by Calculated Risk on 12/01/2008 09:16:00 AM

Monday, December 01, 2008

Whitney: Credit Card Consumer Liquidity to Decline by 45%

Note: I'll post a compendium of Tanta's posts soon, plus a charity of her choosing. The services will be private.

From Reuters: Credit card industry may cut $2 trillion of lines: analyst

The U.S. credit card industry may pull back well over $2 trillion of lines over the next 18 months due to risk aversion and regulatory changes, leading to sharp declines in consumer spending, prominent banking analyst Meredith Whitney said.This would be a stunning reduction in available credit.

...

"In other words, we expect available consumer liquidity in the form or credit-card lines to decline by 45 percent."

Saturday, November 01, 2008

Citigroup: $1.4 Billion in Losses from Credit Card Securitization

by Calculated Risk on 11/01/2008 11:42:00 AM

From the Citigroup 10-Q filed with the SEC on Oct 31st (hat tip Ray):

In the third quarters of 2008 and 2007, the Company recorded net gains (losses) from securitization of credit card receivables of ($1,443) million and $169 million, and ($1,398) million and $747 million during the first nine months of 2008 and 2007, respectively.And Citigroup on Credit Reserves:

The $2.3 billion build in North America Consumer primarily reflected a weakening of leading credit indicators, including higher delinquencies on first mortgages, unsecured personal loans, credit cards and auto loans. Reserves also increased due to trends in the U.S. macroeconomic environment, including the housing market downturn and rising unemployment rates.It is more than just possible that loss rates will exceed their historical peaks during the current recession - it appears highly probable.

...

As the environment for consumer credit continues to deteriorate, the Company has taken many actions to manage risks such as tightening underwriting criteria and reducing credit lines. However, credit card losses may continue to rise well into 2009, and it is possible that the Company's loss rates may exceed their historical peaks.

emphasis added

Click on graph for larger image.

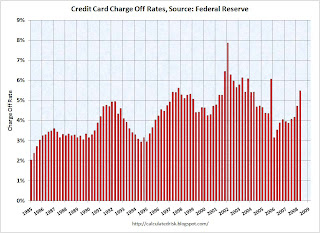

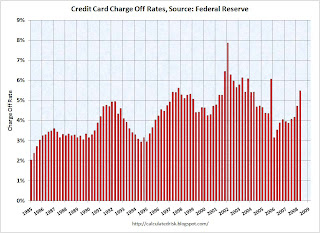

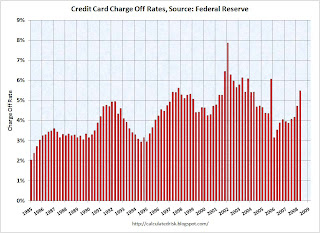

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985. The Federal Reserve reported that the credit card charge-off rate was 5.47% at the end of Q2.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed. Q3 data will be released soon.

Tuesday, October 28, 2008

NY Times: Lenders Begin to Curb Credit Cards

by Calculated Risk on 10/28/2008 10:42:00 PM

From Eric Dash at the NY Times: As Economy Slows, Lenders Begin to Curb Credit Cards

Lenders wrote off an estimated $21 billion in bad credit card loans in the first half of 2008 as more borrowers defaulted on their payments. With companies laying off tens of thousands of workers, the industry stands to lose at least another $55 billion over the next year and a half, analysts say. Currently, the total losses amount to 5.5 percent of credit card debt outstanding, and could surpass the 7.9 percent level reached after the technology bubble burst in 2001.

“If unemployment continues to increase, credit card net charge-offs could exceed historical norms,” Gary L. Crittenden, Citigroup’s chief financial officer, said.

Click on graph for larger image.

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed and a new record will probably set during this recession.

To add to the story, here is a comment from the Capital One conference call two weeks ago:

We have tightened underwriting standards across the boar. In our US card business we have gotten more conservative. We have begun to reduce credit lines. We have continued to tweak our underwriting models and to the recalibrate models this may be unstable. We have adapted our models and approaches as the economic environment has changed and we are intervening judgmentally even more than our models would indicate.No Home ATM. No credit cards. What is a debt addicted U.S. consumer to do?

Wednesday, October 22, 2008

WSJ: Banks may see record credit card losses

by Calculated Risk on 10/22/2008 07:41:00 PM

From David Reilly at the WSJ Heard on the Street: Credit Card Losses May Scale New Peak

... A broader range of consumers now carry cards, and many run consistent credit balances to fund their lifestyles. This has led to successively higher peaks over the years in credit card charge-off rates.The Federal Reserve reported that the credit card charge-off rate was 5.47% at the end of Q2. As Reilly notes, third quarter data hasn't been released yet, but will certainly be higher based on reports from financial institutions:

The danger is that the current financial downturn results in a new, far-higher peak charge-off rate that leads to unexpectedly large losses at banks and other card issuers.

