by Calculated Risk on 10/02/2023 10:53:00 AM

Monday, October 02, 2023

ICE (Black Knight) Mortgage Monitor: "Home Prices Set Yet Another Record in August"

Today, in the Calculated Risk Real Estate Newsletter: ICE (Black Knight) Mortgage Monitor: "Home Prices Set Yet Another Record in August"

A brief excerpt:

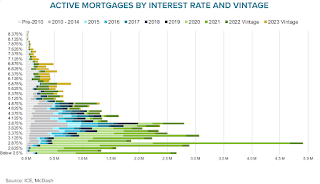

Some interesting data on mortgage rates. Note the higher mortgage rates for the 2023 vintage - still a small portion of the overall market. A large portion of active mortgages are in the 2020-2022 vintages.There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• Given all the talk about near-term prepayment risk – and quick-turn refinance incentive – among recent originations, we thought it prudent to see how much refinance volume may make its way into the market should 30-year rates begin to ease

• As loans seasoned between two and ten years tend to have rates lower than 5%, we explore the distribution of current interest rates among recent originations to help quantify where any pockets of opportunity may exist

• Mortgages originated over the past 18 months are evenly distributed across rate bands ranging from the mid-3% range up through the high 6% range, meaning that rate/term refinance volumes would return gradually should rates improve

• Relatively few loans (~600K as of August month end) have interest rates at or above 7%, such that it would take rates markedly lower than they are today to spur any meaningful refinance incentive

• While 600K may sound significant, historically an average month yields 430K refinances, if every homeowner with a first lien rate of 7% or higher were to refinance it would only result in 1.5 months of ‘normal’ volume

• Another 1.9M loans have rates between 6% and 7%, which would produce moderate opportunity, but rates would need to come down to the mid- to low-5% range to put all of those borrowers in the money, and even that would only be enough for a few months of sustained volume

emphasis added