by Calculated Risk on 11/17/2020 11:09:00 AM

Tuesday, November 17, 2020

NY Fed Q3 Report: "Total Household Debt Increased in Q3 2020, Led by Surge in New Credit Extensions"

From the NY Fed: Total Household Debt Increased in Q3 2020, Led by Surge in New Credit Extensions; Mortgage Originations, Including Refinances, Continue to Soar

The Federal Reserve Bank of New York's Center for Microeconomic Data today issued its Quarterly Report on Household Debt and Credit, which shows that total household debt increased by $87 billion (0.6%) to $14.35 trillion in the third quarter of 2020. The increase more than offset the decline seen in the second quarter of 2020 as total household debt has surpassed its 2020Q1 reading. The Report is based on data from the New York Fed's Consumer Credit Panel, a nationally representative sample of individual- and household-level debt and credit records drawn from anonymized Equifax credit data. This latest report reflects consumer credit data as of September 30, 2020.

Mortgage balances—the largest component of household debt—rose by $85 billion in the third quarter, and sat at $9.86 trillion on September 30. Mortgage originations, which include refinances, were at $1.05 trillion, the second highest volume in the history of the series and second only to the historic refinance boom in 2003Q3. Balances on home equity lines of credit saw a $13 billion decline, their 15th consecutive decrease since 2016Q4, bringing the outstanding balance to $362 billion.

...

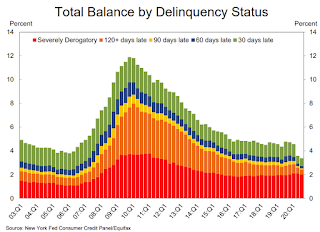

Aggregate delinquency rates across all debt products fell again in the third quarter, indicating the ongoing effect of forbearances provided by the CARES Act or voluntarily offered by lenders. New transitions into early delinquency have also fallen across product type. The various forbearance offerings and uptake have largely protected borrowers' credit files from being marked delinquent from missed payments. As of September 30, 3.4% of outstanding debt was in some stage of delinquency, a 0.2 percentage point decrease from the second quarter, and 1.4 percentage points lower than the rate observed in 2019Q4. About 132,000 consumers had a bankruptcy notation added to their credit reports in 2020Q3, a decline from the previous quarter and a new historical low.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt decreased in Q3. Household debt previously peaked in 2008, and bottomed in Q3 2013.

From the NY Fed:

Aggregate household debt balances increased by $87 billion in the third quarter of 2020, a 0.6% rise from 2020Q2, and now stand at $14.35 trillion. The increase offsets the decline seen in the second quarter of 2020. Balances are $1.68 trillion higher, in nominal terms, than the 2008Q3 peak of $12.68 trillion and 28.7% above the 2013Q2 trough.

The second graph shows the percent of debt in delinquency.

The second graph shows the percent of debt in delinquency.The overall delinquency rate decreased in Q3. From the NY Fed:

Aggregate delinquency rates have dropped markedly in the second and third quarter, reflecting an uptake in forbearances (provided by both the CARES Act and voluntarily offered by lenders), which protect borrowers’ credit records from the reporting of skipped or deferred payments. Note that accounts in forbearance might be categorized as delinquent on the lender’s book, but typically as current on the credit reports. As of September 30, 3.4% of outstanding debt was in some stage of delinquency, a 0.2 percentage point decrease from the second quarter, and 1.4 percentage points lower than the rate observed in the fourth quarter of 2019 and before the Covid pandemic hit the United States. Of the $485 billion of debt that is delinquent, $363 billion is seriously delinquent (at least 90 days late or “severely derogatory”, which includes some debts that have been removed from lenders books but upon which they continue to attempt collection).There is much more in the report.

The uptake in forbearances continues to be visible in the delinquency transition rates for mortgages. The share of mortgages that transitioned to early delinquency remained at a very low 0.5%, as the option to enter forbearance remained. Meanwhile, 47% of loans in early delinquency transitioned to current. There were only 16,000 new foreclosure starts; given that homeowners with federally backed mortgages are currently protected from foreclosure through a moratorium in the CARES Act.