American Express said on its earnings call Monday that its loss rate had increased to 6.1% in September, compared with 5.9% for the quarter overall, and that it expected losses to grow to the end of the year. J.P. Morgan, meanwhile, forecast that its credit card loss rate could climb to 7% by the end of 2009, compared with about 5% in the third quarter.

Click on graph for larger image.

Click on graph for larger image.This graph shows the consumer credit card charge-off rate by quarter starting with 1985.

Note the spike in 2005 was because of the change to the bankruptcy law (Bankruptcy Abuse Prevention and Consumer Protection Act of 2005).

The record charge-off rate was 7.85% in Q1 2002 according to the Fed.

It seems reasonable to expect at or near record credit card charge-off rates during this recession.

Thursday, October 16, 2008

Capital One Conference Call: Downturn "extended and long"

by Calculated Risk on 10/16/2008 06:26:00 PM

Comments about credit cards

We have tightened underwriting standards across the boar. In our US card business we have gotten more conservative. We have begun to reduce credit lines. We have continued to tweak our underwriting models and to the recalibrate models this may be unstable. We have adapted our models and approaches as the economic environment has changed and we are intervening judgmentally even more than our models would indicate.Auto Loan Business

We repositioned our auto business at the beginning of the year. We pulled back on origination and we are shrinking the book of loans and originations. We have leveraged pricing and shrinking competitive supply and we [continue] to aggressively manage operating costs. Originations for the second quarter were $1.4 billion, down 56% from the third quarter of 2007. We are on track for auto loan originations for the full year of 2008 to be at least 45% lower than 2007 origination. The total auto loan portfolio shrink by $2.8 billion year-to-date. Dealer customers, the credit characteristics of new originations continue to improve as evidence by rising average FICO scores, and improving and encouraging early delinquency performance of our 2008 origination vintages. We have been able to maintain pricing power while improving the credit characteristics of new originations. Expected seasonal increases in charge offs will put significant pressure on profitability for the remainder of 2008. The continuing pressure from the seasoning of 2006 and 2007 vintages and broader cyclical economic challenges are likely to be a drag on results throughout 2009 and the continuing decline in loan balances will impact the optics, for example declining loan balances would reduce the denominator like charge offs, and operating expenses as a percentage of loans [the 30 day DQ rate increased to 9.3% from 7.6% from last quarter]Q&A:

Analyst

[Are you inclined to get more aggressive here in pursuing new business?]

Capital One

It is very clear in all of our markets competition is easing in some places, there's more pricing power. We can be more selective et cetera… what holds us back has nothing to do with frankly either capital or liquidity at the moment with respect to originations. It really is - the elephant in the living room is about the economy. From our experience over 20 years of doing this, our [conclusion] is that the assets originated as economy is getting worse tend to have more adverse characteristics than assets at other times. The one thing I would say, though, is everything I said relates to our origination strategy. I think with respect to acquisitions, acquisitions of seasoned businesses and portfolios, distressed sales of those in this environment can in fact be exceptionally profitable. So our capital raise and our kind of looking out on the horizon at the moment is related to acquisition benefits.

Analyst

My follow up question just on the incremental trends in consumer spending, the spending on your cards were flat year-over-year and I just wondered if you could giver a little color into what you have seen September, October trends year-over-year spending patterns of consumer, how much have they worsened?

Capital One

…the right way to look at it on our portfolio is purchases per account. I think it is 4 something percent, but it is just a little bit below the overall growth in purchases that has happened in the industry. We have, everything that we have seen recently has been a mirror of what you see out there in the economy. But, the window we see into the consumer is almost exactly what you see on the outside and all of the public metrics.

Analyst

it just seems like we are just starting to feel the impact of the weakening employment environment. Where do you see charge offs peaking in '09 if you had to guess today?

NEW SPEAKER

First of all, the way we create this outlook is that we base it on a couple of models. One model is a model built on the last downturn, unemployment is the key driver there, and then another model we built in this downturn which not surprisingly, the big driver of a credit worsening is changes in home prices. So, so what we do in our process we go out and we look at kind of consensus estimates for the macro economic variables... The economic outlook assume in the outlook that Gary talked about is unemployment around 7% by mid 2009, and a nationwide peak to trough home price decline of 25%. Although I don't want to get too literal with that… there are so many new things associated with each downturn….. what we share with you is an outlook that we are managing the company to - an underlying assumption [the downturn] is going to be extended and long.

Tuesday, August 12, 2008

Fed: Banks Tighten Consumer Lending

by Calculated Risk on 8/12/2008 10:30:00 AM

This was released yesterday, but this chart is worth posting. Click on table for larger image in new window.

