/17/2008 10:20:00 AM

Monday, November 17, 2008

Credit Crisis Indicators: Unchanged

Another daily look at a few credit indicators ...

The London interbank offered rate, or Libor, that banks say they charge each other for such loans rose less than half a basis point to 2.24 percent today, British Bankers' Association data showed.The three-month LIBOR was 2.23% yesterday and the rate peaked at 4.81875% on Oct. 10. (unchanged)

With the effective Fed Funds rate at 0.35% (as of yesterday), this is probably somewhat in the right range. At some point, I'd like to see the effective Fed funds rate close to the target rate (currently 1.0%) and the 3 month yield within 25 bps of the target rate.

But for now, the Fed is engaged in quantitative easing.

The TED spread is above 2.0 again, and still too high. The peak was 4.63 on Oct 10th. I'd like to see the spread move back down to 1.0 or lower. A normal spread is around 0.5. From reader Kai using data back to 1986: "The average TED spread is 58bps, but the median TED spread is 42bps and the non-crisis (i.e. less than 100bps spread) median is 37.8bps."

The Federal Reserve assets increased $139 billion last week to $2.214 trillion.

Click on graph for larger image in new window.

This is the spread between high and low quality 30 day nonfinancial commercial paper.

The Fed is buying higher quality commercial paper (CP) and this is pushing down the yield on this paper (0.50% yesterday!) - and increasing the spread between AA and A2/P2 CP. So this indicator has been a little misleading. Also the recession is creating concern for lower rated paper. Still, if the credit crisis eases, I'd expect a significant decline in this spread.

Another day with no improvement ... (except the A2/P2 spread).

Note: The Fed's balance sheet is interesting and I'll try to have more on how the Fed is funding their initiatives and quantitative easing. See Bernanke's paper from 2004: Conducting Monetary Policy at Very Low Short-Term Interest Rates One thing is clear - the target Fed funds rate is pretty much meaningless right now.

Wednesday, October 29, 2008

Fed Funds Rate Cut 50 bps to 1.0%

by Calculated Risk on 10/29/2008 02:15:00 PM

FOMC statement:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 50 basis points to 1 percent.

The pace of economic activity appears to have slowed markedly, owing importantly to a decline in consumer expenditures. Business equipment spending and industrial production have weakened in recent months, and slowing economic activity in many foreign economies is damping the prospects for U.S. exports. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit.

In light of the declines in the prices of energy and other commodities and the weaker prospects for economic activity, the Committee expects inflation to moderate in coming quarters to levels consistent with price stability.

Recent policy actions, including today’s rate reduction, coordinated interest rate cuts by central banks, extraordinary liquidity measures, and official steps to strengthen financial systems, should help over time to improve credit conditions and promote a return to moderate economic growth. Nevertheless, downside risks to growth remain. The Committee will monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Elizabeth A. Duke; Richard W. Fisher; Donald L. Kohn; Randall S. Kroszner; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh.

In a related action, the Board of Governors unanimously approved a 50-basis-point decrease in the discount rate to 1-1/4 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, Cleveland, and San Francisco.

emphasis added

Sunday, October 26, 2008

Fed Funds Rate Cut

by Calculated Risk on 10/26/2008 11:42:00 AM

How much will the Fed reduce the Fed Funds rate on Wednesday? And does it matter?

First, here are the latest Fed Fund probabilities from the Cleveland Fed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Market participants expect a 50 bps rate cut to 1.0%, however there is some expectation of a 75 bps cut (to 0.75%).

Earlier this month, I speculated about an intermeeting rate cut: Will there be an Intermeeting Fed Rate Cut?. Sure enough the Fed cut the Fed Funds rate four days later - but market participants were disappointed with what was perceived as a feeble 50 bps effort.

Remember Bernanke wrote in 2004: What Explains the Stock Market’s Reaction to Federal Reserve Policy?

