by Calculated Risk on 6/26/2019 07:00:00 AM

Wednesday, June 26, 2019

MBA: Mortgage Applications Increased in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 1.3 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending June 21, 2019.

... The Refinance Index increased 3 percent from the previous week. The seasonally adjusted Purchase Index decreased 1 percent from one week earlier. The unadjusted Purchase Index decreased 2 percent compared with the previous week and was 9 percent higher than the same week one year ago.

...

“Markets last week reacted to a more dovish FOMC statement and forecast, with Treasury yields falling after the meeting. Mortgage rates dropped again for most loan types, which led to an increase in refinance activity, partly driven by a 9 percent jump in VA applications,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “The 30-year fixed rate has now dropped in three of the last four weeks, and at 4.06 percent, reached its lowest level since September 2017. Despite these lower rates, purchase applications decreased 2 percent, but were still considerably higher (9 percent) than a year ago.”

Added Kan, “Now at almost the half-way mark of 2019, we have generally seen a stronger purchase market than last year, despite still-tight existing inventory and insufficient new construction.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.06 percent from 4.14 percent, with points decreasing to 0.35 from 0.38 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Mortgage rates have declined from close to 5% late last year to around 4% now.

Just about anyone who bought or refinanced over the last year or so can refinance now. But it would take another significant decline in rates for a further large increase in refinance activity.

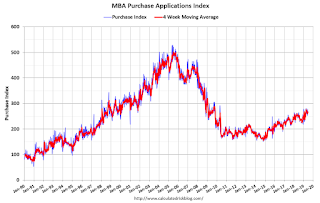

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 9% year-over-year.