by Calculated Risk on 7/07/2022 12:18:00 PM

Thursday, July 07, 2022

June Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for June. The consensus is for 270,000 jobs added, and for the unemployment rate to be unchanged at 3.6%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 800 thousand fewer jobs than in February 2020 (the month before the pandemic).

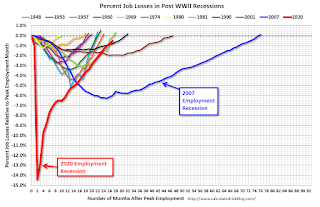

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 27 months after the onset, has recovered quicker than the previous two recessions.

• ADP Report: The ADP employment report has been "paused" and is being retooled.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index decreased in June to 47.3%, down from 50.9% last month. This would suggest 35,000 jobs lost in manufacturing.

The ISM® services employment index decreased in June to 47.4%, down from 50.2% last month. This would suggest service employment was unchanged in June.

Combined, the ISM surveys suggest 35,000 jobs lost in June.

• Unemployment Claims: The weekly claims report showed an increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 218,000 in May to 233,000 in June. This would usually suggest a few more layoffs in June than in May. In general, weekly claims were above expectations in June.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the May report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the May report.This data is only available back to 1994, so there is only data for three recessions. In May, the number of permanent job losers was unchanged at 1.386 million from 1.386 million in the previous month.

These jobs will likely be the hardest to recover, so it is a positive that the number of permanent job losers is declining fairly rapidly.

• COVID: As far as the pandemic, the number of daily cases during the reference week in June was around 105,000, up from 90,000 in May.

• Conclusion: The consensus is for job growth to slow to 270,000 jobs added in June. Overall, the ISM surveys were negative, and unemployment claims increased during the reference week. This suggests a weaker than expected employment report for June.