by Calculated Risk on 8/21/2019 07:00:00 AM

Wednesday, August 21, 2019

MBA: Mortgage Applications Decreased in Latest Weekly Survey

From the MBA: Mortgage Applications Decrease in Latest MBA Weekly Survey

Mortgage applications decreased 0.9 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending August 16, 2019.

... The Refinance Index increased 0.4 percent from the previous week and was 180 percent higher than the same week one year ago. The seasonally adjusted Purchase Index decreased 4 percent from one week earlier. The unadjusted Purchase Index decreased 5 percent compared with the previous week and was 5 percent higher than the same week one year ago.

...

“In a week where worries over global economic growth drove U.S. Treasury yields 13 basis points lower, the 30-year fixed mortgage rate decreased just three basis points. As a result, the refinance index saw only a slight increase but remained at its highest level since July 2016,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The small moves in rates and refinancing are potentially signs that lenders may be approaching capacity constraints as they continue to deal with the largest wave of refinance activity in three years. The refinance share of applications, at almost 63 percent, was also at its highest level since September 2016.”

Added Kan, “Lower mortgage rates have yet to lead to a notable rise in homebuyer demand. Purchase applications fell more than 3 percent, but were still 5 percent higher than a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 3.90 percent from 3.93 percent, with points remaining unchanged at 0.35 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

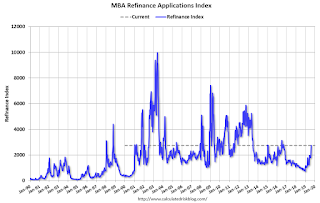

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to under 4%.

With lower rates, we saw a recent sharp increase in refinance activity.

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 5% year-over-year.