Click on table for larger image in new window.

The Home ATM is drying up. And now lending standards are being tightened for credit cards and other consumer loans.

From the Fed:

About 65 percent of domestic banks—up notably from about 30 percent in the April survey—indicated that they had tightened their lending standards on credit card loans over the past three months, and about the same fraction of respondents—up from roughly 45 percent in the April survey—reported having tightened standards on consumer loans other than credit card loans. In addition, considerable fractions of respondents reported having increased minimum required credit scores on both types of consumer loans and reduced the extent to which such loans were granted to customers who did not meet their bank’s credit-scoring thresholds. Finally, large net fractions of banks noted that they had lowered credit limits on credit card accounts over the past three months, and increased interest rate spreads on consumer loans other than credit card loans. On balance, about 35 percent of domestic banks—up from roughly 25 percent in the April survey—expressed a diminished willingness to make consumer installment loans relative to three months earlier. Regarding loan demand, about 30 percent of respondents, on net, indicated that they had experienced weaker demand for consumer loans of all types over the past three months, up from about 20 percent in the April survey.

Monday, August 04, 2008

Credit Card Bond Market Struggles

by Calculated Risk on 8/04/2008 10:30:00 PM

From the WSJ: Credit-Card Bonds Fight A Tougher Debt Market

Investors are growing wary of bonds backed by credit-card payments, jamming up another debt market ... Rising defaults on credit-card payments, coupled with a bleaker economic outlook, are spooking investors ... with risk premiums on ... deals widening by as much as 0.10 to 0.25 percentage point in the past month.Banks had already started tightening lending standards (see figure 4 panel 1 of May Fed Loan Officer Survey) on credit cards during the first half of 2008, but this probably means higher rates and even tighter lending standards.

The July survey of loan officers will be released soon (usually a few days after the Fed meeting). It will be interesting to see if more banks are tightening standards on credit cards.

Thursday, July 17, 2008

Capital One: Negative on Economic Outlook

by Calculated Risk on 7/17/2008 06:00:00 PM

Conference Call: (hat tip Brian) all emphasis added

Comments on the economy:

“While these credit metrics reflect modest credit pressure in the second quarter, there was a more pronounced deterioration in economic indicators. We assume this will translate into additional credit pressure in future quarters causing us to increase our [provisions for losses] in the second quarter. You may recall that we began tightening our under writing in the fourth quarter of 2007. You can see the affects of this tightening in our loan growth in quarter. Managed loans declined $800 million as we have been more selective in originating new loans. We have been focused on those business segments with [stronger profitability]”Outlook for charges in the card business:

“The managed charge off rate increased in the quarter consistent with the low 6% range of expectations we discussed a quarter ago. The increase in charge off rate resulted mostly from the continuing deterioration of the U.S. economic environment. We expect average offs in the third quarter to remain in the low 6% range and rise to about 7% in the fourth quarter. We expect charge offs to increase as a result of three factors. First, expected seasonal patterns would result in higher charge off levels in the fourth quarter, all else equal. Second, [ we see deterioration] in economic indicators. The impact of economic weakening is likely to be evident in our U.S. charge offs in the fourth quarter and finally the initial impacts of the payments [regulations] that I discussed last quarter are expected to begin in the fourth quarter”More bad news for the consumers looking for car loans:

“Looking beyond the second quarter our auto finance business continues to face challenges from the season of 2006 and 2007 originations and cyclical headwinds. Auto resale values are falling as a result of declining auto sales and the rapid shift in consumer preferences to more fuel efficient cars as gas prices continue to rise. To address these challenges we took aggressive steps to retrench and reposition our auto business last quarter... We are pulling back on originations and shrinking loans outstanding while improving the credit characteristics of the portfolio. We are leveraging pricing opportunities in the face of shrinking supply and we are reducing operating costs. Originations for the second quarter were $1.5 billion, 38% lower than the first quarter and 49% than a year ago. We expect auto loan originations for the full year of 2008 to be at least 40% lower than 2007 originations The total auto loan portfolio shrank by $1.7B to date.”

Monday, July 07, 2008

Late Payments on Credit Cards Increase Sharply for Small Businesses

by Calculated Risk on 7/07/2008 09:32:00 AM

From the WaPo: Small firms struggle to pay credit card debt

As credit standards loosened at the beginning of the decade, banks expanded their small-business credit card offerings. ... The result was a boom: Small businesses will charge 2 1/2 times more this year than when they ran up about $140 billion in 2002, according to estimates from TowerGroup, a financial service research and advisory firm.Just another sector were lending standards were too loose and are now being tightened. When a small business goes under - assuming the business was separated from the borrower's personal finances - the loss to the credit card lender is probably 100%.

