by Calculated Risk on 12/18/2019 07:00:00 AM

Wednesday, December 18, 2019

MBA: Mortgage Applications Decreased in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 5.0 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending December 13, 2019.

... The Refinance Index decreased 7 percent from the previous week and was 135 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 2 percent from one week earlier. The unadjusted Purchase Index decreased 6 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

"Mortgage rates were mostly unchanged, even as a potential trade deal between the U.S. and China caused rates to inch forward at the end of last week,” said Mike Fratantoni, MBA Senior Vice President and Chief Economist. “With rates showing little meaningful movement, both refinance and purchase activity took a step back. As we move into the slowest time of the year for home sales, purchase application volume is declining but continues to outperform year-ago levels, when rates were much higher. Purchase activity was 10 percent higher than a year ago.”

Added Fratantoni, “2019 was another year of inadequate housing supply in relation to demand. The good news is that the tide could be slowly turning for potential buyers. Housing starts and permits rose strongly in November, and homebuilder confidence has surged to a level not seen since 1999.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) remained unchanged at 3.98 percent, with points remaining unchanged at 0.33 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

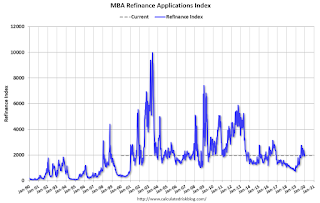

Click on graph for larger image.The first graph shows the refinance index since 1990.

With lower rates, we saw a sharp increase in refinance activity, but mortgage rates would have to decline further to see a huge refinance boom.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.