by Calculated Risk on 4/04/2022 11:22:00 AM

Monday, April 04, 2022

Black Knight Mortgage Monitor for February: "Tightest affordability in 15 years"

Today, in the Calculated Risk Real Estate Newsletter: Black Knight Mortgage Monitor for February: "Tightest affordability in 15 years"

A brief excerpt:

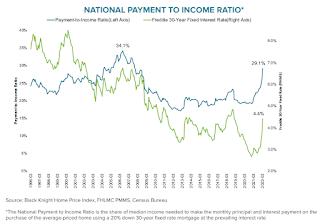

And on the payment to income ratio (this is high):There is much more in the article. You can subscribe at https://calculatedrisk.substack.com/

• It now takes 29.1% of the median household income to make that P&I payment, up from 19.3% just 15 months agoAs Black Knight noted, there were “affordability products” with low teaser rates available during the housing bubble. Excluding the bubble years, this is the worst affordability since the early ‘90s.

• That is a full 4 percentage points more than the 1995-2003 long-term average, though still below the 2006 high of 34%

• In recent years, a payment-to-income ratio above 21% has worked to cool the housing market, but record-low inventory continues to fuel growth even in the face of the tightest affordability in 15 years

• At current home prices and interest rates, it would take a 16% rise in incomes to bring the P&I ratio back down to benchmark affordability levels