But as the economy slowed, so did payments. Major small-business credit card issuers reported a sharp increase in late payments and bad debt over the last year.

...

Now credit card issuers are becoming more careful.

"The mantra before was bigger is better in the card business; now [issuers] are becoming much more risk-averse," said Brian Riley, research director for bank cards at TowerGroup. "Standards are getting tightened in line with the economy."

Tuesday, April 22, 2008

Target Credit Card Net Charge-Offs Rise to 8.1% Annual Rate

by Calculated Risk on 4/22/2008 10:15:00 PM

From Bloomberg: Target Writes Off 8.1% of March Credit-Card Loans

Target Corp., the second-largest U.S. discount chain, said it wrote off 8.1 percent of its credit-card loans in March as consumers grappled with job losses and the biggest housing slump in a quarter century.This is pretty ugly - especially the increase in the charge-off rate from 6.8% to 8.1% over one month (this is another company pointing to significant problems in March).

Defaults during the month totaled $55.5 million, the Minneapolis-based retailer said in a regulatory filing today. The charge-off rate was 6.8 percent in February.

Note: Target didn't write off 8.1 percent in March - that is the annual charge-off rate.

Wednesday, April 16, 2008

JPMorgan: Conference Call Comments

by Calculated Risk on 4/16/2008 12:53:00 PM

From the Q&A: (hat tip Brian)

No stabilization in home equity portfolio:

Analyst Question: Just a question on whether you're seeing anything that would give you some signs of stabilization of the loss and delinquency rates in the home equity portfolio?And on the deteriorating prime mortgage portfolio:

JPM: No, it's exactly what we saw, higher, more houses are going negative equity, roll rates are high, home prices we expect to still go down. We have not seen it.

Analyst: You talked a little bit about prime mortgage and that it's definitely getting worse. But I look at a 48 basis point charge-off ratio on and say that's pretty bad. From that as a base, how much worse do you envision it getting or could it get?And on Credit Card losses:

JPM: You know, first of all, the risk factors in prime mortgage are exactly the same as in elsewhere, which is negative home prices, high LTV, things like that, and you know, I think it will probably get a little bit worse and we probably owe you a better answer on that. We did not -- but it's hard in almost all these mortgage areas to say exactly what's going to happen to behavior. You can guess as well as we can what's going to happen to home prices. We expect it will go down another 7, 8, 9% in '08.

“Outlook, 4.5 to 5% full year losses trending higher as we get through the rest of the year and probably a little bit of an effect of slowing card spend which is what we've seen in the past couple of weeks.”How many companies - from GE to JPM - have said they saw a slowdown in March?

all emphasis added

Monday, April 14, 2008

Moody's: Credit Card Charge-Offs, Delinquency Rates Rise

by Calculated Risk on 4/14/2008 03:02:00 PM

From a Moody's Credit Card Credit Indices (via Dow Jones): Credit Card Charge-Off, Delinquency Rates Up In Feb (no link)

The charge-off rate climbed to 5.59% in February - the highest rate since December 2005 - from 4.51% a year earlier. That was the fifth consecutive monthly increase from the previous month and the 14th month in a row that the rate was higher than the year-earlier period.This is more evidence of consumer stress.

The February delinquency rate was 4.53%, the highest since March 2004. The delinquency rate, which was 3.89% a year earlier, measures the proportion of account balances for which a monthly payment is more than 30 days late as a percent of total balances.

...

The percentage of credit card balances being paid fell to 17.3% in February from 17.7% a year earlier. That was the sixth month in a row that the rate fell from the year-earlier period.

Monday, February 04, 2008

Credit Crunch and Credit Cards

by Calculated Risk on 2/04/2008 10:49:00 PM

Update: John Goodman at the NY Times reports on "a period of involuntary thrift".

... now the freewheeling days of credit and risk may have run their course — at least for a while and perhaps much longer — as a period of involuntary thrift unfolds in many households. With the number of jobs shrinking, housing prices falling and debt levels swelling, the same nation that pioneered the no-money-down mortgage suddenly confronts an unfamiliar imperative: more Americans must live within their means.The WSJ reports: Credit Cards Are Playing Harder to Get

Big card issuers such as Citigroup Inc. are requiring higher credit scores before issuing new cards, particularly in states that have been hit hard by the housing downturn, including California, Arizona and Florida. Some lenders, including Bank of America Corp., are offering lower initial credit lines. Other lenders, such as Capital One Financial Corp., are limiting credit-line increases or reducing credit lines for existing customers if they see signs that they are suddenly applying for more credit or are having trouble paying down their balances. ...I don't know - my mailbox has been of full of credit card offers recently.

