by Calculated Risk on 4/27/2022 07:00:00 AM

Wednesday, April 27, 2022

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 8.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending April 22, 2022.

... The Refinance Index decreased 9 percent from the previous week and was 71 percent lower than the same week one year ago. The seasonally adjusted Purchase Index decreased 8 percent from one week earlier. The unadjusted Purchase Index decreased 7 percent compared with the previous week and was 17 percent lower than the same week one year ago.

“With mortgage rates increasing last week to the highest level since 2009, applications continued to decline. Overall application activity fell to the lowest level since 2018, with both purchase and refinance applications posting declines. Refinance applications were 70 percent below the same week a year ago, when the 30-year fixed rate was in the 3-percent range,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The drop in purchase applications was evident across all loan types. Prospective homebuyers have pulled back this spring, as they continue to face limited options of homes for sale along with higher costs from increasing mortgage rates and prices. The recent decrease in purchase applications is an indication of potential weakness in home sales in the coming months.”

Added Kan, “In a period of high home-price growth and rapidly increasing mortgage rates, borrowers continued to mitigate higher monthly payments by applying for ARM loans. The ARM share of applications last week was over 9 percent by loan count and 17 percent based on dollar volume. At 9 percent, the ARM share was double what it was three months ago, which also coincides with the 1.5 percentage point increase in the 30-year fixed rate.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($647,200 or less) increased to 5.37 percent from 5.20 percent, with points increasing to 0.67 from 0.66 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

With higher mortgage rates, the refinance index has declined sharply over the last several months.

The refinance index is at the lowest level since December 2018.

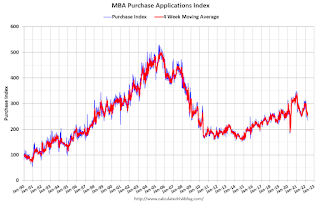

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 17% year-over-year unadjusted.

According to the MBA, purchase activity is down 17% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).