by Calculated Risk on 3/22/2021 12:09:00 PM

Monday, March 22, 2021

Comments on February Existing Home Sales

Earlier: NAR: Existing-Home Sales Decreased to 6.22 million in February

A few key points:

1) This was the highest sales rate for February since 2006, and the 2rd highest sales for February on record. Some of the increase over the last eight months was probably related to pent up demand from the shutdowns in March and April. Other reasons include record low mortgage rates, a move away from multi-family rentals, strong second home buying (to escape the high-density cities), a strong stock market and favorable demographics.

The delay in the buying season has pushed the seasonally adjusted number to very high levels.

For example, assuming the buying season was shifted three months by the pandemic, this number of sales, Not Seasonally Adjusted (NSA) in November, would have given a 4.9 million Seasonally Adjusted Annual Rate (SAAR), as opposed to the reported 6.22 million SAAR for February. So the delay in the 2020 buying season is probably a factor in the headline number being so high.

2) Inventory is very low, and was down 29.5% year-over-year (YoY) in January. Also, as housing economist Tom Lawler has noted, the local MLS data shows even a larger decline in active inventory (the NAR appears to include some pending sales in inventory). Lawler noted:

Months-of-supply is just above the record low set in December 2020 and January 2021. Inventory will be important to watch in 2021, see: Some thoughts on Housing Inventory

This also means there are going to be some difficult comparisons in the second half of 2021!

2) Inventory is very low, and was down 29.5% year-over-year (YoY) in January. Also, as housing economist Tom Lawler has noted, the local MLS data shows even a larger decline in active inventory (the NAR appears to include some pending sales in inventory). Lawler noted:

"As I’ve noted before, the inventory measure in most publicly-released local realtor/MLS reports excludes listings with pending contracts, but that is not the case for many of the reports sent to the NAR (referred to as the “NAR Report!”), Since the middle of last Spring inventory measures excluding pending listings have fallen much more sharply than inventory measures including such listings, and this latter inventory measure understates the decline in the effective inventory of homes for sale over the last several months."

It seems likely that active inventory is down close to 50% year-over-year.

3) As usual, housing economist Tom Lawler's forecast was closer to the NAR report than the Consensus. The NAR reported 6.22 million SAAR, Lawler estimated the NAR would report 6.29 million SAAR, and the consensus was 6.50 million SAAR.

Click on graph for larger image.

Click on graph for larger image.

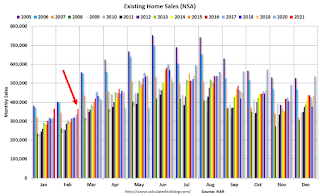

This graph shows existing home sales by month for 2020 and 2021.

The year-over-year comparisons will be easy in the first half of 2021 - especially in April, May and June - and then difficult in the second half of the year.

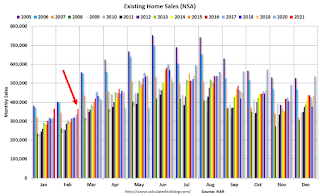

The second graph shows existing home sales for each month, Not Seasonally Adjusted (NSA), since 2005.

Sales NSA in February (364,000) were 8.7% above sales last year in February (335,000).

Sales NSA in February (364,000) were 8.7% above sales last year in February (335,000).

This was the highest sales for February (NSA) since 2006.

Click on graph for larger image.

Click on graph for larger image.This graph shows existing home sales by month for 2020 and 2021.

The year-over-year comparisons will be easy in the first half of 2021 - especially in April, May and June - and then difficult in the second half of the year.

The second graph shows existing home sales for each month, Not Seasonally Adjusted (NSA), since 2005.

Sales NSA in February (364,000) were 8.7% above sales last year in February (335,000).

Sales NSA in February (364,000) were 8.7% above sales last year in February (335,000).This was the highest sales for February (NSA) since 2006.