by Calculated Risk on 7/03/2008 09:09:00 AM

Thursday, July 03, 2008

Unemployment Claims Over 400K

First a correction: last week I mentioned that historically weekly claims increase after Congress passes an extension to unemployment insurance benefits. In the past, workers who had exhausted their benefits could reapply for extended benefits, and these workers were included in the first time claims report.

Although the above was true during previous downturns, the DOL BLS has apparently changed their methodology and the extended benefits are not included in first time claims anymore.

So the jump to 400K first time claims is not the result of Congress extending benefits (and it would be too soon anyway).

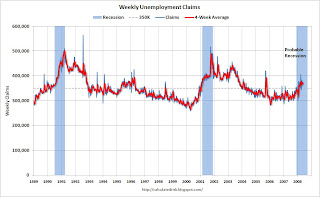

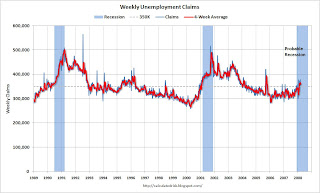

Here is the current report from the Department of Labor for the week ending June 28, showing initial unemployment claims increased to 404,000, and the 4-week moving average was 390,500. This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989.

This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989.

The four week moving average has been trending upwards for the last few months, and is now at 390,500 - solidly above the possible recession level (approximately 350K).

BLS: Employment Flat Year over Year

by Calculated Risk on 7/03/2008 08:41:00 AM

From the BLS: Employment Situation Summary

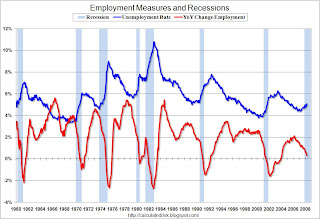

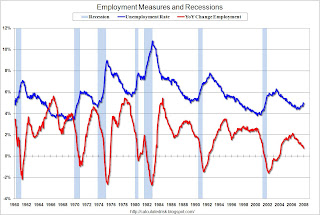

This graph shows the unemployment rate and the year-over-year change in employment vs. recessions. Click on graph for larger image.

Click on graph for larger image.

Although the unemployment rate was unchanged from last month, the rate has jumped sharply from a cycle low of 4.4% to 5.5%; a strong recession indicator.

The YoY change in employment is close to zero (the economy has added only 15 thousand jobs in the last year), also suggesting a recession.

The private sector (excluding government jobs) declined 242 thousand over the last year.

Note the current recession indicated on the graph is "probable", and is not official.

This is the sixth straight month of job losses.

Monday, June 30, 2008

Unemployment Benefits Extended

by Calculated Risk on 6/30/2008 12:05:00 PM

An extension of unemployment benefits for 13 weeks was included in the war funding bill signed by President Bush today.

This extension covers workers who used all their unemployment benefits between November 2006 and March 2009. As I noted last week, some of these people will reapply for benefits, probably pushing weekly claims over 400K per week once the benefits become available. (Typically an extension of benefits adds about 50K per week for about four weeks).

Extended benefits are not included in continued claims (there is a separate category), however continued claims will probably also get a small boost as some job seekers wait for better opportunities.

Although unemployed workers receive the direct benefit of this extension, this program (like all safety nets) is really aimed at employed workers worried about their jobs. Far more people are worried about losing their jobs than will actually be laid off in this downturn - and if all these people pull back sharply on their spending, then the layoffs might become a self fulfilling prophesy. This program helps reduce the financial fear for these workers.

Thursday, June 26, 2008

Claims: The Impact of Unemployment Benefits Extension

by Calculated Risk on 6/26/2008 08:30:00 AM

It now appears like that Congress will extend unemployment insurance benefits from 26 weeks to 39 weeks. How will this impact the Weekly Claims data?

First, weekly claims typically get a short term bounce with an unemployment benefit extension as some workers refile for claims. This will probably add 50K per week to claims for several weeks (pushing claims solidly above 400K).

Extended benefits are not included in continued claims (there is a separate category), however continued claims will probably also get a small boost as some job seekers wait for better opportunities.