The most direct and immediate effects of monetary policy actions, such as changes in the federal funds rate, are on the financial markets; by affecting asset prices and returns, policymakers try to modify economic behavior in ways that will help to achieve their ultimate objectives.Bernanke can probably add the Oct 8th 50 bps rate cut to his list of "disappointing cuts" since the market sold off about 10% over the two days following the Fed action.

...

The unexpected 50-basis-point intermeeting rate reductions on 3 January [2001] and 18 April [2001] were both greeted euphorically, with one-day returns of 5.3% and 4.0% respectively. The 50-basis-point rate cut on 20 March [2001] was received less enthusiastically, however. Even though the cut was more or less what the futures market had been anticipating, financial press reported that many equity market participants were “disappointed” the rate cut hadn’t been an even larger 75 basis point action. Consequently, the market lost more than 2%.

Of course the FOMC just sets the target rate. The effective Fed Funds rate has already been at or under 1% for the last couple of weeks. So the Fed will just be making this official.

And does it even matter? Probably not much at this point. But I suspect market observers will be focused on the economic outlook.

Note: Dr. Krugman is updating his book "Return of Depression Economics". I think this 1998 paper from Professor Paul on the Japanese experience might be of interest to some readers: It's BAAACK! Japan's Slump and the Return of the Liquidity Trap.

Wednesday, October 08, 2008

Fed Funds Rate Cut 50 bps, Global Rate Cuts

by Calculated Risk on 10/08/2008 08:28:00 AM

Some easing of global monetary conditions is therefore warranted. Accordingly, the Bank of Canada, the Bank of England, the European Central Bank, the Federal Reserve, Sveriges Riksbank, and the Swiss National Bank are today announcing reductions in policy interest rates. The Bank of Japan expresses its strong support of these policy actions.

...

The Federal Open Market Committee has decided to lower its target for the federal funds rate 50 basis points to 1-1/2 percent. The Committee took this action in light of evidence pointing to a weakening of economic activity and a reduction in inflationary pressures.

Incoming economic data suggest that the pace of economic activity has slowed markedly in recent months. Moreover, the intensification of financial market turmoil is likely to exert additional restraint on spending, partly by further reducing the ability of households and businesses to obtain credit. Inflation has been high, but the Committee believes that the decline in energy and other commodity prices and the weaker prospects for economic activity have reduced the upside risks to inflation.

Saturday, October 04, 2008

Will there be an Intermeeting Fed Rate Cut?

by Calculated Risk on 10/04/2008 05:18:00 PM

The next Fed meeting is more than three weeks away (a two day meeting on October 28th and 29th) and the economic data suggests the economy is deteriorating rapidly. And the TARP will not start buying assets for several weeks, maybe not until mid-November. This suggests the possibility of an intermeeting Fed rate cut.

Fed Chairman Bernanke released a statement on Friday:

We will continue to use all of the powers at our disposal to mitigate credit market disruptions and to foster a strong, vibrant economy.The Financial Times notes: Declining economy could force Fed to act

The last time the macro-economic data deteriorated rapidly – around the turn of the year – the Fed reacted decisively with big rate cuts, including an intermeeting move. In the eyes of many the latest data also adds up to an open-and-shut case for further Fed rate cuts.And here are the latest Fed Fund probabilities from the Cleveland Fed.

...

If the Fed does decide to cut, the case for cutting at the meeting is that a new set of economic forecasts could win over doubters. But if the Fed wants to maximise the impact of the cut it could move intermeeting in the hope of shocking the credit markets back to life.

emphasis added

Click on graph for larger image in new window.

Click on graph for larger image in new window.Until a couple of weeks ago, market participants anticipated no change in the Fed Funds rate in October.

Now, because of recent events, there is a strong consensus for a rate cut by the October meeting.

But if you are going to lower rates at the end of October, why wait?

