by Calculated Risk on 7/01/2020 07:00:00 AM

Wednesday, July 01, 2020

MBA: Mortgage Applications Decrease in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 1.8 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 26, 2020.

... The Refinance Index decreased 2 percent from the previous week and was 74 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 15 percent higher than the same week one year ago.

“Mortgage applications fell last week despite mortgage rates hitting another record low in MBA’s survey. Investors are contemplating the risks of the recent resurgence of COVID-19 cases to the labor market and economy, and Treasury rates and mortgage rates are moving lower as a result,” said Joel Kan, MBA’s Associative Vice President of Economic and Industry Forecasting. “After two months of strong growth, purchase applications declined for the second week in a row. The weakening in activity is potentially a signal that pent-up demand is starting to wane and that low housing supply is limiting prospective buyers’ options. The average purchase application loan size increased to a record high in our survey – more proof that tight inventory conditions are leading to faster price growth.”

Added Kan, “Refinance applications also decreased but remained 74 percent higher than a year ago. The 30-year fixed rate has been below the 3.5 percent mark since late March. It is possible that many borrowers have already refinanced or are waiting for rates to go even lower.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.29 percent from 3.30 percent, with points increasing to 0.36 from 0.32 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

The refinance index has been very volatile recently depending on rates and liquidity.

But the index is up signficantly from last year.

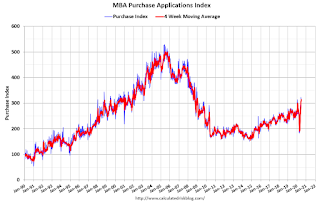

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 15% year-over-year.

Note: Red is a four-week average (blue is weekly).