Just a couple of points to remember when claims get a boost - probably as soon as next month. Of course weekly claims are already rising, even before the extended benefits become available, indicating a weakening labor market.

Here is the current report from the Department of Labor for the week ending June 21, showing initial unemployment claims increased to 384,000, and the 4-week moving average was 378,250. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the continued claims since 1989.

Continued claims increased this week to 3,139,000, an increase of 82,000 from the preceding week.

Notice that following the previous two recessions, continued claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable). The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Thursday, June 19, 2008

Weekly Unemployment Claims

by Calculated Risk on 6/19/2008 09:02:00 AM

Here is another look at unemployment claims. According to the Department of Labor for the week ending June 14, initial unemployment claims were at 381,000, and the 4-week moving average was 375,250. Click on graph for larger image in new window.

Click on graph for larger image in new window.

The first graph shows the continued claims since 1989.

Continued claims declined this week, but have been trending higher and are still above the 3 million level.

Notice that following the previous two recessions, continued claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable). The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Friday, June 06, 2008

Jobs: Unemployment Rate Jumps to 5.5%

by Calculated Risk on 6/06/2008 08:43:00 AM

From the BLS: Employment Situation Summary

The unemployment rate rose from 5.0 to 5.5 percent in May, and nonfarm payroll employment continued to trend down (-49,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. In May, employment continued to fall in construction, manufacturing, retail trade, and temporary help services, while health care continued to add jobs.The first graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Click on graph for larger image.

Click on graph for larger image.Unemployment jumped sharply and the rise in unemployment, from a cycle low of 4.4% to 5.5%, is a strong recession indicator.

Also concerning is the YoY change in employment is close to zero (the economy has added only 236 thousand jobs in the last year), also suggesting a recession.

Note the current recession indicated on the graph is "probable", and is not official.

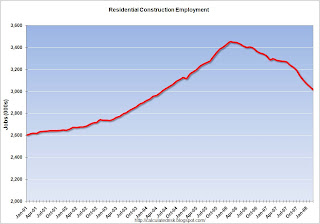

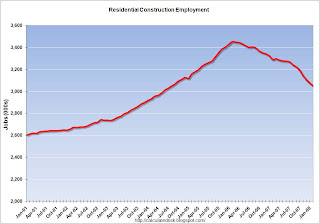

The second graph shows residential construction employment.

Note: graph doesn't start at zero to better show the change.

Note: graph doesn't start at zero to better show the change.Residential construction employment declined 25,100 in May, and including revisions to previous months, is down 494 thousand, or about 14.3%, from the peak in February 2006. (compared to housing starts off over 50%).

This is the fifth straight month of job losses. This is a weak report, and the jump in unemployment strongly suggests a recession.

Thursday, May 29, 2008

Continued Unemployment Claims Continue to Rise

by Calculated Risk on 5/29/2008 10:08:00 AM

Earlier this month, continued unemployment claims exceeded 3 million for the first time in four years. Now the continued claims have passed 3.1 million (see first graph).

Here is the data from the Department of Labor for the week ending May 24th. Click on graph for larger image.

Click on graph for larger image.

The first graph shows the continued claims since 1989.

Clearly people losing their jobs are having difficulty finding new jobs.

Notice that following the previous two recessions, continued claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable). The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

The second graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy is in recession.

Thursday, May 08, 2008

Northern Trust on Continuing Claims

by Calculated Risk on 5/08/2008 08:15:00 PM

Asha Bangalore at Northern Trust presented a great chart today on continuing unemployment claims. Click on graph for larger image.

Click on graph for larger image.

This morning I noted that continuing claims had reached the 3 million level for the first time in four years.

This graph shows the increase in both initial claims and continuing claims.

Bangalore also presents a graph on the relationship between the Fed's Senior Loan Survey and GDP. This is similar to the research paper I excerpted from yesterday (see: The Impact of Tighter Credit Standards on Lending and Output), and suggests that the economy will slow over the next few quarters.

