by Calculated Risk on 3/27/2023 04:23:00 PM

Monday, March 27, 2023

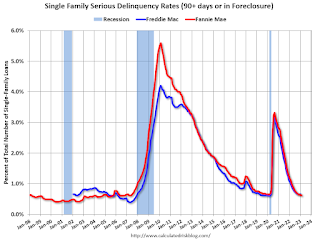

Fannie Mae: Mortgage Serious Delinquency Rate Decreased in February

Fannie Mae reported that the Single-Family Serious Delinquency decreased to 0.62% in February from 0.64% in January. The serious delinquency rate is down from 1.11% in February 2022. This is below the pre-pandemic levels.

These are mortgage loans that are "three monthly payments or more past due or in foreclosure".

The Fannie Mae serious delinquency rate peaked in February 2010 at 5.59% following the housing bubble and peaked at 3.32% in August 2020 during the pandemic.

By vintage, for loans made in 2004 or earlier (1% of portfolio), 2.04% are seriously delinquent (down from 2.11% in January).

For loans made in 2005 through 2008 (1% of portfolio), 3.31% are seriously delinquent (down from 3.40%),

For recent loans, originated in 2009 through 2021 (98% of portfolio), 0.51% are seriously delinquent (down from 0.52%). So, Fannie is still working through a few poor performing loans from the bubble years.

Mortgages in forbearance were counted as delinquent in this monthly report, but they were not reported to the credit bureaus.

Mortgages in forbearance were counted as delinquent in this monthly report, but they were not reported to the credit bureaus.