Fewer applicants are being issued new cards: On average, credit-card approval rates have dropped to 32% of applicants from 40% a year ago ... This comes as issuers are doing fewer direct-mail solicitations to new customers. The number of such mailings fell about 16% ...

Click on graph for larger image.

Click on graph for larger image.This graph is from the Fed's Senior Loan Officer Opinion Survey on Bank Lending Practices and shows the net percentage of banks tightening lending standards for credit cards and other consumer loans.

So far standards are being tightened for other consumer loans more than credit cards. And, according to the Fed, tightening for consumer loans is minimal compared to the tightening for commercial real estate (CRE).

Saturday, February 02, 2008

UK: The Return of Negative Equity

by Calculated Risk on 2/02/2008 05:51:00 PM

From the Daily Mail: The return of negative equity:

Thousands Credit ratings agency Experian have drawn up a map showing which areas of the country are most at risk from a fall in prices.Negative equity limits mobility, prevents homeowners from selling, refinancing, or borrowing from their homes in case of an emergency. So it shouldn't be a surprise that negative equity is also highly correlated with foreclosures.

It found that in some parts of Britain, the average mortgage debt is more than 90 per cent of local property prices.

This leaves owners vulnerable to negative equity ...

The financial regulator, the Financial Services Authority, has warned tmore than a million families are in danger of losing their homes in the next 18 months.

Also in the UK, the WSJ reports: Citigroup Cuts Off Some U.K. Credit Cards

In a sign of more consumers losing access to loans, Citigroup Inc. has told some 161,000 credit-card customers in the U.K. that they can use their cards until the first week of March and then they'll no longer be able to tap the New York bank for credit.

Tuesday, January 22, 2008

BofA Conference Call

by Calculated Risk on 1/22/2008 10:33:00 AM

On CDOs:

“From a valuation and management standpoint, we've evolved towards a view that for many if not most of these structures will see terminations and therefore have looked through the securities to the net asset value support by the underlying securities. In these cases we utilized external pricing services consistent with our normal valuation processes. We priced over 70% of the exposure in this manner”Via MarketWatch:

CFO Joe Price also told listeners on a conference call Tuesday morning that the company marked down its value for CDOs and subprime loans to less than half their original value. "The combined subprime CDO sales and trading positions at 12/31 are carried at 600 million or about 30 cents on the dollar," Price said.Credit Cards:

“We have seen an increase in delinquency in our card portfolio in those states most affected by housing problems. So give you a little insight, the quarter-over-quarter rate of increase in 30-day plus delinquencies in the combined states of California , Florida , Arizona , and Nevada increased over five times the pace of the rest of the portfolio. That group makes up a little more than a quarter of our domestic consumer card book. We have mentioned before that we expect to be in the 5 to 5.5% range for overall consumer card losses for the full year of '08. That compares to the 4.75% we experienced in the fourth quarter”Home Equity:

“Home equity reported an increase in net charge-offs of 179 million or 63 basis points, up from 20 basis points at the end of September. 30-day plus performing delinquencies are up 25 basis points to 1.26%. Nonperformers in home equity rose to 1.25% of the portfolio from 82 basis points in the prior quarter. Even though our averaged refreshed FICO score remains strong at 721 and the combined loan to value is at 70%, we have seen a rise in the percentage of loan that is have a CLTV above 90% driven by the more recent vintaging. 90% plus CLTV currently represents 21% of the loans versus 17% in the third quarter. We believe net charge-offs in home equity will continue to rise given seasoning in the portfolio and softness in the real estate values. We increased reserves for this portfolio to 84 basis points but wouldn't be surprise to do see losses cross the 100 basis point mark by the middle of this year as we work through higher CLTV vintages. And relative to the industry's performance, we believe that our results will continue to benefit from our relationship base direct-to-consumer strategy. Again, continued economic deterioration could drive losses higher. Our residential mortgage portfolio continues to say perform well with losses at only 4 basis points in the fourth quarter. While we've seen some deterioration in subsegments, namely our community reinvestment act portfolio under our low to moderate income programs to total some 8% of the book, nothing really stands out to us at this point”On Countrywide (from MarketWatch): Bank of America sees Countrywide deal done in second half

Bank of America CEO Ken Lewis said Tuesday that the company expects to close its previously announced acquisition of mortgage giant Countrywide Financial in the second half of 2008.

Tuesday, January 15, 2008

Citi Dividend, Future Prospects and Credit Cards

by Calculated Risk on 1/15/2008 12:00:00 PM

There comments are very telling about the future return on capital, and possible additional shocks. (all emphasis added). Also see the comments on tightening credit card standards, evaluating current customers and the trade-offs between HELOCs and credit cards.

