by Calculated Risk on 12/05/2016 04:11:00 PM

Monday, December 05, 2016

A few comments on the Seasonal Pattern for House Prices

CR Note: This is a repeat of a previous post with updated graphs.

A few key points:

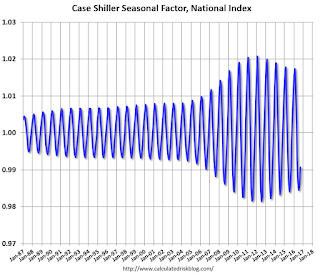

1) There is a clear seasonal pattern for house prices.

2) The surge in distressed sales during the housing bust distorted the seasonal pattern.

3) Even though distressed sales are down significantly, the seasonal factor is based on several years of data - and the factor is now overstating the seasonal change (second graph below).

4) Still the seasonal index is probably a better indicator of actual price movements than the Not Seasonally Adjusted (NSA) index.

For in depth description of these issues, see Trulia chief economist Jed Kolko's article "Let’s Improve, Not Ignore, Seasonal Adjustment of Housing Data"

Note: I was one of several people to question the change in the seasonal factor (here is a post in 2009) - and this led to S&P Case-Shiller questioning the seasonal factor too (from April 2010). I still use the seasonal factor (I think it is better than using the NSA data).

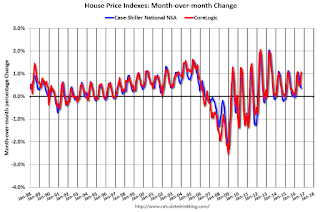

This graph shows the month-to-month change in the CoreLogic (through September 2016) and NSA Case-Shiller National index since 1987 (through September 2016). The seasonal pattern was smaller back in the '90s and early '00s, and once the bubble burst.

The seasonal swings have declined since the bubble.

The seasonal factor has started to decrease, and I expect that over the next several years - as the percent of distressed sales declines further and recent history is included in the factors - the seasonal factors will move back towards more normal levels. However, as Kolko noted, there will be a lag with the seasonal factor since it is based on several years of recent data.