by Calculated Risk on 3/08/2021 08:33:00 AM

Monday, March 08, 2021

Seven High Frequency Indicators for the Economy

These indicators are mostly for travel and entertainment. It will interesting to watch these sectors recover as the vaccine is distributed.

IMPORTANT: Be safe now - if all goes well, we could all be vaccinated by Q2 2021.

----- Airlines: Transportation Security Administration -----

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.

This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of March 7th.

The seven day average is down 55.9% from the same week in 2019 (45.1% of last year). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - but TSA data has mostly moved sideways or slightly up in 2021.

----- Restaurants: OpenTable -----

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

----- Hotel Occupancy: STR -----

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Even when occupancy increases to 2009 levels, hotels will still be hurting.

This data is through February 27th. Hotel occupancy is currently down 25.8% year-over-year. In a few weeks, the year-over-year comparisons will be easy - since occupancy declined sharply at the onset of the pandemic - but occupancy will still be down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

----- Gasoline Supplied: Energy Information Administration -----

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

Blue is for 2020. At one point, gasoline supplied was off almost 50% YoY. Red is for 2021.

As of February 26th, gasoline supplied was off about 10.0% (about 90.0% of the same week in 2019).

Note: Gasoline supplied was impacted by the snowstorm in Texas and other states the previous week.

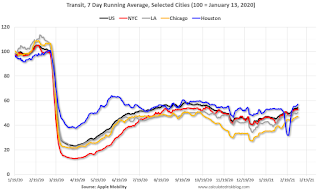

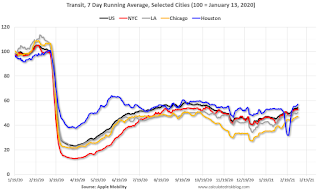

----- Transit: Apple Mobility -----

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through March 6th for the United States and several selected cities.

This data is through March 6th for the United States and several selected cities.

The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 54% of the January 2020 level. It is at 47% in Chicago, and 57% in Houston (the dip was a weather related decline) - and moving up recently.

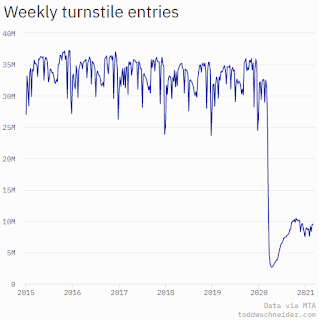

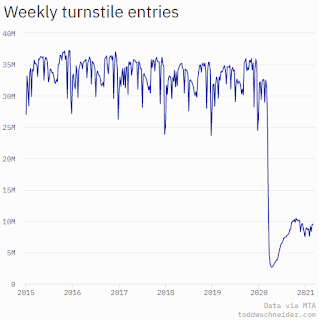

----- New York City Subway Usage -----

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015. Most weeks are between 30 and 35 million entries, and currently there are under 10 million subway turnstile entries per week.

This graph is from Todd W Schneider. This is weekly data since 2015. Most weeks are between 30 and 35 million entries, and currently there are under 10 million subway turnstile entries per week.

This data is through Friday, March 5th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".

The TSA is providing daily travel numbers.

Click on graph for larger image.

Click on graph for larger image.This data shows the seven day average of daily total traveler throughput from the TSA for 2019 (Light Blue), 2020 (Blue) and 2021 (Red).

The dashed line is the percent of 2019 for the seven day average.

This data is as of March 7th.

The seven day average is down 55.9% from the same week in 2019 (45.1% of last year). (Dashed line)

There was a slow increase from the bottom, with ups and downs due to the holidays - but TSA data has mostly moved sideways or slightly up in 2021.

The second graph shows the 7 day average of the year-over-year change in diners as tabulated by OpenTable for the US and several selected cities.

IMPORTANT: OpenTable is reporting the year-over-year change. Since dining started to collapse in early March 2020, this will start showing a pickup relative to that collapse. I'll adjust this to compare to the same week in 2019.

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:

This data is updated through March 6, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, the slumped with the huge winter surge in cases. Dining is picking up again.

----- Movie Tickets: Box Office Mojo -----

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

Thanks to OpenTable for providing this restaurant data:

Thanks to OpenTable for providing this restaurant data:This data is updated through March 6, 2021.

This data is "a sample of restaurants on the OpenTable network across all channels: online reservations, phone reservations, and walk-ins. For year-over-year comparisons by day, we compare to the same day of the week from the same week in the previous year."

Note that this data is for "only the restaurants that have chosen to reopen in a given market". Since some restaurants have not reopened, the actual year-over-year decline is worse than shown.

Dining picked up during the holidays, the slumped with the huge winter surge in cases. Dining is picking up again.

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue).

This data shows domestic box office for each week and the median for the years 2016 through 2019 (dashed light blue). Blue is 2020 and Red is 2021.

The data is from BoxOfficeMojo through Mar 4th.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $5 million last week, down about 96% from the median for the week.

Note that the data is usually noisy week-to-week and depends on when blockbusters are released.

Movie ticket sales were at $5 million last week, down about 96% from the median for the week.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average.

This graph shows the seasonal pattern for the hotel occupancy rate using the four week average. The red line is for 2021, black is 2020, blue is the median, and dashed light blue is for 2009 (the worst year since the Great Depression for hotels - before 2020).

Even when occupancy increases to 2009 levels, hotels will still be hurting.

This data is through February 27th. Hotel occupancy is currently down 25.8% year-over-year. In a few weeks, the year-over-year comparisons will be easy - since occupancy declined sharply at the onset of the pandemic - but occupancy will still be down significantly from normal levels.

Notes: Y-axis doesn't start at zero to better show the seasonal change.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.

This graph, based on weekly data from the U.S. Energy Information Administration (EIA), shows gasoline supplied compared to the same week of 2019.Blue is for 2020. At one point, gasoline supplied was off almost 50% YoY. Red is for 2021.

As of February 26th, gasoline supplied was off about 10.0% (about 90.0% of the same week in 2019).

Note: Gasoline supplied was impacted by the snowstorm in Texas and other states the previous week.

This graph is from Apple mobility. From Apple: "This data is generated by counting the number of requests made to Apple Maps for directions in select countries/regions, sub-regions, and cities." This is just a general guide - people that regularly commute probably don't ask for directions.

There is also some great data on mobility from the Dallas Fed Mobility and Engagement Index. However the index is set "relative to its weekday-specific average over January–February", and is not seasonally adjusted, so we can't tell if an increase in mobility is due to recovery or just the normal increase in the Spring and Summer.

This data is through March 6th for the United States and several selected cities.

This data is through March 6th for the United States and several selected cities.The graph is the running 7 day average to remove the impact of weekends.

IMPORTANT: All data is relative to January 13, 2020. This data is NOT Seasonally Adjusted. People walk and drive more when the weather is nice, so I'm just using the transit data.

According to the Apple data directions requests, public transit in the 7 day average for the US is at 54% of the January 2020 level. It is at 47% in Chicago, and 57% in Houston (the dip was a weather related decline) - and moving up recently.

Here is some interesting data on New York subway usage (HT BR).

This graph is from Todd W Schneider. This is weekly data since 2015. Most weeks are between 30 and 35 million entries, and currently there are under 10 million subway turnstile entries per week.

This graph is from Todd W Schneider. This is weekly data since 2015. Most weeks are between 30 and 35 million entries, and currently there are under 10 million subway turnstile entries per week.This data is through Friday, March 5th.

Schneider has graphs for each borough, and links to all the data sources.

He notes: "Data updates weekly from the MTA’s public turnstile data, usually on Saturday mornings".