by Calculated Risk on 4/28/2022 03:05:00 PM

Thursday, April 28, 2022

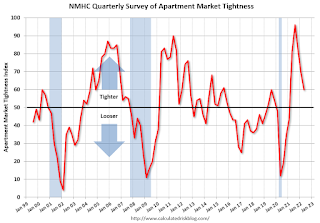

NMHC: April Apartment Market Survey shows Tighter Conditions

From the National Multifamily Housing Council (NMHC): Apartment Demand Continues to Grow, but Investors Face Tougher Financing Conditions

Apartment markets tightened further according to the National Multifamily Housing Council’s Quarterly Survey of Apartment Market Conditions for April 2022, while financing became more costly. The Market Tightness (60) index was the only index to come in above the breakeven level (50) this quarter; the Sales Volume (50) index came in at exactly 50, with much disagreement among respondents; while both the Equity Financing (35) and Debt Financing (9) indexes indicated weaker conditions compared to three months prior.

“Demand for apartments continues to exceed supply, resulting in the fifth straight quarter of tightening markets,” noted NMHC’s Chief Economist, Mark Obrinsky. “Yet, even as rent growth and occupancy remain elevated, developers are struggling to build more housing due to the increasing cost of materials, a lack of available labor, continued obstructionism from NIMBYs, and, because of rising interest rates, an increasing cost of capital.”

...

The Market Tightness Index came in at 60 this quarter – above the breakeven level of 50 – indicating that market conditions have become tighter. While less than one-third (30 percent) of respondents reported markets to be tighter than three months ago, an even smaller share (10 percent) thought that markets have become looser. A majority of respondents (59 percent), meanwhile, thought that apartment market conditions were unchanged from last quarter.

Click on graph for larger image.

This graph shows the quarterly Apartment Tightness Index. Any reading above 50 indicates tighter conditions from the previous quarter.

Even though the index declined in April, this indicates market conditions tightened further in April for the fifth consecutive quarter, after being especially weak during the early months of the pandemic.