by Calculated Risk on 11/02/2021 05:35:00 PM

Tuesday, November 02, 2021

Q3 2021 GDP Details on Residential and Commercial Real Estate

The BEA released the underlying details for the Q3 advance GDP report on Friday.

The BEA reported that investment in non-residential structures increased at a 2.4% annual pace in Q3. Note that weakness in non-residential structures started in 2019, before the pandemic.

Investment in petroleum and natural gas structures increased sharply in Q3 compared to Q2, and was up 67% year-over-year.

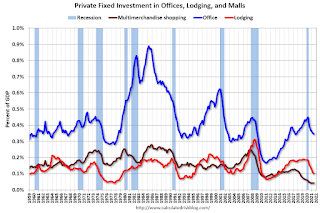

The first graph shows investment in offices, malls and lodging as a percent of GDP.

Investment in offices (blue) increased slightly in Q3, and was down 4.9% year-over-year.

Investment in multimerchandise shopping structures (malls) peaked in 2007 and was down about 2% year-over-year in Q3 - and near a record low as a percent of GDP. The vacancy rate for malls is still very high, so investment will probably stay low for some time.

Lodging investment decreased slightly in Q3 compared to Q2, and lodging investment was down 29% year-over-year.

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).

The second graph is for Residential investment components as a percent of GDP. According to the Bureau of Economic Analysis, RI includes new single family structures, multifamily structures, home improvement, Brokers’ commissions and other ownership transfer costs, and a few minor categories (dormitories, manufactured homes).Even though investment in single family structures has increased from the bottom, single family investment is just approaching normal levels as a percent of GDP.

Investment in single family structures was $411 billion (SAAR) (about 1.8% of GDP), and up 38% year-over-year.

Investment in multi-family structures decreased slightly in Q3.

Investment in home improvement was at a $324 billion Seasonally Adjusted Annual Rate (SAAR) in Q2 (about 1.4% of GDP). Home improvement spending has been strong during the pandemic.