Weekly Unemployment Claims: Continuing Claims at 3 Million

by Calculated Risk on 5/08/2008 09:47:00 AM

Here is our monthly look at unemployment claims. Note that continuing claims has now reached a four-year high of 3 million.

From the Department of Labor:

In the week ending May 3, the advance figure for seasonally adjusted initial claims was 365,000, a decrease of 18,000 from the previous week's revised figure of 383,000. The 4-week moving average was 367,000, an increase of 2,500 from the previous week's revised average of 364,500.

...

The advance number for seasonally adjusted insured unemployment during the week ending April 26 was 3,020,000, a decrease of 10,000 from the preceding week's revised level of 3,030,000. The 4-week moving average was 2,998,750, an increase of 16,750 from the preceding week's revised average of 2,982,000.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy is in recession. Notice that following the previous two recessions, weekly unemployment claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable).

Note: There is nothing magical about the 350K level. We don't need to adjust for population growth because this indicator is just suggestive and not precise.

Friday, May 02, 2008

Jobs: Nonfarm Payrolls Decline 20,000

by Calculated Risk on 5/02/2008 08:44:00 AM

From the BLS: Employment Situation Summary

Nonfarm payroll employment was little changed in April (-20,000), following job losses that totaled 240,000 in the first 3 months of the year, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The unemployment rate, at 5.0 percent, also was little changed in April. Employment continued to decline in construction, manufacturing, and retail trade, while jobs were added in health care and in professional and technical services.The first graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Click on graph for larger image.

Click on graph for larger image.Unemployment was essentially unchanged, but the rise in unemployment, from a cycle low of 4.4% to 5.0% is a recession warning.

Also concerning is the YoY change in employment is barely positive (the economy has added only 460 thousand jobs in the last year), also suggesting a recession.

Note the current recession indicated on the graph is "probable", and is not official.

The second graph shows residential construction employment.

Note: graph doesn't start at zero to better show the change.

Note: graph doesn't start at zero to better show the change.Residential construction employment declined 31,100 in April, and including downward revisions to previous months, is down 478 thousand, or about 13.8%, from the peak in February 2006. (compared to housing starts off over 50%).

This is the fourth straight month of job losses.

Friday, April 04, 2008

Jobs: Nonfarm Payrolls Decline 80,000 in March

by Calculated Risk on 4/04/2008 08:40:00 AM

From the BLS: Employment Situation Summary

The unemployment rate rose from 4.8 to 5.1 percent in March, and nonfarm payroll employment continued to trend down (-80,000), the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Over the past 3 months, payroll employment has declined by 232,000.

Click on graph for larger image.

Click on graph for larger image.Note: graph doesn't start at zero to better show the change.

Residential construction employment declined 31,000 in March, and including downward revisions to previous months, is down 442.9 thousand, or about 12.8%, from the peak in February 2006. (compared to housing starts off over 50%).

The second graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Unemployment was higher, and the rise in unemployment, from a cycle low of 4.4% to 5.1% is a recession warning.

Also concerning is the YoY change in employment is barely positive (the economy has added just over 500 thousand jobs in the last year), also suggesting a recession.

The WSJ reports: Economy Shed Jobs in March, Fueling Fears of Recession

Nonfarm payrolls fell 80,000 in March, the Labor Department said Friday, its biggest decline in five years, after falling by 76,000 in both January and February. Both were revised to show even bigger losses.Overall this is a very weak report.

Had it not been for a rise in government jobs last month, payrolls would have fallen by around 100,000.

Thursday, April 03, 2008

Weekly Unemployment Claims Indicate Probable Recession

by Calculated Risk on 4/03/2008 10:21:00 AM

The 4-week moving average of weekly unemployment insurance claims reached 374,500 this week.

From the Department of Labor:

In the week ending March 29, the advance figure for seasonally adjusted initial claims was 407,000, an increase of 38,000 from the previous week's revised figure of 369,000. The 4-week moving average was 374,500, an increase of 15,750 from the previous week's revised average of 358,750.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now solidly above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy is in recession. Notice that following the previous two recessions, weekly unemployment claims stayed elevated for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable).

