by Calculated Risk on 11/30/2021 11:08:00 AM

Tuesday, November 30, 2021

More on Case-Shiller and FHFA House Price Increases

Today, in the Newsletter: Case-Shiller National Index up 19.5% Year-over-year in September

Excerpt:

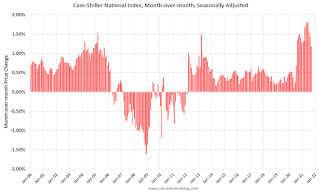

Both the Case-Shiller House Price Index (HPI) and the Federal Housing Finance Agency (FHFA) HPI for September were released today. Here is a graph of the month-over-month (MoM) change in the Case-Shiller National Index Seasonally Adjusted (SA).

The MoM increase in Case-Shiller was at 1.18%; still historically high, but lower than the previous 13 months. House prices started increasing sharply in the Case-Shiller index in August 2020, so the last 14 months have all been historically very strong, but the peak MoM growth is behind us - and the year-over-price growth is starting to decelerate.

...

As I discussed in How Much will the Fannie & Freddie Conforming Loan Limit Increase for 2022?, the FHFA HPI is used to determine the increase in the Conforming Loan Limit. The relevant quarterly index, the Expanded-Data Indexes (Estimated using Enterprise, FHA, and Real Property County Recorder Data Licensed from DataQuick for sales below the annual loan limit ceiling), was released this morning, and it was up 18.04% YoY. The actual 2022 CLL will be released later.

emphasis added