by Calculated Risk on 12/13/2021 12:19:00 PM

Monday, December 13, 2021

A Few Comments on Inflation

This is an update to a post I wrote in August.

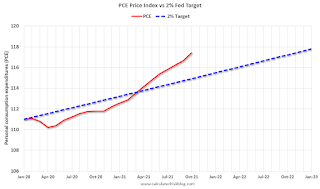

The first graph shows the PCE price index since January 2020 (before the pandemic), and the dashed blue line is the Fed's target of 2%.

Click on graph for larger image.

Click on graph for larger image.

The recent increase in inflation has led to some analysts to call for the Fed to raise rates. For example, from CNBC this morning: El-Erian says ‘transitory’ was the ‘worst inflation call in the history’ of the Fed

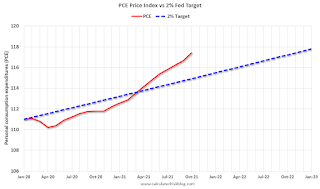

The second graph is from January 2005 (just an arbitrary date).

The second graph is from January 2005 (just an arbitrary date).

This shows that inflation has been below target for years. If we were doing price targeting (we aren't), then prices would just be getting back to the target.

The graphs for core PCE inflation show the same pattern, but core PCE is even further below the trend line.

The question is not will some prices "stick", but rather will YoY inflation ease back towards the Fed's target? Or will inflation stay elevated?

My sense is inflation will ease back towards the Fed's target over the next year.

Click on graph for larger image.

Click on graph for larger image.The recent increase in inflation has led to some analysts to call for the Fed to raise rates. For example, from CNBC this morning: El-Erian says ‘transitory’ was the ‘worst inflation call in the history’ of the Fed

“If I were them, I would do three things, which they will not do,” [El-Erian] said during a “Squawk Box” interview. “I would 1) be very open and honest as to why I got the inflation call wrong and try to regain the inflation narrative. 2) I would go even further than doubling the rate of taper, and 3) I would open it up to the possibility that rate hikes may come faster than what the market has. They’re not gonna do that."The FOMC will likely announce a faster pace of tapering assets purchases at the meeting this week, and asset purchases will probably end in March (if not sooner).

The second graph is from January 2005 (just an arbitrary date).

The second graph is from January 2005 (just an arbitrary date).This shows that inflation has been below target for years. If we were doing price targeting (we aren't), then prices would just be getting back to the target.

The graphs for core PCE inflation show the same pattern, but core PCE is even further below the trend line.

The question is not will some prices "stick", but rather will YoY inflation ease back towards the Fed's target? Or will inflation stay elevated?

My sense is inflation will ease back towards the Fed's target over the next year.