by Calculated Risk on 4/25/2023 09:15:00 AM

Tuesday, April 25, 2023

Case-Shiller: National House Price Index "Declines Moderated" to 2.0% year-over-year increase in February

S&P/Case-Shiller released the monthly Home Price Indices for February ("February" is a 3-month average of December, January and February closing prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Declines Moderated in February

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 2.0% annual gain in February, down from 3.7% in the previous month. The 10-City Composite annual increase came in at 0.4%, down from 2.5% in the previous month. The 20-City Composite posted a 0.4% year-over-year gain, down from 2.6% in the previous month.

Miami, Tampa, and Atlanta again reported the highest year-over-year gains among the 20 cities in February. The order remained the same with Miami leading the way with a 10.8% year-over-year price increase, followed by Tampa in second with a 7.7% increase, and Atlanta in third with a 6.6% increase. All 20 cities reported lower prices in the year ending February 2023 versus the year ending January 2023.

...

Before seasonal adjustment, the U.S. National Index posted a 0.2% month-over-month increase in February, while the 10-City and 20-City Composites posted increases of 0.3% and 0.2%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.2%, while both the 10-City and 20-City Composites posted increases of 0.1%.

In January, before seasonal adjustment, 19 cities reported declines with only Miami reporting an increase at 0.1%. After seasonal adjustment, 15 cities reported declines while Miami, Boston, Charlotte, and Cleveland had slight increases.

“Home price trends moderated in February 2023,” says Craig J. Lazzara, Managing Director at S&P DJI. “The National Composite, which had declined for seven consecutive months, rose a modest 0.2% in February, and now stands 4.9% below its June 2022 peak. Our 10- and 20-City Composites performed similarly, with February gains of 0.3% and 0.2%; these Composites are currently 6.0% and 6.6% below their respective peaks. On a trailing 12-month basis, the National Composite is only 2.0% above its level in February 2022; the 10- and 20-City Composites are both up 0.4% on a year-over-year basis."

emphasis added

Click on graph for larger image.

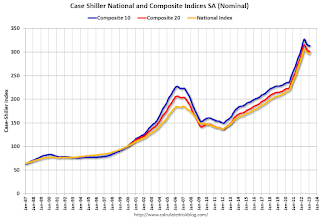

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 0.1% in February (SA) and down 4.3% from the recent peak in June 2022.

The Composite 20 index is up 0.1% (SA) in February and down 4.6% from the recent peak in June 2022.

The National index is up 0.2% (SA) in February and is down 2.8% from the peak in June 2022.

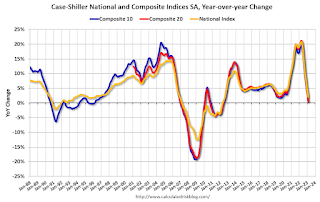

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 0.4% year-over-year. The Composite 20 SA is up 0.4% year-over-year.

The National index SA is up 2.0% year-over-year.

Annual price increases were below expectations. I'll have more later.