Note: There is nothing magical about the 350K level. We don't need to adjust for population growth because this indicator is just suggestive and not precise.

Thursday, March 20, 2008

Weekly Unemployment Claims

by Calculated Risk on 3/20/2008 08:49:00 AM

The 4-week moving average of weekly unemployment insurance claims reached 365,250 this week.

From the Department of Labor:

In the week ending March 15, the advance figure for seasonally adjusted initial claims was 378,000, an increase of 22,000 from the previous week's revised figure of 356,000. The 4-week moving average was 365,250, an increase of 6,000 from the previous week's revised average of 359,250.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy might be in recession. Notice that following the previous two recessions, weekly unemployment claims stayed high for a couple of years after the official recession ended - suggesting the weakness in the labor market lingered. The same will probably be true for the current recession (probable).

Note: There is nothing magical about the 350K level. We don't need to adjust for population growth because this indicator is just suggestive and not precise.

Friday, March 07, 2008

Jobs: Nonfarm Payrolls Decline 63,000 in February

by Calculated Risk on 3/07/2008 08:39:00 AM

From the BLS: Employment Situation Summary

Nonfarm payroll employment edged down in February (-63,000), and the unemployment rate was essentially unchanged at 4.8 percent, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. Employment fell in manufacturing, construction, and retail trade. Job growth continued in health care and in food services.

Click on graph for larger image.

Click on graph for larger image.Residential construction employment declined 25,700 in February, and including downward revisions to previous months, is down 407.1 thousand, or about 11.8%, from the peak in February 2006. (compared to housing starts off over 50%).

The second graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Although unemployment was slightly lower - as people leave the workforce - the rise in unemployment, from a cycle low of 4.4% to 4.8% is a recession warning.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Overall this is a weak report.

Sunday, March 02, 2008

TrimTabs: Job Losses in February

by Calculated Risk on 3/02/2008 11:31:00 AM

Gretchen Morgenson at the NY Times provides us with some employment data from TrimTabs: The Buck Has Stopped

TRIMTABS, which estimates employment growth using data from an online job index and an analysis of income tax withheld versus job creation rates, has been far more accurate than the Bureau of Labor Statistics. For example, in 2006, the government’s initial estimates of employment growth came in at 1.52 million jobs. But the bureau revised that data upward in February 2007, for a total of 2.24 million.I don't know about the accuracy of the real time TrimTab estimates, but this reminds us that the BLS methodology is subject to signficant revisions (that might be lagged by a year), and that the BLS will almost certainly miss any turning point.

By comparison, TrimTabs’ estimates of 2006 employment growth, using real-time data, totaled 2.39 million jobs. The firm reported those figures to clients contemporaneously.

Last week, TrimTabs told clients it estimated that 77,000 jobs would be lost in February; Wall Street economists are calling for a gain of 30,000 for the month.

Since October 2007, TrimTabs estimates, the economy has lost about 175,000 jobs, the first sustained employment drop since early 2003.

The BLS had acknowledged this weakness:

The most significant potential drawback ... is that time series modeling assumes a predictable continuation of historical patterns and relationships and therefore is likely to have some difficulty producing reliable estimates at economic turning points or during periods when there are sudden changes in trend.This is something to think about for those that argue - because the BLS employment numbers haen't been consistently negative - the economy isn't in recession yet. Just wait for the revisions.

And on recessions, the NY Times reports in "A Rerun, Maybe, but of What Show?" that Citigroup's Tobias Levkovich and Byron Wien of Pequot Capital are also predicting a recession. Welcome to the dark side.

Thursday, February 21, 2008

Weekly Unemployment Claims

by Calculated Risk on 2/21/2008 08:58:00 AM

The 4-week moving average of weekly unemployment insurance claims reached 360,500 this week, indicating a possible recession.

From the Department of Labor:

In the week ending Feb.16, the advance figure for seasonally adjusted initial claims was 349,000, a decrease of 9,000 from the previous week's revised figure of 358,000. The 4-week moving average was 360,500, an increase of 10,750 from the previous week's revised average of 349,750.

