by Calculated Risk on 4/04/2016 10:46:00 AM

Monday, April 04, 2016

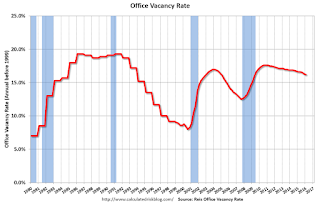

Reis: Office Vacancy Rate declined in Q1 to 16.2%

Reis released their Q1 2016 Office Vacancy survey this morning. Reis reported that the office vacancy rate declined to 16.2% in Q1, from 16.3% in Q4. This is down from 16.6% in Q1 2015, and down from the cycle peak of 17.6%.

From Reis Senior Economist and Director of Research Ryan Severino:

Although vacancy only declined by 10 basis points this quarter to 16.2%, the steady drumbeat of vacancy declines should be taken as a heartening sign.

Given the relative weakness during this recovery phase, it is realistic to expect that any acceleration in vacancy compression will occur gradually and inconsistently. The vacancy rate has now declined in six of the last seven quarters and remains at its lowest level since the second quarter of 2009 when it was at 16%. Although construction and net absorption both pulled back a bit this quarter, the trend over time is for both of those metrics to increase, not decrease. Therefore, a pullback this quarter should not be interpreted as a retrenchment in the market. Moreover, beginning the year with a compression in vacancy, which has not occurred consistently during this recovery, positions the market well. 10 basis points is in line with our forecast for 2016 and leaves the possibility that the market could slightly surprise to the upside if office-using employment growth remains robust.

...

Asking and effective rents both grew by 0.9% during the first quarter, marking the twenty-second consecutive quarter of asking and effective rent growth. These growth rates marginally exceeded last quarter's asking and effective rent growth of 0.8%. Consequently, the year-over-year rent growth figures were little changed versus the fourth quarter. When looking at rent growth over time, it is apparent that it is slowly, but surely gaining momentum, with quarterly increases creeping their way toward 1%, a relatively strong growth rate, especially for a market with a 16.2% vacancy rate. However, that apparent inconsistency stems from the fact that a handful of markets, particularly the technology-oriented markets, are outperforming by such a wide margin that they are pulling the rental growth rates above the level that would normally be associated with a 16.2% vacancy rate. The outliers are clearly skewing the overall results. Otherwise, the majority of markets are still at very nascent stages of rent growth.

Click on graph for larger image.

Click on graph for larger image.This graph shows the office vacancy rate starting in 1980 (prior to 1999 the data is annual).

Reis reported the vacancy rate was at 16.2% in Q1.

Office vacancy data courtesy of Reis.