Back in 2004, Bernanke wrote a paper (with NBER economist Kenneth Kuttner) What Explains the Stock Market’s Reaction to Federal Reserve Policy?

The most direct and immediate effects of monetary policy actions, such as changes in the federal funds rate, are on the financial markets; by affecting asset prices and returns, policymakers try to modify economic behavior in ways that will help to achieve their ultimate objectives.To surprise the market, the Fed might need to cut by at least 50 bps - maybe 75 bps - and announce the action before the market opens on Monday.

...

The unexpected 50-basis-point intermeeting rate reductions on 3 January [2001] and 18 April [2001] were both greeted euphorically, with one-day returns of 5.3% and 4.0% respectively. The 50-basis-point rate cut on 20 March [2001] was received less enthusiastically, however. Even though the cut was more or less what the futures market had been anticipating, financial press reported that many equity market participants were “disappointed” the rate cut hadn’t been an even larger 75 basis point action. Consequently, the market lost more than 2%.

...

Another unusually vehement reaction to a Fed action is associated with the 25-basis-point intermeeting rate cut on 15 October 1998, which was taken in response to unsettled conditions in the financial markets — specifically, the deteriorating situations in Asia and Russia. For whatever reason, the unexpected intermeeting cut lifted equities over 4%.

...

This study has documented a relatively strong and consistent response of the stock market to unexpected monetary policy actions, using federal funds futures data to gauge policy expectations.

Tuesday, September 16, 2008

Fed: No Change in Fed Funds Rate

by Calculated Risk on 9/16/2008 02:14:00 PM

From the Fed:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Strains in financial markets have increased significantly and labor markets have weakened further. Economic growth appears to have slowed recently, partly reflecting a softening of household spending. Tight credit conditions, the ongoing housing contraction, and some slowing in export growth are likely to weigh on economic growth over the next few quarters. Over time, the substantial easing of monetary policy, combined with ongoing measures to foster market liquidity, should help to promote moderate economic growth.

Inflation has been high, spurred by the earlier increases in the prices of energy and some other commodities. The Committee expects inflation to moderate later this year and next year, but the inflation outlook remains highly uncertain.

The downside risks to growth and the upside risks to inflation are both of significant concern to the Committee. The Committee will monitor economic and financial developments carefully and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Christine M. Cumming; Elizabeth A. Duke; Richard W. Fisher; Donald L. Kohn; Randall S. Kroszner; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Ms. Cumming voted as the alternate for Timothy F. Geithner.

Fed Fund Probabilities

by Calculated Risk on 9/16/2008 10:28:00 AM

Since the Fed is meeting today, here is the latest Fed Fund probabilities from the Cleveland Fed. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Until the last couple of days market participants anticipated no change in the Fed Funds rate in Septemeber. Now, because of recent events, there is significant uncertainty.

The Fed will probably leave rates unchanged (although a 50bps cut is possible), but the wording of the announcement will probably show more concern about the slowing economy and credit markets, and less concern about inflation.

Tuesday, August 05, 2008

Fed: No Change in Fed Funds Rate

by Calculated Risk on 8/05/2008 02:13:00 PM

From the Federal Reserve:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Economic activity expanded in the second quarter, partly reflecting growth in consumer spending and exports. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and elevated energy prices are likely to weigh on economic growth over the next few quarters. Over time, the substantial easing of monetary policy, combined with ongoing measures to foster market liquidity, should help to promote moderate economic growth.

Inflation has been high, spurred by the earlier increases in the prices of energy and some other commodities, and some indicators of inflation expectations have been elevated. The Committee expects inflation to moderate later this year and next year, but the inflation outlook remains highly uncertain.

Although downside risks to growth remain, the upside risks to inflation are also of significant concern to the Committee. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Elizabeth A. Duke; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred an increase in the target for the federal funds rate at this meeting.

