by Calculated Risk on 6/22/2022 07:00:00 AM

Wednesday, June 22, 2022

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 4.2 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 17, 2022.

... The Refinance Index decreased 3 percent from the previous week and was 77 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 8 percent from one week earlier. The unadjusted Purchase Index increased 6 percent compared with the previous week and was 10 percent lower than the same week one year ago.

“Mortgage rates continued to surge last week, with the 30-year fixed mortgage rate jumping 33 basis points to 5.98 percent – the highest since November 2008 and the largest single-week increase since 2009. All other loan types also increased by at least 20 basis points, influenced by the Federal Reserve’s 75-basis-point rate hike and commentary that more are coming to slow inflation,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Mortgage rates are now almost double what they were a year ago, leading to a 77 percent drop in refinance volume over the past 12 months.”

Added Kan, “Purchase applications increased for the second straight week – driven mainly by conventional applications – and the ARM share of applications jumped back to over 10 percent. However, purchase activity was still 10 percent lower than a year ago, as inventory shortages and higher mortgage rates are dampening demand. The average loan size, at just over $420,000, is well below its $460,000 peak earlier this year and is potentially a sign that home price-growth is moderating.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.98 percent from 5.65 percent, with points increasing to 0.77 from 0.71 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

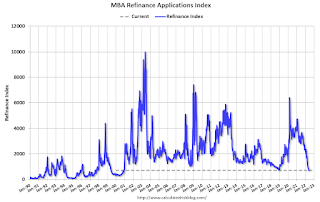

Click on graph for larger image.The first graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index has declined sharply over the last several months.

The refinance index is just above the lowest level since the year 2000.

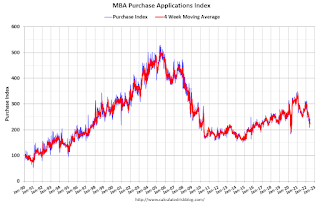

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 10% year-over-year unadjusted.

According to the MBA, purchase activity is down 10% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).