by Calculated Risk on 11/24/2021 07:00:00 AM

Wednesday, November 24, 2021

MBA: Mortgage Applications Increase in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending November 19, 2021.

... The Refinance Index increased 0.4 percent from the previous week and was 34 percent lower than the same week one year ago. The seasonally adjusted Purchase Index increased 5 percent from one week earlier. The unadjusted Purchase Index decreased 0.4 percent compared with the previous week and was 4 percent lower than the same week one year ago.

“The financial markets continue to discern the Federal Reserve’s policy path in the coming months in light of the current high growth, high inflation environment. Despite a fair amount of rate volatility last week, mortgage rates were higher, with the 30-year fixed rate increasing 4 basis points to 3.24 percent,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Despite the increase in rates, refinance applications rose slightly, driven by a 2 percent gain in conventional refinances. Borrowers continue to lock in mortgages in anticipation of higher rates in the future. Refinance applications were still more than 30 percent below a year ago, when the 30-year fixed rate was 32 basis points lower.”

Added Kan, “Purchase activity increased for the third straight week, as housing demand remains robust, even as the housing market approaches the typically slower holiday season. Both conventional and government loan applications increased, and the average loan size for a purchase loan was at $407,200, continuing its ongoing 2021 run of being mostly above $400,000.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($548,250 or less) increased to 3.24 percent from 3.20 percent, with points decreasing to 0.36 from 0.43 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

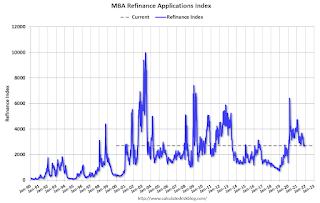

Click on graph for larger image.The first graph shows the refinance index since 1990.

With relatively low rates, the index remains somewhat elevated, but down sharply from last year.

The second graph shows the MBA mortgage purchase index

According to the MBA, purchase activity is down 4% year-over-year unadjusted.

According to the MBA, purchase activity is down 4% year-over-year unadjusted.Note: Red is a four-week average (blue is weekly).