by Calculated Risk on 8/31/2021 09:13:00 AM

Tuesday, August 31, 2021

Case-Shiller: National House Price Index increased 18.6% year-over-year in June

S&P/Case-Shiller released the monthly Home Price Indices for June ("June" is a 3 month average of April, May and June prices).

This release includes prices for 20 individual cities, two composite indices (for 10 cities and 20 cities) and the monthly National index.

From S&P: S&P Corelogic Case-Shiller Index Shows Annual Home Price Gain Topped 18.6% In June

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index, covering all nine U.S. census divisions, reported a 18.6% annual gain in June, up from 16.8% in the previous month. The 10-City Composite annual increase came in at 18.5%, up from 16.6% in the previous month. The 20-City Composite posted a 19.1% year-over-year gain, up from 17.1% in the previous month.

Phoenix, San Diego, and Seattle reported the highest year-over-year gains among the 20 cities in June. Phoenix led the way with a 29.3% year-over-year price increase, followed by San Diego with a 27.1% increase and Seattle with a 25.0% increase. All 20 cities reported higher price increases in the year ending June 2021 versus the year ending May 2021.

...

Before seasonal adjustment, the U.S. National Index posted a 2.2% month-over-month increase in June, while the 10-City and 20-City Composites both posted increases of 1.8% and 2.0%, respectively.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 1.8%, and the 10-City and 20-City Composites both posted increases of 1.6% and 1.8%, respectively. In June, all 20 cities reported increases before and after seasonal adjustments.

“June 2021 is the third consecutive month in which the growth rate of housing prices set a record, says Craig J. Lazzara, Managing Director and Global Head of Index Investment Strategy at S&P DJI. “The National Composite Index marked its thirteenth consecutive month of accelerating prices with an 18.6% gain from year-ago levels, up from 16.8% in May and 14.8% in April. This acceleration is also reflected in the 10- and 20-City Composites (up 18.5% and 19.1%, respectively). The last several months have been extraordinary not only in the level of price gains, but in the consistency of gains across the country. In June, all 20 cities rose, and all 20 gained more in the 12 months ended in June than they had gained in the 12 months ended in May. Home prices in 19 of our 20 cities (all but Chicago) now stand at all-time highs, as do the National Composite and both the 10- and 20-City indices.

June’s 18.6% price gain for the National Composite is the highest reading in more than 30 years of S&P CoreLogic Case-Shiller data. This month, Boston joined Charlotte, Cleveland, Dallas, Denver, and Seattle in recording their all-time highest 12-month gains. Price gains in all 20 cities were in the top quartile of historical performance; in 19 cities, price gains were in top decile.

We have previously suggested that the strength in the U.S. housing market is being driven in part by reaction to the COVID pandemic, as potential buyers move from urban apartments to suburban homes. June’s data are consistent with this hypothesis. This demand surge may simply represent an acceleration of purchases that would have occurred anyway over the next several years. Alternatively, there may have been a secular change in locational preferences, leading to a permanent shift in the demand curve for housing. More time and data will be required to analyze this question.

emphasis added

Click on graph for larger image.

Click on graph for larger image. The first graph shows the nominal seasonally adjusted Composite 10, Composite 20 and National indices (the Composite 20 was started in January 2000).

The Composite 10 index is up 1.6% in June (SA).

The Composite 20 index is up 1.8% (SA) in June.

The National index is 40% above the bubble peak (SA), and up 1.8% (SA) in June. The National index is up 90% from the post-bubble low set in February 2012 (SA).

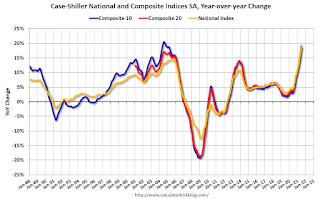

The second graph shows the year-over-year change in all three indices.

The second graph shows the year-over-year change in all three indices.The Composite 10 SA is up 18.5% compared to June 2020. The Composite 20 SA is up 19.1% year-over-year.

The National index SA is up 18.6% year-over-year.

Price increases were at expectations. I'll have more later.