by Calculated Risk on 5/24/2022 02:09:00 PM

Tuesday, May 24, 2022

FDIC: Problem Banks Declined, Residential REO Increased Slightly in Q1 2022

The FDIC released the Quarterly Banking Profile for Q1 2022 this morning:

Net income fell by $17.0 billion (22.2 percent) to $59.7 billion in first quarter 2022 from the year-ago quarter.

...

Total assets increased $253.9 billion (1.1 percent) from fourth quarter 2021 to $24.0 trillion. Cash and balances due from depository institutions declined $183.5 billion (5.2 percent) from fourth quarter 2021. Total loan and lease balances increased $109.9 billion (1.0 percent), federal funds sold increased 48.3 billion (8.1 percent), and securities rose $14.6 billion (0.2 percent). Growth in U.S. Treasury securities (up $37.9 billion, or 2.6 percent) continued to drive the quarterly increases in total securities. The proportion of securities to total assets declined slightly to 26.1 percent from the QBP high of 26.3 percent reported in fourth quarter 2021.

Loans and leases 90 days or more past due or in nonaccrual status (noncurrent loan balances) declined (down $4.5 billion, or 4.5 percent) from fourth quarter 2021, supporting a 5 basis point reduction in the noncurrent rate to 0.84 percent. The noncurrent rate was just 14 basis points above the historical low reported in second quarter 2006. Noncurrent 1–4 family residential real estate loan balances declined most among noncurrent loan categories (down $4.8 billion, or 10.5 percent).

emphasis added

Click on graph for larger image.

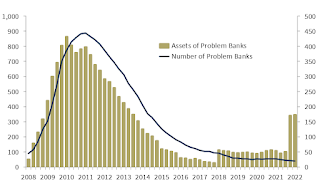

Click on graph for larger image.The FDIC reported the number of problem banks declined to 40.

The number of FDIC-insured institutions declined from 4,839 in fourth quarter 2021 to 4,796. In first quarter, 3 banks opened and 44 institutions merged with other FDIC-insured institutions. The number of banks on the FDIC’s “Problem Bank List” declined by 4 from fourth quarter to 40, the lowest level since QBP data collection began in 1984. Total assets of problem banks increased $3.0 billion to $173.1 billion.11 No banks failed in the first quarter.This graph from the FDIC shows the number of problem banks and assets at problem institutions.

Note: The number of assets for problem banks increased significantly back in 2018 when Deutsche Bank Trust Company Americas was added to the list. An even larger bank was added to the list last year, although the identity of the bank is unclear.

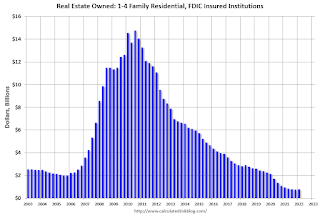

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) increased slightly from $779 million in Q4 2021 to $788 million in Q1 2022.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) increased slightly from $779 million in Q4 2021 to $788 million in Q1 2022. This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.