by Calculated Risk on 2/01/2022 12:19:00 PM

Tuesday, February 01, 2022

Construction Spending Increased 0.2% in December

From the Census Bureau reported that overall construction spending increased 0.2%:

Construction spending during December 2021 was estimated at a seasonally adjusted annual rate of $1,639.9 billion, 0.2 percent above the revised November estimate of $1,636.5 billion. The December figure is 9.0 percent above the December 2020 estimate of $1,504.2 billion.Private spending increased and public spending decreased:

The value of construction in 2021 was $1,589.0 billion, 8.2 percent above the $1,469.2 billion spent in 2020.

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,292.9 billion, 0.7 percent above the revised November estimate of $1,283.8 billion. ...

In December, the estimated seasonally adjusted annual rate of public construction spending was $347.0 billion, 1.6 percent below the revised November estimate of $352.7 billion.

Click on graph for larger image.

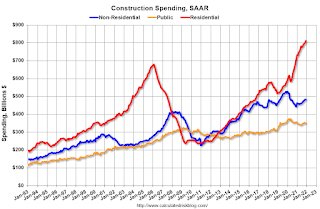

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 19% above the bubble peak (in nominal terms - not adjusted for inflation).

Non-residential spending is 16% above the bubble era peak in January 2008 (nominal dollars) but has been soft recently.

Public construction spending is 7% above the peak in March 2009.

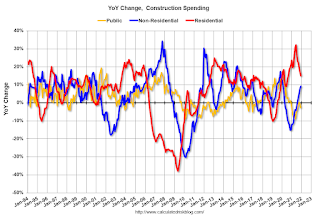

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 15.0%. Non-residential spending is up 9.1% year-over-year. Public spending is down 2.9% year-over-year.

Construction was considered an essential service during the early months of the pandemic in most areas and did not decline sharply like many other sectors. However, some sectors of non-residential have been under pressure. For example, lodging is down 23% YoY.

This was below consensus expectations of a 0.6% increase in spending; however, construction spending for the previous two months was revised up.