by Calculated Risk on 10/18/2021 08:39:00 AM

Monday, October 18, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the pandemic subsides.

The TSA is providing daily travel numbers.

This data is as of October 17th.

Click on graph for larger image.

Click on graph for larger image.This data shows the 7-day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

The 7-day average is down 21.4% from the same day in 2019 (78.6% of 2019). (Dashed line)

Note that the dashed line hit a pandemic high over the Labor Day weekend - probably due to leisure travel, but is now at pre-holiday levels.

Travel usually increases seasonally after Labor Day due to business travel.

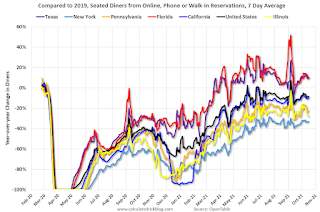

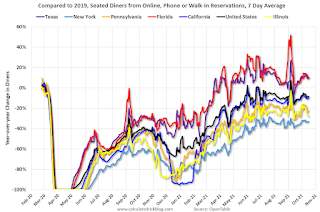

The second graph shows the 7-day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

IMPORTANT: OpenTable notes: "we’ve updated the data including downloadable dataset from January 1, 2021 onward to compare seated diners from 2021 to 2019, as opposed to year over year." Thanks!

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:

This data is updated through October 16, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - but might be picking up a little again. The 7-day average for the US is down 8% compared to 2019.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through October 16, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up for the Labor Day weekend, but declined after the holiday - but might be picking up a little again. The 7-day average for the US is down 8% compared to 2019.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Blue is 2020 and Red is 2021.

The data is from BoxOfficeMojo through October 14th.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $147 million last week, down about 12% from the median for the week.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $147 million last week, down about 12% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, dashed purple is 2019, and dashed light blue is for 2009 (the worst year on record for hotels prior to 2020).

This data is through October 2nd. The occupancy rate was down 9.6% compared to the same week in 2019.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

The Summer months had decent occupancy with solid leisure travel, and occupancy was only off about 7% in July and August compared to 2019. Usually weekly occupancy increases to around 70% in the weeks following Labor Day due to renewed business travel. However, this year, so far, business travel has been lighter than leisure travel in 2021.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. Red is for 2021.

As of October 8th, gasoline supplied was down 1.8% compared to the same week in 2019.

There have been six weeks so far this year when gasoline supplied was up compared to the same week in 2019 - and consumption is running close to 2019 levels now.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through October 15th for the United States and several selected cities.

This data is through October 15th for the United States and several selected cities.The graph is the running 7-day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 117% of the January 2020 level.

New York City is doing well by this metric, but subway usage in NYC is down sharply (next graph).

----- New York City Subway Usage -----

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015.

This graph is from Todd W Schneider. This is weekly data since 2015. Most weeks are between 30 and 35 million entries, and currently there are under 15 million subway turnstile entries per week, but mostly moving up recently.

This data is through Friday, October 15th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

This data is through Friday, October 15th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".