by Calculated Risk on 4/03/2019 07:00:00 AM

Wednesday, April 03, 2019

MBA: Mortgage Applications Increased Sharply in Latest Weekly Survey

From the MBA: Mortgage Applications Increase in Latest MBA Weekly Survey

Mortgage applications increased 18.6 percent from one week earlier, according to data from the Mortgage Bankers Association’s (MBA) Weekly Mortgage Applications Survey for the week ending March 29, 2019.

... The Refinance Index increased 39 percent from the previous week, and was at its highest level since January 2016. The seasonally adjusted Purchase Index increased 3 percent from one week earlier. The unadjusted Purchase Index increased 4 percent compared with the previous week and was 10 percent higher than the same week one year ago.

...

“There was a tremendous surge in overall applications activity, as mortgage rates fell for the fourth week in a row – with rates for some loan types reaching their lowest levels since January 2018. Refinance borrowers with larger loan balances continue to benefit, as we saw another sizeable increase in the average refinance loan size to $438,900 – a new survey record,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “We had expected factors such as the ongoing strong job market and favorable demographics to help lift purchase activity this year, and the further decline in rates is providing another tailwind. Purchase applications were almost 10 percent higher than a year ago.”

...

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($484,350 or less) decreased to 4.36 percent from 4.45 percent, with points increasing to 0.44 from 0.39 (including the origination fee) for 80 percent loan-to-value ratio (LTV) loans.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The first graph shows the refinance index since 1990.

Now that mortgage rates have fallen more than 50 bps from the highs last year, a number of recent buyers are able to refinance.

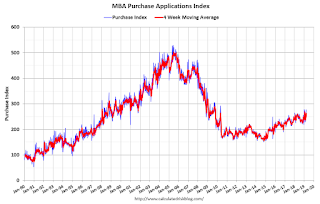

The second graph shows the MBA mortgage purchase index

The second graph shows the MBA mortgage purchase indexAccording to the MBA, purchase activity is up 10% year-over-year.