Click on graph for larger image.

Click on graph for larger image.This graph shows the weekly claims and the four week moving average of weekly unemployment claims since 1989. The four week moving average has been trending upwards for the last few months, and the level is now above the possible recession level (approximately 350K).

Labor related gauges are at best coincident indicators, and this indicator suggests the economy might be in recession.

Note: There is nothing magical about the 350K level. We don't need to adjust for population growth because this indicator is just suggestive and not precise.

Friday, February 08, 2008

Recession: Impact on Employment

by Calculated Risk on 2/08/2008 06:35:00 PM

John Schmitt and Dean Baker at CEPR released a new report on the possible impact of the recession: What We’re In For, Projected Economic Impact of the Next Recession (hat tip risk capital)

If the next recession follows the pattern set by the three most recent downturns, a recession in 2008 would raise the national unemployment rate by between 2.1 (a mild-to-moderate recession) and 3.8 percentage points (a severe recession along the lines of the early 1980s), increasing the number of unemployed Americans by between 3.2 million and 5.8 million.This raises a key point: the severity of an economic downturn can be measured in how high the unemployment rate rises. I've argued several times that the current slowdown will not be severe, with severe being defined as an unemployment rate above 8%.

Following Schmitt and Baker, and using the cycle unemployment rate low of 4.4%, the unemployment rate would rise to 6.5% for a mild-to-moderate recession, and to 8.2% for a severe recession.

Click on graph for larger image.

Click on graph for larger image. This first graph shows the unemployment rate and the number of unemployed workers since 1969. The two curves clearly move together, although with a growing population, the same number of unemployed workers now gives a lower unemployment rate than in earlier periods.

During an economic slowdown, some potential workers don't seek work (whether by choice or circumstances), so the participation rate falls too. This makes forecasting the rise in unemployed workers, using a given unemployment rate, a little tricky.

By my calculation, an increase in the unemployment rate to 8.2%, would give about 12.8 million unemployed workers, or an increase of 5.2 million from today. For a mild-to-moderate recession, with an increase in the unemployment rate to 6.5%, the number of unemployed workers would rise by 2.6 million to 10.2 million.

Based on the size of the current credit and solvency problems, in relation to the $14 trillion U.S. economy, I think a less than severe recession is most likely (less than 8% unemployment at the peak). A severe recession is still possible, as San Francisco Fed President Janet Yellen noted today:

"[W]e can’t rule out the possibility of getting into an adverse feedback loop—that is, the slowing economy weakens financial markets, which induces greater caution by lenders, households, and firms, and which feeds back to even more weakness in economic activity and more caution."To predict a severe recession, we need to forecast the number of unemployed workers rising by 5 million or more. Right now I don't see this happening. Here is why:

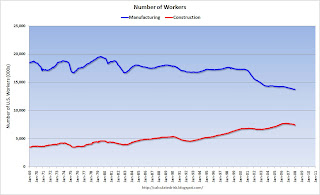

The second graph shows the number of workers employed in construction and manufacturing in the U.S. In previous severe recessions, there were a large number of manufacturing jobs lost. However, the number of manufacturing jobs has been declining steadily (not a news flash) and never recovered following the 2001 investment led recession.

The second graph shows the number of workers employed in construction and manufacturing in the U.S. In previous severe recessions, there were a large number of manufacturing jobs lost. However, the number of manufacturing jobs has been declining steadily (not a news flash) and never recovered following the 2001 investment led recession. Another way to look at construction and manufacturing employment is as a percent of the total civilian workforce.

We all expect construction employment to fall, but even a decline to the previous low (3.6% of the total workforce), would only result in the loss of 1.9 million construction jobs.

We all expect construction employment to fall, but even a decline to the previous low (3.6% of the total workforce), would only result in the loss of 1.9 million construction jobs. For the recession to be "severe", another 3+ million unemployed workers would have to come from financial, retail, manufacturing and other areas. Right now this seems unlikely to me.

