by Calculated Risk on 1/24/2022 08:45:00 AM

Monday, January 24, 2022

Six High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It is interesting to watch these sectors recover as the pandemic subsides.

There is a clear negative impact from the omicron variant of COVID.

Note: Gasoline consumption returned to pre-pandemic levels.

----- Airlines: Transportation Security Administration -----

The TSA is providing daily travel numbers.

This data is as of January 23rd.

Click on graph for larger image.

Click on graph for larger image.

This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 24.7% from the same day in 2019 (75.3% of 2019). (Dashed line)

----- Restaurants: OpenTable -----

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

----- Movie Tickets: Box Office Mojo -----

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

----- Hotel Occupancy: STR -----

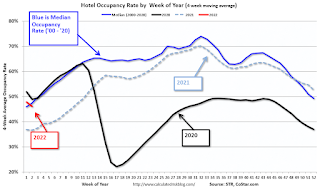

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through January 15th. The occupancy rate was down 16.3% compared to the same week in 2019.

----- Transit: Apple Mobility -----

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through January 21st

This data is through January 21st

----- New York City Subway Usage -----

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider.

This data is through Friday,January 21st.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

Note: Gasoline consumption returned to pre-pandemic levels.

The TSA is providing daily travel numbers.

This data is as of January 23rd.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Black), 2021 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven-day average.

The 7-day average is down 24.7% from the same day in 2019 (75.3% of 2019). (Dashed line)

Air travel had been off about 20% relative to 2019 for most of the second half of 2021 (with some ups and downs) - but picked up over the Thanksgiving and Christmas holidays (solid leisure travel) - and has declined in early 2022 (weak business travel).

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

IMPORTANT: OpenTable notes: "we’ve updated the data including downloadable dataset from January 1, 2021, onward to compare seated diners from 2021 to 2019, as opposed to year over year." Thanks!

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:

This data is updated through January 22, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways, but there has been some decline recently, probably due to the winter wave of COVID. The 7-day average for the US is down 25% compared to 2019.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through January 22, 2022.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Dining was mostly moving sideways, but there has been some decline recently, probably due to the winter wave of COVID. The 7-day average for the US is down 25% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Black is 2020, Blue is 2021 and Red is 2022.

The data is from BoxOfficeMojo through January 13th.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $100 million last week, down about 49% from the median for the week.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $100 million last week, down about 49% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four-week average. The red line is for 2022, black is 2020, blue is the median, and dashed light blue is for 2021.

This data is through January 15th. The occupancy rate was down 16.3% compared to the same week in 2019.

lthough down compared to 2019, the 4-week average of the occupancy rate is close to the median rate for the previous 20 years (Blue).

Notes: Y-axis doesn't start at zero to better show the seasonal change.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

The 4-week average of the occupancy rate will increase seasonally over the next few months. The key question is: How much business travel will return?

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

This data is through January 21st

This data is through January 21st for the United States and several selected cities.

The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 90% of the January 2020 level.

The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7-day average for the US is at 90% of the January 2020 level.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider.

This graph is from Todd W Schneider. This graph shows how much MTA traffic has recovered in each borough (Graph starts at first week in January 2020 and 100 = 2019 average).

Manhattan is at about 28% of normal.

This data is through Friday,January 21st.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".