by Calculated Risk on 7/10/2019 07:00:00 AM

Wednesday, July 10, 2019

MBA: Mortgage Applications Decreased in Latest Weekly Survey

From the MBA: Mortgage Applications Decreased in Latest MBA Weekly Survey

Mortgage applications decreased 2.4 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending July 5, 2019. This week’s results include an adjustment for the Fourth of July holiday.

... The Refinance Index decreased 7 percent from the previous week and was 88 percent higher than the same week one year ago. The seasonally adjusted Purchase Index increased 2 percent from one week earlier. The unadjusted Purchase Index decreased 18 percent compared with the previous week and was 6 percent higher than the same week one year ago.

...

“Mortgage applications were down slightly, even after adjusting for the July 4th holiday, as we saw opposing moves in purchase and refinance applications over the week. Purchase applications increased from the previous week and were up 5 percent from a year ago, a continuation of the strong annual growth that we saw in the first half of 2019. Refinance activity decreased over 6 percent and the refinance share of applications fell back below 50 percent, even as the 30-year, fixed-rate declined 3 basis points to 4.04 percent," said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. "Borrowers have been less sensitive to low rates as many borrowers have either recently refinanced or are likely waiting for rates to fall even further. Other mortgage rates in our survey were unchanged or slightly higher than in the previous week.”

...

The average contract interest rate for 30-year, fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.04 percent from 4.07 percent, with points increasing to 0.37 from 0.36 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 4% now.

Just about anyone who bought or refinanced over the last year or so can refinance now. But it would take another significant decline in rates for a further large increase in refinance activity.

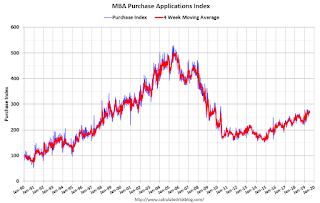

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 6% year-over-year.