Friday, July 18, 2008

Fed's Stern: Fed Can't Wait for Crisis to End to Raise Rates

by Calculated Risk on 7/18/2008 05:06:00 PM

From Bloomberg: Fed's Stern Says Rate Rise Can't Wait for Crisis End

``We can't wait until we clearly observe the financial markets at normal, the economy growing robustly, and so on and so forth, before we reverse course,'' Stern, president of the Federal Reserve Bank of Minneapolis, said in an interview today.Market participants expect no rate change through at least the September meeting. Stern is a voting member of the FOMC.

...

``We're pretty well-positioned for the downside risks we might encounter from here,'' said Stern, 63, the Fed's longest- serving policy maker. ``I worry a little bit more about the prospects for inflation.''

Wednesday, July 16, 2008

Fed Funds Probabilities: No rate change through September

by Calculated Risk on 7/16/2008 05:27:00 PM

Reading the Fed minutes today, it appears that as of the last FOMC meeting in June, most FOMC members were once again missing the downside risks to the economy. Chairman Bernanke somewhat corrected that mistake in his testimony over the last two days as he acknowledged the "significant downside risks to the outlook for growth".

As of yesterday - before the stock market rally today - market participants were expecting the Fed to hold rates steady at 2.0% through September, and a rate cut is now more likely (in their view) than a rate hike by the September meeting. Click on graph for larger image in new window.

Click on graph for larger image in new window.

This graph from the Cleveland Fed shows the implied probability of what Fed Funds futures market participants expect the most likely outcome to be at the Fed meeting in September.

I also think the Fed will hold rates steady - probably through the end of the year.

Friday, June 27, 2008

Professor Duy: "This Is Not Good"

by Calculated Risk on 6/27/2008 10:54:00 AM

Tim Duy has another great post on the Fed being caught between inflation and recession: This Is Not Good. Here is his conclusion:

This is a no win situation...which way will the Fed turn? The Fed will hold the current policy in place until policymakers becomes sufficiently distressed by the impact of energy price inflation ... Note that market participants are increasingly aware that the Fed’s default policy for the time being is higher inflation, as evidenced by the rise in 10 year TIPS breakeven levels to 254bp today.

In theory, the best outcome is to find is a sweet spot that allows global growth outside of the US to decelerate while avoiding a free fall in the Dollar. In the absence of such equilibrium, the US economy can hobble along only as long as the following three conditions hold:

1. The Federal Reserve can maintain easy monetary policy.

2. The US government can sustain repeated fiscal stimulus measures.

3. China and the rest of the dollar bloc continue to be willing to accumulate US assets, primarily the Treasury debt needed for fiscal stimulus.

When these conditions no longer hold – such as the Fed needs to tighten to counter energy inflation, or the demand for US debt drops sharply – then I suspect the US economic environment will shift decisively toward higher inflation or significant recession.

Wednesday, June 25, 2008

Fed: No Rate Change

by Calculated Risk on 6/25/2008 02:12:00 PM

From the FOMC:

The Federal Open Market Committee decided today to keep its target for the federal funds rate at 2 percent.

Recent information indicates that overall economic activity continues to expand, partly reflecting some firming in household spending. However, labor markets have softened further and financial markets remain under considerable stress. Tight credit conditions, the ongoing housing contraction, and the rise in energy prices are likely to weigh on economic growth over the next few quarters.

The Committee expects inflation to moderate later this year and next year. However, in light of the continued increases in the prices of energy and some other commodities and the elevated state of some indicators of inflation expectations, uncertainty about the inflation outlook remains high.

The substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time. Although downside risks to growth remain, they appear to have diminished somewhat, and the upside risks to inflation and inflation expectations have increased. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Charles I. Plosser; Gary H. Stern; and Kevin M. Warsh. Voting against was Richard W. Fisher, who preferred an increase in the target for the federal funds rate at this meeting.