From the Citi conference call:

“The dividend reduction reflects the approximate sizing of our dividend relative to our growth opportunities and the volatility of each of our businesses. After a careful analysis of our businesses, given the normal risk that we have on an ongoing basis, we were faced with two choices -- either increase the excess capital that we carried permanently to reflect the ongoing exposures of the Company or better align our payout ratio so as to be able to restore our targeted capital ratios in a reasonable timeframe after a capital-reducing event. We recommended a dividend policy change to the Board alongside the capital raise and they approved this change yesterday. When the Company returns to a more normalized level of earnings generation and capital ratios, we have the flexibility to supplement the dividend with share repurchases.”And from the Q&A:

Richard Bove, Punk Ziegel:And the following exchange on consumer credit cards:

The second question would relate to the cash flow indication that you just mentioned and that is, to my knowledge, the $26 billion that has been taken either in write-downs or in loan loss provision are all non-cash charges. I think I heard it said that the equity raises will put the relevant ratios above what they were targeted to be let's say three months ago. Given the fact that there is no significant cash charge here, given the fact that the Company is going to wind up with perhaps some excess capital, I find it difficult to understand why you would cut the dividend. In addition, since by cutting the dividend, you have knocked, at least today, $5 billion off the value of the stock, I am wondering where do the shareholders show up in this whole calculation? You've lost 40% of his dividend, his stock price is down $5 billion in value, and from what I think I heard you say, if there is no prospect of the dividend going back up again, there is going to be share repurchases as opposed to replacing the dividend. So how does the stockholder benefit by this?

Gary Crittenden, Citi CFO:

Let me talk first of all, Dick, about the way we have thought about the dividend and just give you a little bit more color around that. So if you took the kind of a normalized situation -- so if you go back over the last few years and we have had say a $20 billion earnings level and you assumed a 55% payout ratio or something like that, that gave you 45% of that capital essentially to allow the business to grow and to take care of any shocks that might happen in the system assuming that we ran the Company right at the kind of targeted ratios that we have, right at 6.5% in TCE and 7.5% in terms of our tier one ratio. That is basically the assumption that you made. That essentially, even under that scenario, gives you relatively little capital to rebuild your capital in the event of a shock scenario and obviously one of the things that I have to, as part of my job, think about all the time is what is the implications of the Company of having a shock scenario happen and we have just experienced one of those. We have just been through that and we have obviously taken the charge associated with that in this quarter. And that kind of an event could happen at some point down the road. If it did happen at some point down the road, the proper way I think to manage this would be to do one of two things -- either to hold significant additional excess capital -- so even in the event of a shock, you are able to recover relatively quickly -- or alternatively, to reduce the payout ratio that would reflect what you believe the growth prospects of the business and the inherent exposures of the Company to be. Those are kind of the opposing trade-offs that we have as an organization and having thought through very carefully the amount of excess capital that we would need to hold the return on capital implications associated with that and looked at the trade-off of that relative to the payout ratio given the businesses that we are in and the inherent volatility that we think exists in those businesses, we tried to make the right long-term decision. So this was not a -- this decision was not made for the next quarter or the quarter after that. It was a recommendation that we made looking forward overtime, trying to consider the growth prospects of the Company and as I say, the inherent exposures that the Company has and with an eye towards trying to maximize the return on equity that we can provide back to our shareholders. And all of that kind of taken together really reinforced the decision that we made around the dividend. Now there is no doubt that this is a short-term difficult decision for us, but we felt, in the context of the uncertainty that exists in the environment, as well as the growth opportunities that exist in front of us, that both the capital raise made a lot of sense for us, as well as a dividend policy that positions us appropriately to rebound in the event of an exposure event down the road.

Bove:

A final thought on that and that is that I think I heard a number of times said that the dividend was being sized relative to the growth prospects of the Company. So if I assume a 40% payout ratio and a dividend of about 28, presumably the Company is setting out a 320 if you will, ability to show earnings over some timeframe, which would be substantially lower than let's say the $1.25 inherent in the second-quarter numbers. So is the Company, in fact, saying that it's earning capacity is substantially less and because it's earning capacity at substantially less, shareholders should take a $5 billion one-day hit in their holdings and a 40% reduction in their dividends?

Crittenden:

Dick, obviously, we don't give forecasts for where we think the future is going to go. We also carefully did not talk about a payout ratio here. We didn't think about it necessarily in terms of a specific payout ratio. We thought about it in terms of the capital formation and our ability to respond relatively quickly to a stress scenario in the environment. And it doesn't -- I mean it mathematically calculates into a payout ratio, but that is not the way we derived it.

