by Calculated Risk on 2/02/2021 01:52:00 PM

Tuesday, February 02, 2021

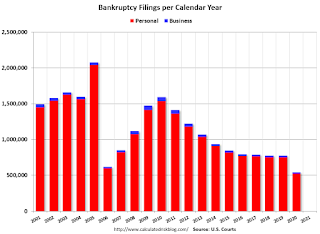

U.S. Courts: Bankruptcy Filings Decline 29.7% in 2020

From the U.S. Courts: Annual Bankruptcy Filings Fall 29.7 Percent

Bankruptcy filings fell sharply for the 12-month period ending Dec. 31, 2020, despite a significant surge in unemployment related to the coronavirus (COVID-19).

Annual bankruptcy filings in calendar year 2020 totaled 544,463, compared with 774,940 cases in 2019, according to statistics released by the Administrative Office of the U.S. Courts. That is a decrease of 29.7 percent.

Only one category saw an increase in filings. Chapter 11 reorganizations rose 19.2 percent, from 6,808 in 2019 to 8,113 in 2020. Of those, 7,561 involved business reorganizations.

The number of total filings was the lowest since 1986, when 530,438 bankruptcies were filed. Filings fell sharply in the early months of the pandemic, starting in March 2020, when many courts offered limited access to the public. In addition, bankruptcy filings can lag behind other economic indicators. Following the Great Recession, which began in 2007, new filings escalated until they peaked in 2010.

Click on graph for larger image.

Click on graph for larger image.This graph shows the business and non-business bankruptcy filings by calendar year since 2001.

The sharp decline in 2006 was due to the so-called "Bankruptcy Abuse Prevention and Consumer Protection Act of 2005". (a good example of Orwellian named legislation since this was more a "Lender Protection Act").

Due to the pandemic, bankruptcy filings fell sharply in 2020 to the lowest level since 1986. It is likely that bankruptcy filings will increase in 2021.