by Calculated Risk on 10/01/2020 10:17:00 AM

Thursday, October 01, 2020

Construction Spending Increased 1.4% in August

From the Census Bureau reported that overall construction spending decreased in June:

Construction spending during August 2020 was estimated at a seasonally adjusted annual rate of $1,412.8 billion, 1.4 percent above the revised July estimate of $1,392.7 billion. The August figure is 2.5 percent above the August 2019 estimate of $1,379.0 billion.Both private and public spending increased:

emphasis added

Spending on private construction was at a seasonally adjusted annual rate of $1,061.4 billion, 1.9 percent above the revised July estimate of $1,041.7 billion. ...

In August, the estimated seasonally adjusted annual rate of public construction spending was $351.4 billion, 0.1 percent above the revised July estimate of $350.9 billion.

Click on graph for larger image.

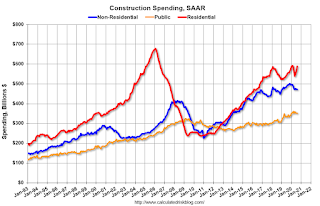

Click on graph for larger image.This graph shows private residential and nonresidential construction spending, and public spending, since 1993. Note: nominal dollars, not inflation adjusted.

Residential spending is 13% below the previous peak.

Non-residential spending is 14% above the previous peak in January 2008 (nominal dollars), but has been weak recently.

Public construction spending is 8% above the previous peak in March 2009, and 34% above the austerity low in February 2014.

The second graph shows the year-over-year change in construction spending.

The second graph shows the year-over-year change in construction spending.On a year-over-year basis, private residential construction spending is up 6.7%. Non-residential spending is down 4.3% year-over-year. Public spending is up 5.5% year-over-year.

This was above consensus expectations of a 0.7% increase in spending, and construction spending for the previous two months was revised up.

Construction was considered an essential service in most areas and did not decline sharply like many other sectors, but it seems likely that non-residential, and possibly public spending, will be under pressure.