Friday, February 01, 2008

Jobs: Nonfarm payrolls fell 17,000 in January

by Calculated Risk on 2/01/2008 09:40:00 AM

From the BLS: Employment Situation Summary

Both nonfarm payroll employment, at 138.1 million, and the unemployment rate, at 4.9 percent, were essentially unchanged in January, the Bureau of Labor Statistics of the U.S. Department of Labor reported today. The small January movement in nonfarm payroll employment (-17,000) reflected declines in construction and manufacturing and job growth in health care.

Click on graph for larger image.

Click on graph for larger image.Residential construction employment declined 28,100 in December, and including downward revisions to previous months, is down 375.3 thousand, or about 10.9%, from the peak in February 2006. (compared to housing starts off about 50%).

The second graph shows the unemployment rate and the year-over-year change in employment vs. recessions.

Although unemployment was slightly lower, the rise in unemployment, from a cycle low of 4.4% to 4.9% is a recession warning.

Also concerning is the YoY change in employment is less than 1%, also suggesting a recession.

Overall this is a very weak report, especially including the downward revisions to prior months (although December was revised up).

Friday, January 18, 2008

Employment-Population Ratio and Recessions

by Calculated Risk on 1/18/2008 01:02:00 AM

In his testimony to Congress, Chairman Bernanke argued that any fiscal stimulus package be structured to impact spending within the next twelve months, otherwise the economy would probably already be improving:

"To be useful, a fiscal stimulus package should be implemented quickly and structured so that its effects on aggregate spending are felt as much as possible within the next twelve months or so. Stimulus that comes too late will not help support economic activity in the near term, and it could be actively destabilizing if it comes at a time when growth is already improving."Professor Krugman writes Not so fast:

One assumption in Ben Bernanke’s testimony today was that if a recession happens, it will be over soon, so stimulus has to come fast or not at all. It’s by no means clear that this is right. ... both recent history and the nature of our current problem suggest that we may be in for more than a few bad months.Krugman plots the employment-population ratio, and argues that if this slowdown is like the previous two recessions, employment growth will be sluggish even after the official recession is over. Here is a long term graph of the employment-population ratio with recessions added:

Click on graph for larger image.

Click on graph for larger image.Note that the scale doesn't start at zero to better show the changes in the population ratio.

First, there has been a steady trend of a rising employment-population ratio since 1960. This is mostly due to more women joining the work force. It is very possible that this underlying trend is now flat, or even declining slightly, as the baby boomers start to leave the work force.

The waves on the long term trend are related to economic expansions and slowdowns. Historically the employment-population ratio bottomed out soon after a recession ended. However for the two most recent recessions, the employment-population ratio continued to decline, even after the recession ended.

After the 2001 recession, the ratio declined until almost September 2003, and for many people it seemed like the recession lingered for a couple of years. For the current slowdown (probable recession), the employment-population ratio has been declining for a year, and this is probably part of the reason so many people feel the economy has been in a recession for some time.

I suspect that even if the official recession is not severe (less than 8% unemployment and shorter than 12 months in duration), the employment effects will, once again, linger for some time.

Thursday, January 10, 2008

Fed Funds Probabilities: 50 bps in January

by Calculated Risk on 1/10/2008 07:31:00 PM

Here is a graph of the Fed Funds rate, inflation (as measured by Cleveland Fed median CPI), and the unemployment rate since 1990. Click on graph for larger image.

Click on graph for larger image.

The inflation rate is the Cleveland Fed median CPI and is a year-over-year rate - so it is a lagged series.

It's not unusual for the YoY inflation rate to be rising as the Fed cuts rates. Usually, as the economy weakens, the inflation rate will fall. That is the current expectation of the Fed.

Note: The graphs shows the Fed Funds rate at 3.75% at the end of January; that is what the market expects following Chairman Bernanke's speech this morning.

Source: Cleveland Fed, Fed Funds Rate Predictions

The market expectations are now solidly for a 50 bps rate cut on January 30th.