Friday, June 13, 2008

Kasriel On MEW and the Fed

by Calculated Risk on 6/13/2008 07:46:00 PM

Northern Trust chief economist Paul Kasriel discusses active MEW:

Economists refer to something called the “wealth” effect. It is hypothesized that households tend to spend relatively more of their income when their wealth is increasing and vice versa. Mind you, households do not have any more cash in hand to spend when the value of their stock portfolios or houses go up. They are just wealthier “on paper.”Note: my graphs have focused on MEW including turnover. Active MEW is a subset of the data I've presented and consists of cash out refis and HELOCs.

In this past cycle, it had become very easy for households to turn their increased “paper” housing wealth into actual cash by borrowing against their increased home equity. This borrowing is called mortgage equity withdrawal, or MEW. Active MEW can be defined as mortgage equity withdrawal consisting of refinancing and home equity borrowing. In contrast, inactive MEW consists of turnover. At an annualized rate, active MEW peaked at $576 billion in the second quarter of 2006. Active Mew has slowed to only $114 billion in the first quarter of this year – the smallest amount since the fourth quarter of 1999 (see Chart 3 [at link]). There is no doubt in my mind that active MEW, which actually puts additional cash into the hands of households, played an important role in boosting consumer spending in this past expansion. And there is no doubt in my mind that the recent and likely continued decline in active MEW will play an important role in retarding consumer spending in this recession. Because it has been easier to borrow against the increased wealth in one’s house than in one’s stock portfolio, dollar-for-dollar, falling house prices will have a more important negative effect on household spending that will falling stock prices.

And on Fed tightening:

It is conceivable the Fed could engage in a one-off 25 basis point hike in the funds rate, which could not make a material difference on business activity because the Fed has taken radical preemptive action as an insurance against the possibility of a severe economic downturn and/or continued financial market disruptions. ... But, there is a distinctly stronger probability attached to the likelihood of an unchanged federal funds rate well into 2009 ... In other words, in our estimation, the Fed may not need to translate rhetoric into action given the fragile economic environment and the likelihood that inflation will be moderating in the second half of the year.Goldman Sachs has the same view (no link): Could They? Yes. Will They? We Don't Think So.

[W]e still believe that tightening is both inappropriate and unlikely anytime soon. It is inappropriate because: (1) the economy is fundamentally weak, with tax rebates driving the surge in retail sales; (2) financial markets remain fragile; and (3) worries about inflation are overdone ...

Thursday, June 12, 2008

Fed's Plosser Calls for "Preemptively" Rate Hikes

by Calculated Risk on 6/12/2008 02:22:00 PM

From MarketWatch: Fed's Plosser pushes for quick rate hikes

"We need to take steps to insure that inflation does not get out of control," [Federal Reserve President Charles Plosser] said in an interview on the CNBC television network. "We need to act preemptively."

...

Plosser said Thursday the inflation threat facing the U.S. economy "is serious."

"Inflation has been gradually been creeping up and more than just in oil and food," he said. "The base of inflation is broadening."

Wednesday, June 11, 2008

Tim Duy: Fed Between a Rock and ...

by Calculated Risk on 6/11/2008 09:52:00 AM

From Professor Duy: Fed Watch: Between a Rock and a Hard Place

Fedspeak turned decidedly hawkish this week, and market participants responded accordingly, moving up expectations for a rate hike to as early as this August. But is Federal Reserve Chairman Ben Bernanke really ready to follow through? The answer could make or break the Dollar in the coming weeks.Tim covers the current situation, the recent Fedspeak, the arguments for and against raising rates and keep rates steady - and the politic issues. Duy concludes:

Bottom Line: The Fed has no one to blame for their predicament but themselves. Bernanke & Co. cut rates too deeply, fighting a battle against deflation that never was. Now they are backed into a corner; either raise rates and risk upsetting a very fragile economy, or stay the path and risk the inflationary consequences. If the Fed is truly concerned about the Dollar and commodity prices – and their open talk about currency values implies real and serious concerns – Bernanke will have to follow through with his newfound hawkish side. The bluntness of Fedspeak looks to signal a dramatic shift in thinking on Constitution Ave., and that argues for a rate hike by September, earlier than I had previously expected, and I cannot rule out an August move. Such a move is not without considerable risk for the economy.The Fed is still data dependent, and unless the economic numbers improve, it seems unlikely the Fed will raise rates. But, as Tim notes, the Fedspeak has turned decidedly hawkish.