Mike Mayo, Deutsche Bank:

Good morning. Can you talk some about the trade-off between pursuing growth and managing risk and as you pointed out, the credit card losses are up over 100 basis points in three months with unemployment only at 5% and mortgages getting worse. At the same time, short-term funding costs are higher over the last three months. So does that encourage you to pull back growth at all? ... specifically, as it relates to US credit cards, the margin was down linked quarter. Is that an area where you might want to pull back or increase pricing or neither?

Cittenden:

Actually all of the above is happening, Mike. So we are tightening underwriting standards as you might guess. We are evaluating the open lines of credit that exist with current customers. We are doing cross reference work between customers where we have the mortgage position and where we hold the credit card and obviously, we are off of promotional balances essentially as we go through this fourth quarter. So this is a time -- as you no doubt have read -- there was a good article in the New York Times a couple of days ago about this. This is no doubt a time where, in the credit card business, you could make some substantial missteps if you weren't careful in watching the credit because there is some natural growth in outstandings that will take place. There's a bit of a substitution effect between home-equity loans and credit card loans and we are very aware of what those trade-offs are. This falls into the second category that Vikram just talked about. There is some growth that's good growth and there is other growth, which can be dangerous if it is done without the proper kind of risk parameters around it. But I think our team is very focused on these issues right now in the card business. Obviously, we have taken a bit of a reserve increase in the card business in this quarter, but we are very focused on what the risks are around the inherent or natural growth that is going to happen in that business over the next year.

From the Citi Conference Call

by Calculated Risk on 1/15/2008 09:36:00 AM

Here are some excerpts from the Citi conference call (hat tip Brian), and a couple of graphs from the Citi presentation. emphasis added

Re: charges to consumer credit portfolio:

Consumer lending net credit losses were higher by $396 million over last year, primarily driven by losses in the consumer mortgage portfolio. In US cards, net credit losses were up by $156 million, reflecting higher write-offs, lower recoveries and higher average yield balances. While delinquency levels remain relatively stable, the increase in write-offs reflect higher bankruptcy filings and the impact of customers that are delinquent in advancing to write-offs at a higher rate.

Within our bank cards portfolio, approximately two-thirds of the losses occurred in five states -- California , Florida , Illinois , Arizona and Michigan . And the loss rates on customers with mortgages in those states increased by fourfold versus the loss rates in the rest of the country .... Loss rates in the branch-originated mortgage business remained relatively stable, where face-to-face interaction with customers and long-standing relationships have historically resulted in lower losses. The CitiFinancial real estate mortgage portfolio, for example, is comprised primarily of full documentation, fixed-rate loans with low loan to values.Consumer reserve build:

Second, the loan-loss reserve build of $3.8 billion was primarily driven by the US consumer reserve build of $3.3 billion. Approximately 73% or $2.4 billion of the US consumer build was in the consumer lending group, reflecting continued weakness in the mortgage portfolio and a higher expectation for losses in the auto portfolio. The auto portfolio is primarily subprime with loans sourced directly through dealers. I will discuss the mortgage portfolio in more detail in just a minute. Approximately 15% of the US consumer build or $493 million was in US cards. While US cards delinquencies remain relatively stable, the build reflects recently observed trends, which point to an expectation of higher losses in the near term. As I mentioned, the rate at which delinquent customers advance to write-offs has increased. This is especially true in certain geographic areas where the impact of events in the housing market has been greatest driving higher loss rates. Bankruptcy filings have increased from historically low levels. These trends and other portfolio indicators led to a build in reserves for US cards in the quarter. …..This increase in net credit losses included $[535] million related to loans with subprime mortgage collateral included in the $18.1 billion figure that I previously mentioned. Credit costs also include a $284 million net charge to increase loan-loss reserves reflecting a slight weakening in overall portfolio credit quality. They also include loan-loss reserves set aside for specific counterparties, including $169 million related to our direct subprime exposures, which is also included in the $18.1 billion figure.Delinquency specifics in mortgages:

