by Calculated Risk on 3/08/2019 09:22:00 AM

Friday, March 08, 2019

Comments on February Employment Report

The headline jobs number at 20 thousand for February was well below consensus expectations of 178 thousand, however the previous two months were revised up 12 thousand, combined. The unemployment rate decreased to 3.8%, due to government employees on furlough being counted as employed in the February household survey. Overall this was a weak report, but it followed a strong January report, so there was probably some payback (the weather was good in January, and bad in February).

Earlier: February Employment Report: 20,000 Jobs Added, 3.8% Unemployment Rate

In February, the year-over-year employment change was 2.509 million jobs. That is solid year-over-year growth.

Average Hourly Earnings

Wage growth was at expectations in January. From the BLS:

"In February, average hourly earnings for all employees on private nonfarm payrolls rose by 11 cents to $27.66, following a 2-cent gain in January. Over the year, average hourly earnings have increased by 3.4 percent."

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.

This graph is based on “Average Hourly Earnings” from the Current Employment Statistics (CES) (aka "Establishment") monthly employment report. Note: There are also two quarterly sources for earnings data: 1) “Hourly Compensation,” from the BLS’s Productivity and Costs; and 2) the Employment Cost Index which includes wage/salary and benefit compensation.The graph shows the nominal year-over-year change in "Average Hourly Earnings" for all private employees. Nominal wage growth was at 3.4% YoY in January.

Wage growth has generally been trending up.

Prime (25 to 54 Years Old) Participation

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.

Since the overall participation rate has declined due to cyclical (recession) and demographic (aging population, younger people staying in school) reasons, here is the employment-population ratio for the key working age group: 25 to 54 years old.In the earlier period the participation rate for this group was trending up as women joined the labor force. Since the early '90s, the participation rate moved more sideways, with a downward drift starting around '00 - and with ups and downs related to the business cycle.

The 25 to 54 participation rate decreased in February to 82.5%, and the 25 to 54 employment population ratio was unchanged at 79.9%.

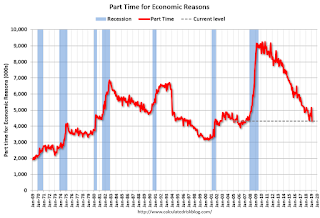

Part Time for Economic Reasons

From the BLS report:

From the BLS report:"The number of persons employed part time for economic reasons (sometimes referred to as involuntary part-time workers) decreased by 837,000 to 4.3 million in February. This decline follows a sharp increase in January that may have resulted from the partial federal government shutdown."The number of persons working part time for economic reasons has been generally trending down. The number increased sharply in January, probably as a result of the government shutdown, and decreased sharply in February - to the lowest level since 2007.

These workers are included in the alternate measure of labor underutilization (U-6) that decreased sharply to 7.3% in February.

Unemployed over 26 Weeks

This graph shows the number of workers unemployed for 27 weeks or more.

This graph shows the number of workers unemployed for 27 weeks or more. According to the BLS, there are 1.271 million workers who have been unemployed for more than 26 weeks and still want a job. This was up slightly from 1.252 million in January.

Summary:

The headline jobs number was well below expectations, however the previous two months were revised up slightly. The headline unemployment rate decreased to 3.8% due to unwinding from the government shutdown.

This was a weak jobs report - but it is probably mostly payback from the strong January report (and could be weather related). Some positives include the decline in the employment rate (expected following end of government shutdown), increase in wages, and decline in people working part time for economic reasons.