Tuesday, June 10, 2008

Will the Fed Raise Rates in August?

by Calculated Risk on 6/10/2008 06:09:00 PM

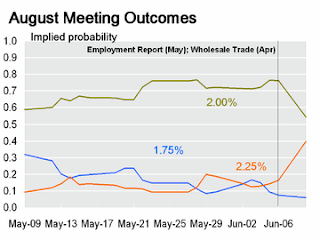

The buzz on the street is that the Fed might raise the Fed Funds rate 25 bps at the August meeting. Click on graph for larger image in new window.

Click on graph for larger image in new window.

Here are the probabilities from the Cleveland Fed. As of yesterday, the market was still expecting no move in June - with the odds of a 25 bps rate hike increasing only slightly.

But all the tough talk about inflation and supporting the dollar is getting some attention.

The 2nd graph shows the August meeting probabilities as of yesterday.

As of yesterday, the implied probability of a 25 bps rate hike in August was below 40%. However, according to a private calculation (using the August Fed Funds future contract), the odds of a 25 bps rate hike increased to over 70% today!

However, according to a private calculation (using the August Fed Funds future contract), the odds of a 25 bps rate hike increased to over 70% today!

Raising rates with unemployment rising, and the economic risks to the downside, seems very unusual - but that is what the market expects.

Wednesday, May 21, 2008

Fed Minutes Suggest Rate Cuts Are Done

by Calculated Risk on 5/21/2008 02:29:00 PM

From the WSJ: Fed Signals Rate Cuts Are Done, Lowers Growth Forecast for 2008

The Federal Reserve on Wednesday appeared to shut the door to the possibility of further interest rate cuts, saying in April meeting minutes that the last rate cut was a "close call," and that many officials think future reductions are unlikely even if the economy contracts.Here are the minutes.

...

The Fed also released updated quarterly economic forecasts with the April minutes. The central tendency of officials' forecasts is for gross domestic product to rise between just 0.3% and 1.2% this year, down from the last forecast of growth between 1.3% to 2%. Officials also raised their forecasts for the unemployment rate and both headline and core inflation as measured by the price index for personal consumption expenditures.

Slower growth, more inflation, no rate cuts ...

Wednesday, April 30, 2008

Fed Cuts Rate to 2%, Signals Pause

by Calculated Risk on 4/30/2008 02:21:00 PM

Update: The Fed's "Pause" signal:

If you compare the current FOMC statement to the March 18th statement (previous meeting), it appears the Fed is signaling a pause.

On March 18th, from the FOMC statement (emphasis added):

"Today’s policy action, combined with those taken earlier, including measures to foster market liquidity, should help to promote moderate growth over time and to mitigate the risks to economic activity. However, downside risks to growth remain. The Committee will act in a timely manner as needed to promote sustainable economic growth and price stability."The same paragraph of the statement today:

"The substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time and to mitigate risks to economic activity. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability."It appears the Fed believes the downside risks to growth have diminished and the inflation concerns remain about the same.

FOMC statement:

The Federal Open Market Committee decided today to lower its target for the federal funds rate 25 basis points to 2 percent.

Recent information indicates that economic activity remains weak. Household and business spending has been subdued and labor markets have softened further. Financial markets remain under considerable stress, and tight credit conditions and the deepening housing contraction are likely to weigh on economic growth over the next few quarters.

