by Calculated Risk on 8/30/2016 02:11:00 PM

Tuesday, August 30, 2016

FDIC: Fewer Problem banks, Residential REO Declined in Q2

The FDIC released the Quarterly Banking Profile for Q2 today:

Commercial banks and savings institutions insured by the Federal Deposit Insurance Corporation (FDIC) reported aggregate net income of $43.6 billion in the second quarter of 2016, up $584 million (1.4 percent) from a year earlier. The increase in earnings was mainly attributable to a $5.2 billion (4.8 percent) increase in net interest income and a $981 million decline in expenses for litigation reserves at a few large banks. Banks increased their loan-loss provisions by $3.6 billion (44.2 percent) compared to a year ago, partly in response to rising levels of troubled loans to commercial and industrial borrowers, particularly in the energy sector.

...

“Income and revenue both increased from a year ago, loan growth remained strong, the number of unprofitable banks was at an 18-year low, and there were fewer banks on the problem list. Community banks reported strong net income, revenue, and loan growth,” Chairman Gruenberg said.

“However, challenges continue,” he said. “Revenue growth remains sluggish as a prolonged period of low interest rates has put downward pressure on net interest margins. This has led some institutions to reach for yield, increasing their exposure to interest-rate risk.

“More recently, persistent stress in the energy sector has resulted in asset quality deterioration at banks that lend to oil and gas producers. We likely have not yet seen the full impact of low energy prices on the banking industry, particularly for consumer and commercial and industrial loans in energy-producing regions of the country.

“We will continue to closely monitor the environment in which banks operate, and we will remain vigilant as we conduct our supervision of the industry.”

...

“Problem List” Continues to Shrink: The number of banks on the FDIC’s Problem List fell from 165 to 147 during the second quarter. This is the smallest number of problem banks in more than seven years and is down significantly from the peak of 888 in the first quarter of 2011. Total assets of problem banks fell from $30.9 billion to $29.0 billion during the second quarter. Two banks failed during the quarter.

Deposit Insurance Fund’s Reserve Ratio Surpasses 1.15 Percent Benchmark: The DIF increased $2.8 billion during the second quarter, from $75.1 billion at the end of March to $77.9 billion at the end of June, largely driven by $2.3 billion in assessment income. The DIF reserve ratio rose from 1.13 percent to 1.17 percent during the quarter. Under previously approved FDIC regulations, once the reserve ratio exceeds 1.15 percent, lower regular assessment rates will go into effect. As a result of lower rates, the FDIC estimates that regular assessments paid by banks to the FDIC will decline by about one-third.

emphasis added

Click on graph for larger image.

Click on graph for larger image.The FDIC reported the number of problem banks declined (Note: graph shows problem banks for Q1 and Q2 2016, and year end prior to 2016):

The number of FDIC-insured commercial banks and savings institutions reporting quarterly financial results declined to 6,058 from 6,122 in the second quarter. During the quarter, mergers absorbed 57 insured institutions, two banks failed, and no new charters were added. The number of banks on the FDIC’s “Problem List” declined from 165 to 147, and total assets of problem banks fell from $30.9 billion to $29 billion. This is the smallest number of problem banks in eight years

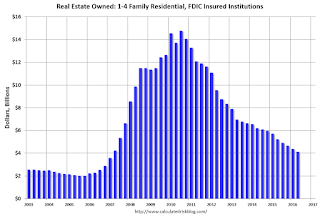

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $4.38 billion in Q1 2016 to $4.12 billion in Q2. This is the lowest level of REOs since Q1 2007.

The dollar value of 1-4 family residential Real Estate Owned (REOs, foreclosure houses) declined from $4.38 billion in Q1 2016 to $4.12 billion in Q2. This is the lowest level of REOs since Q1 2007.This graph shows the nominal dollar value of Residential REO for FDIC insured institutions. Note: The FDIC reports the dollar value and not the total number of REOs.