by Calculated Risk on 5/17/2017 11:13:00 AM

Wednesday, May 17, 2017

NY Fed: "Household Debt Surpasses its Peak Reached During the Recession in 2008"

The Q1 report was released today: Household Debt and Credit Report.

From the NY Fed: Household Debt Surpasses its Peak Reached During the Recession in 2008

The Federal Reserve Bank of New York today issued its Quarterly Report on Household Debt and Credit, which reported that total household debt reached $12.73 trillion in the first quarter of 2017 and finally surpassed its $12.68 trillion peak reached during the recession in 2008. This marked a $149 billion (1.2%) quarterly increase and nearly three years of continued growth since the long period of deleveraging following the Great Recession.

...

“Almost nine years later, household debt has finally exceeded its 2008 peak but the debt and its borrowers look quite different today. This record debt level is neither a reason to celebrate nor a cause for alarm. But it does provide an opportune moment to consider debt performance,” said Donghoon Lee, Research Officer at the New York Fed. “While most delinquency flows have improved markedly since the Great Recession and remain low overall, there are divergent trends among debt types. Auto loan and credit card delinquency flows are now trending upwards, and those for student loans remain stubbornly high.”

Mortgage balances increased again while originations declined and median credit scores of borrowers for new mortgages increased, reflecting tightening underwriting.

Mortgage delinquencies worsened slightly and foreclosure notations increased but remained low by historical standards.

...

Bankruptcy notations reached another low the 18-year history of this series.

This quarter saw a notable uptick in credit card debt transitioning into delinquencies, a continued upward trend of auto loans transitioning into serious delinquencies, and student loan transitions into serious delinquencies remaining high.

emphasis added

Click on graph for larger image.

Click on graph for larger image.Here are two graphs from the report:

The first graph shows aggregate consumer debt increased in Q1. Household debt previously peaked in 2008, and bottomed in Q2 2013.

Mortgage debt increased in Q1, from the NY Fed:

Mortgage balances, the largest component of household debt, increased again during the first quarter. Mortgage balances shown on consumer credit reports on March 31 stood at $8.63 trillion, an increase of $147 billion from the fourth quarter of 2016. Balances on home equity lines of credit (HELOC) declined by $17 billion and now stand at $456 billion. Non-housing balances were mixed in the first quarter. Auto loans and student loan balances grew, by $10 billion and $34 billion respectively, while credit card balances declined by $15 billion.

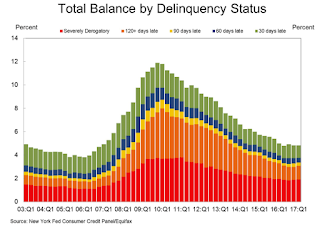

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).

The second graph shows the percent of debt in delinquency. There is still a larger than normal percent of debt 90+ days delinquent (Yellow, orange and red).The overall delinquency rate was mostly unchanged in Q1. From the NY Fed:

Aggregate delinquency rates were roughly flat in the first quarter of 2017, with some variation across product types. As of March 31, 4.8% of outstanding debt was in some stage of delinquency. Of the $615 billion of debt that is delinquent, $426 billion is seriously delinquent (at least 90 days late or “severely derogatory”).