Although readings on core inflation have improved somewhat, energy and other commodity prices have increased, and some indicators of inflation expectations have risen in recent months. The Committee expects inflation to moderate in coming quarters, reflecting a projected leveling-out of energy and other commodity prices and an easing of pressures on resource utilization. Still, uncertainty about the inflation outlook remains high. It will be necessary to continue to monitor inflation developments carefully.

The substantial easing of monetary policy to date, combined with ongoing measures to foster market liquidity, should help to promote moderate growth over time and to mitigate risks to economic activity. The Committee will continue to monitor economic and financial developments and will act as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Gary H. Stern; and Kevin M. Warsh. Voting against were Richard W. Fisher and Charles I. Plosser, who preferred no change in the target for the federal funds rate at this meeting.

Tuesday, March 18, 2008

Fed cuts rate 75 bps to 2.25%

by Calculated Risk on 3/18/2008 01:58:00 PM

The Federal Open Market Committee decided today to lower its target for the federal funds rate 75 basis points to 2-1/4 percent.

Recent information indicates that the outlook for economic activity has weakened further. Growth in consumer spending has slowed and labor markets have softened. Financial markets remain under considerable stress, and the tightening of credit conditions and the deepening of the housing contraction are likely to weigh on economic growth over the next few quarters.

Inflation has been elevated, and some indicators of inflation expectations have risen. The Committee expects inflation to moderate in coming quarters, reflecting a projected leveling-out of energy and other commodity prices and an easing of pressures on resource utilization. Still, uncertainty about the inflation outlook has increased. It will be necessary to continue to monitor inflation developments carefully.

Today’s policy action, combined with those taken earlier, including measures to foster market liquidity, should help to promote moderate growth over time and to mitigate the risks to economic activity. However, downside risks to growth remain. The Committee will act in a timely manner as needed to promote sustainable economic growth and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; Timothy F. Geithner, Vice Chairman; Donald L. Kohn; Randall S. Kroszner; Frederic S. Mishkin; Sandra Pianalto; Gary H. Stern; and Kevin M. Warsh. Voting against were Richard W. Fisher and Charles I. Plosser, who preferred less aggressive action at this meeting.

In a related action, the Board of Governors unanimously approved a 75-basis-point decrease in the discount rate to 2-1/2 percent. In taking this action, the Board approved the requests submitted by the Boards of Directors of the Federal Reserve Banks of Boston, New York, and San Francisco.

Monday, March 17, 2008

Is Bernanke Running out of Ammunition?

by Calculated Risk on 3/17/2008 11:42:00 PM

From Bloomberg: Bernanke May Run Low on `Ammunition' for Loans, Rates (hat tip jsdg)

The Fed has committed as much as 60 percent of the $709 billion in Treasury securities on its balance sheet to providing liquidity and opened the door to more with yesterday's decision to become a lender of last resort for the biggest Wall Street dealers. The central bank has cut short-term rates by 2.25 percentage points since September and will probably reduce them again tomorrow.These are two separate issues. The Fed isn't constrained by their balance sheet; they can just keep on lending. My understanding is their balance sheet limits the amount of sterilized lending (non-inflationary); further lending would increase the money supply and be inflationary.

On interest rates, the Fed is clearly running out of ammunition, and the street is expecting another rate cut tomorrow of between 50 bps and 100 bps. This raises the question of a liquidity trap (see Krugman: How close are we to a liquidity trap?). For those that want to understand the Japanese experience, I recommend a series of articles written by Professor Krugman in the '90s (those with asterisks are technical for all you Econ UberNerds!)

OK, some people might be asking what is sterilization? Sterilization means intervention that does not increase the money supply, like exchanging treasuries for mortgage backed securities (MBS). Say a bank needs cash, it puts up MBS as collateral (the Fed doesn't actually swap ownership), and the Fed loans the bank treasuries (that they are holding on their balance sheet). The bank can sell the treasuries, and raise cash, but the money supply doesn't increase.