by Calculated Risk on 2/03/2022 11:58:00 AM

Thursday, February 03, 2022

January Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for January. The consensus is for 155 thousand jobs added, and for the unemployment rate to be unchanged at 3.9%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 3.6 million fewer jobs than in February 2020 (before the pandemic).

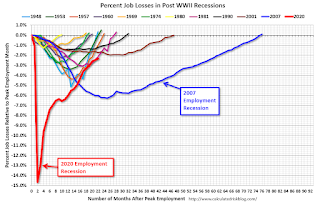

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms. However, the current employment recession, 22 months after the onset, is now significantly better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a loss of 301,000 private sector jobs, well below the consensus estimates of 208,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be below expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in January to 54.5%, up from 53.9% last month. This would suggest 5,000 jobs added in manufacturing employment in January. ADP showed 21,000 manufacturing jobs lost.

The ISM® Services employment index decreased in January to 52.3%, down from 54.7% last month. This would suggest a 135 thousand increase in service employment in January. Combined, the ISM indexes suggest employment slightly below the consensus estimate.

• Unemployment Claims: The weekly claims report showed a sharp increase in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 206,000 in December to 290,000 in January. This would usually suggest more layoffs in January than in December, although this might not be very useful right now. In general, weekly claims were below expectations in January.

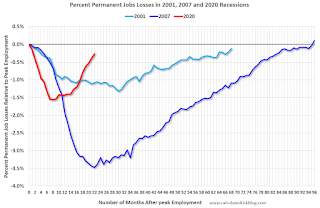

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the November report.This data is only available back to 1994, so there is only data for three recessions. In December, the number of permanent job losers decreased to 1.703 million from 1.905 million in November.

These jobs will likely be the hardest to recover, so it is a positive that the number of permanent job losers is declining fairly rapidly.

• Annual Benchmark Revision: The benchmark revision for 2021 will be released with the January employment report. The preliminary estimate was the revision will show 166,000 fewer jobs as of March 2021.

• COVID: As far as the pandemic, the number of daily cases during the reference week in January was a record 800,000, up sharply from around 120,000 in December. The current wave peaked during the January reference week, and probably had a significant impact on January hiring.

• COVID: As far as the pandemic, the number of daily cases during the reference week in January was a record 800,000, up sharply from around 120,000 in December. The current wave peaked during the January reference week, and probably had a significant impact on January hiring.

• Conclusion: There is significant pessimism concerning the January employment report due to the current COVID wave, and many analysts are expecting job losses in January. For example, from Merrill Lynch economists:

"We expect nonfarm payrolls contracted by 150k in Jan owing to the shock from the Omicron variant. The U-rate should hold at 3.9%"

Overall, the ADP report was very weak, and unemployment claims increased sharply during the reference week. My sense is the report will be below consensus expectations.