by Calculated Risk on 11/04/2021 01:37:00 PM

Thursday, November 04, 2021

October Employment Preview

On Friday at 8:30 AM ET, the BLS will release the employment report for October. The consensus is for 450 thousand jobs added, and for the unemployment rate to decrease to 4.7%.

Click on graph for larger image.

Click on graph for larger image.• First, currently there are still about 5.0 million fewer jobs than in February 2020 (before the pandemic).

This graph shows the job losses from the start of the employment recession, in percentage terms.

The current employment recession was by far the worst recession since WWII in percentage terms, but is now better than the worst of the "Great Recession".

• ADP Report: The ADP employment report showed a gain of 571,000 private sector jobs, above the consensus estimate of 400,000 jobs added. The ADP report hasn't been very useful in predicting the BLS report, but this suggests the BLS report could be above expectations.

• ISM Surveys: Note that the ISM services are diffusion indexes based on the number of firms hiring (not the number of hires). The ISM® manufacturing employment index increased in October to 52.0%, up from 50.2% last month. This would suggest a decline in manufacturing employment of around 8,000 jobs in October. ADP showed 53,000 manufacturing jobs added.

The ISM® Services employment index decreased in October to 51.6%, down from 53.0% last month. This would suggest an increase in service employment of around 115,000 jobs in September.

Combined, the ISM indexes suggest a weaker than expected employment report.

• Unemployment Claims: The weekly claims report showed a sharp decline in the number of initial unemployment claims during the reference week (includes the 12th of the month) from 351,000 in September to 291,000 in October. This would usually suggest fewer layoffs in October than in September, although this might not be very useful right now. In general, weekly claims have been falling, and have been below expectations in October.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.

• Permanent Job Losers: Something to watch in the employment report will be "Permanent job losers". This graph shows permanent job losers as a percent of the pre-recession peak in employment through the June report.This data is only available back to 1994, so there is only data for three recessions. In September, the number of permanent job losers decreased to 2.251 million from 2.487 million in August. These jobs will likely be the hardest to recover, so it is a positive that the number of permanent job losers is declining rapidly

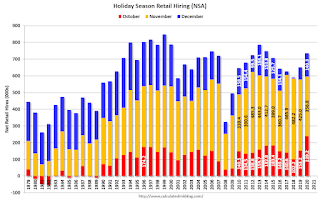

• Seasonal Retail Hiring: Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. But only a few temporary workers are hired in December. Here is a graph that shows the historical net retail jobs added for October, November and December by year.

• Seasonal Retail Hiring: Typically retail companies start hiring for the holiday season in October, and really increase hiring in November. But only a few temporary workers are hired in December. Here is a graph that shows the historical net retail jobs added for October, November and December by year.In 2020, retailers hired 239,200 employees (NSA) in October (most seasonal, but some bounce back during pandemic). That translated to a gain of 106,000 jobs SA.

If seasonal retail hiring is around 140,000 this year (NSA) that will translate to around zero jobs added (SA).

• Conclusion: There is significant optimism concerning the October employment report, and many analysts are expecting a strong report. We have to be a little cautious because some of the apparent pickup in hiring might be for seasonal retail jobs.

Overall, the ADP report was solid and unemployment claims have been falling quickly. The ISM reports were less positive.

As far as the pandemic, the number of daily cases during the reference week in October was around 90,000, down from around 142,000 in September. New cases per day peaked in early September, so by the October reference week there was significant optimism due to cases declining.

My sense is the report will be above consensus expectations.