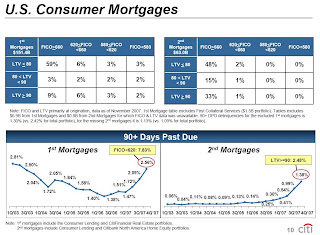

On slide 10, the two grides, which show the FICO and LTV distribution for the US consumer mortgage portfolio, are listed. The two graphs at the bottom show the 90 plus day delinquencies in each of the first and second mortgage portfolios. In the grids on the top half of the slide, there are two segments which have demonstrated the greatest weaknesses. In first mortgages, we are experiencing higher losses from the loans which have FICO scores less than 620. This comprises roughly 15% or $23 billion of the first mortgage portfolio. In second mortgages, we are experiencing higher losses from loans with origination loan to value that are greater or equal to 90%, which comprise 34% or $20 billion of the second mortgage portfolio. We consider these two segments the higher risk segments of the portfolio. The bottom graph shows that delinquencies have increased substantially, particularly since the beginning of September. The first mortgage delinquency trend shows that current delinquency levels are almost at their early 2003 peak. A further breakout of the below 620 segment in the yellow box indicates that delinquencies in this segment are three times higher than the overall first mortgage portfolio. By contrast, delinquency rates in our second mortgage portfolio are at historically high levels, particularly in the 90% LTV segment -- 90% and higher LTV segment as shown in the yellow box. This segment has a delinquency rate twice as high as the rate for the overall second mortgage portfolio. In general, first mortgages have higher delinquencies than second mortgages. This is driven by the fact that first mortgages include government guaranteed loans such as those to low and middle income families, which have sharply higher delinquencies due to the guarantee future. There is no equivalent product in the second mortgage portfolio. On the other hand, second mortgages are much more likely to go directly from delinquency to charge-off without going into foreclosure, which explains why the loss deterioration in second mortgages has been more significant than for first mortgages.

Sunday, January 13, 2008

We're All Subprime Now

by Calculated Risk on 1/13/2008 09:41:00 PM

From Wolfgang Münchau at the Financial Times: This is not merely a subprime crisis (hat tip FFDIC)

If this had been a mere subprime crisis, it would now be over. But it is not, and nor will it be over soon. The reason is that several other pockets of the credit market are also vulnerable. Credit cards are one such segment, similar in size to the subprime market. Another is credit default swaps, relatively modern financial instruments that allow bondholders to insure against default.The article focuses on Credit Default Swaps (CDS) and suggests the current downturn could be longer than most anticipate (including me):

The German experience has taught us that persistent problems in financial transmission channels cause long economic downturns. Today, the really important question is not whether the US can avoid a sharp downturn. It probably cannot. Far more important is the question of how long such a downturn or recession will last. An optimistic scenario would be a short and shallow downturn. A second-best scenario would be for a sharp, but still short, recession.And from Robin Sidel and David Enrich at the WSJ: High-End Cards Fall From Grace (hat tip Brian)

A truly awful scenario would be a long recession.

The luster on all those silver, gold and platinum credit cards is getting tarnished.Affluent customers aren't paying their credit card bills? How did the credit card companies define "affluent"? The same standard as the mortgage lenders: Fog a mirror, get a Platinum card?

For the past few years, banks that issue credit cards have aggressively wooed affluent customers with lavish perks and fat credit lines. Now, that high-end strategy is coming back to bite the banks: There are growing signs that some of those consumers are having a hard time paying their bills.

We're all subprime now.

Wednesday, November 21, 2007

Fed: Delinquency Rates Rise in Q3

by Calculated Risk on 11/21/2007 02:10:00 PM

From the Federal Reserve Charge-off and Delinquency Rates.

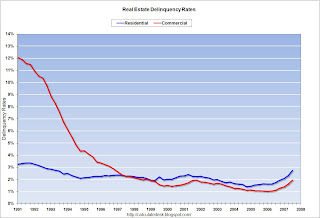

Delinquency rates rose in Q3 for real estate (residential and commercial), consumer loans and commercial and industry loans.  Click on graph for larger image.

Click on graph for larger image.

This graph shows the delinquency rates for residential and commercial real estates since 1991 (start of series).

For residential real estate, the delinquency rate increased from 2.32% to 2.74%. For commercial real estate, the delinquency rate increased from 1.61% to 1.94%.

There was a also sharp increase for consumer credit card delinquencies, rising from 4.03% to 4.29% in Q3.

Update: Note that the Commercial Real Estate delinquency rate is above the peak of the '91 '01 recession (1.94% now, 1.93% then). I doubt CRE delinquencies will match the S&L crisis levels of the late '80s, early '90s - but clearly delinquencies are rising rapidly.

Yes, it does appear the curves are about to go parabolic!

Thursday, October 18, 2007

Earning the BS at Subprime U

by Tanta on 10/18/2007 09:15:00 AM

Michelle Singletary goes after college-sponsored programs to load students up with credit cards:

In a 2004 study of credit card usage by undergraduates, 56 percent of freshmen reported that they had obtained their first card at the age of 18. The student loan lender Nellie Mae, which conducted the study, said that as students progress through school, their credit card usage swells.Giving a college student one low-balance card as a form of "starter credit" is, possibly, defensible. Giving a college student four cards? That's the kind of extra credit that prepares them to be subprime borrowers for the rest of their lives.

By the time they reach their senior year, 56 percent of students carry four or more cards, with an average balance of $2,864. Of course, some have much more than that. . . .

Not surprisingly, in the Nellie Mae report, only 21 percent of undergraduates with credit cards reported that they paid off all cards each month, and 11 percent said they made less than the minimum required payment each month.